Mizuho Securities USA LLC lessened its position in lululemon athletica inc. (NASDAQ:LULU - Free Report) by 16.2% in the 1st quarter, according to its most recent filing with the SEC. The firm owned 8,971 shares of the apparel retailer's stock after selling 1,735 shares during the period. Mizuho Securities USA LLC's holdings in lululemon athletica were worth $2,539,000 at the end of the most recent reporting period.

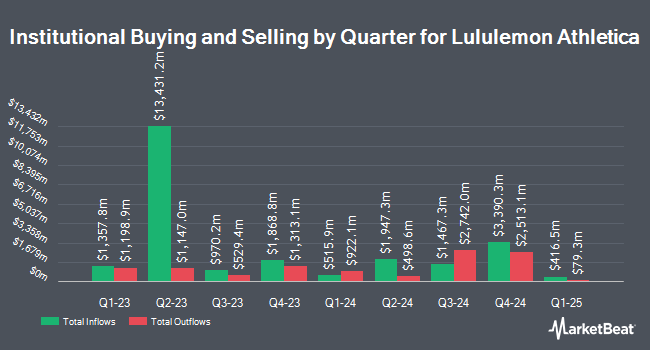

Several other hedge funds also recently made changes to their positions in the company. Vanguard Group Inc. lifted its stake in shares of lululemon athletica by 1.2% in the 1st quarter. Vanguard Group Inc. now owns 13,266,929 shares of the apparel retailer's stock worth $3,755,337,000 after acquiring an additional 157,764 shares during the period. Price T Rowe Associates Inc. MD lifted its stake in shares of lululemon athletica by 95.7% in the fourth quarter. Price T Rowe Associates Inc. MD now owns 4,848,613 shares of the apparel retailer's stock valued at $1,854,160,000 after purchasing an additional 2,371,079 shares during the period. Capital World Investors lifted its stake in shares of lululemon athletica by 34.6% in the fourth quarter. Capital World Investors now owns 2,163,484 shares of the apparel retailer's stock valued at $827,338,000 after purchasing an additional 556,406 shares during the period. Flossbach Von Storch SE lifted its stake in shares of lululemon athletica by 10.3% in the first quarter. Flossbach Von Storch SE now owns 1,401,885 shares of the apparel retailer's stock valued at $396,818,000 after purchasing an additional 130,565 shares during the period. Finally, Northern Trust Corp lifted its stake in shares of lululemon athletica by 15.2% in the fourth quarter. Northern Trust Corp now owns 1,143,730 shares of the apparel retailer's stock valued at $437,374,000 after purchasing an additional 151,336 shares during the period. Institutional investors and hedge funds own 85.20% of the company's stock.

Insiders Place Their Bets

In other lululemon athletica news, CEO Calvin Mcdonald sold 27,049 shares of lululemon athletica stock in a transaction that occurred on Friday, June 27th. The shares were sold at an average price of $235.69, for a total transaction of $6,375,178.81. Following the transaction, the chief executive officer directly owned 110,564 shares of the company's stock, valued at $26,058,829.16. The trade was a 19.66% decrease in their ownership of the stock. The sale was disclosed in a filing with the SEC, which is accessible through this hyperlink. 0.54% of the stock is currently owned by company insiders.

lululemon athletica Stock Up 3.5%

Shares of LULU traded up $6.49 during mid-day trading on Tuesday, hitting $192.93. The company had a trading volume of 3,390,657 shares, compared to its average volume of 3,164,083. The business's 50-day simple moving average is $230.90 and its 200-day simple moving average is $290.19. lululemon athletica inc. has a 1-year low of $185.95 and a 1-year high of $423.32. The stock has a market cap of $23.12 billion, a PE ratio of 13.07, a P/E/G ratio of 1.59 and a beta of 1.16.

lululemon athletica (NASDAQ:LULU - Get Free Report) last released its earnings results on Thursday, June 5th. The apparel retailer reported $2.60 earnings per share (EPS) for the quarter, hitting the consensus estimate of $2.60. lululemon athletica had a net margin of 16.82% and a return on equity of 43.48%. The business had revenue of $2.37 billion for the quarter, compared to analysts' expectations of $2.36 billion. During the same period last year, the company earned $2.54 earnings per share. The company's quarterly revenue was up 7.3% on a year-over-year basis. On average, sell-side analysts expect that lululemon athletica inc. will post 14.36 earnings per share for the current year.

Wall Street Analyst Weigh In

Several brokerages recently commented on LULU. The Goldman Sachs Group reduced their price objective on shares of lululemon athletica from $363.00 to $302.00 and set a "neutral" rating for the company in a research note on Tuesday, April 22nd. TD Securities raised their price objective on shares of lululemon athletica from $370.00 to $373.00 and gave the company a "buy" rating in a research note on Tuesday, June 3rd. CICC Research reiterated a "market perform" rating and issued a $280.49 price objective on shares of lululemon athletica in a research note on Monday, June 9th. Stifel Nicolaus dropped their target price on shares of lululemon athletica from $353.00 to $324.00 and set a "buy" rating for the company in a report on Friday, June 6th. Finally, BMO Capital Markets dropped their target price on shares of lululemon athletica from $302.00 to $250.00 and set a "market perform" rating for the company in a report on Friday, June 6th. One research analyst has rated the stock with a sell rating, thirteen have given a hold rating, sixteen have assigned a buy rating and one has issued a strong buy rating to the company's stock. According to data from MarketBeat, the stock presently has a consensus rating of "Moderate Buy" and an average price target of $327.15.

View Our Latest Stock Analysis on LULU

About lululemon athletica

(

Free Report)

Lululemon Athletica Inc, together with its subsidiaries, designs, distributes, and retails athletic apparel, footwear, and accessories under the lululemon brand for women and men. It offers pants, shorts, tops, and jackets for healthy lifestyle, such as yoga, running, training, and other activities. It also provides fitness-inspired accessories.

Featured Articles

Before you consider lululemon athletica, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and lululemon athletica wasn't on the list.

While lululemon athletica currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the top 7 AI stocks to invest in right now. This exclusive report highlights the companies leading the AI revolution and shaping the future of technology in 2025.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.