Modera Wealth Management LLC purchased a new stake in shares of Ralph Lauren Corporation (NYSE:RL - Free Report) during the 1st quarter, according to the company in its most recent 13F filing with the SEC. The institutional investor purchased 972 shares of the textile maker's stock, valued at approximately $215,000.

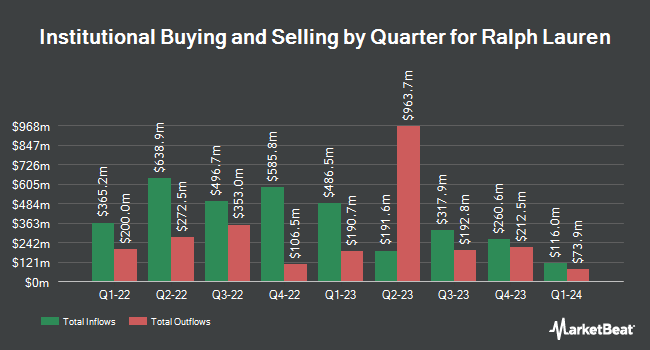

A number of other institutional investors also recently bought and sold shares of RL. Baader Bank Aktiengesellschaft raised its holdings in shares of Ralph Lauren by 3.4% in the first quarter. Baader Bank Aktiengesellschaft now owns 1,367 shares of the textile maker's stock worth $300,000 after buying an additional 45 shares during the period. Bayforest Capital Ltd increased its stake in Ralph Lauren by 92.5% in the first quarter. Bayforest Capital Ltd now owns 462 shares of the textile maker's stock worth $102,000 after purchasing an additional 222 shares during the period. Vestcor Inc lifted its position in shares of Ralph Lauren by 116.6% during the first quarter. Vestcor Inc now owns 2,827 shares of the textile maker's stock worth $624,000 after purchasing an additional 1,522 shares during the last quarter. XTX Topco Ltd purchased a new stake in shares of Ralph Lauren during the first quarter valued at $929,000. Finally, Prosperity Consulting Group LLC grew its holdings in shares of Ralph Lauren by 21.5% in the first quarter. Prosperity Consulting Group LLC now owns 1,545 shares of the textile maker's stock worth $341,000 after purchasing an additional 273 shares during the last quarter. 67.91% of the stock is currently owned by institutional investors.

Wall Street Analyst Weigh In

Several equities research analysts have issued reports on RL shares. Jefferies Financial Group boosted their price objective on shares of Ralph Lauren from $250.00 to $328.00 and gave the company a "buy" rating in a research report on Friday, May 23rd. JPMorgan Chase & Co. increased their price objective on Ralph Lauren from $355.00 to $406.00 and gave the stock an "overweight" rating in a research note on Monday, July 28th. Telsey Advisory Group upped their target price on Ralph Lauren from $315.00 to $335.00 and gave the stock an "outperform" rating in a report on Monday. Bank of America raised their price target on Ralph Lauren from $318.00 to $328.00 and gave the company a "buy" rating in a research note on Friday, May 23rd. Finally, The Goldman Sachs Group upped their price objective on shares of Ralph Lauren from $262.00 to $324.00 and gave the stock a "buy" rating in a research note on Friday, May 23rd. One analyst has rated the stock with a sell rating, three have given a hold rating, fourteen have given a buy rating and one has issued a strong buy rating to the company's stock. According to MarketBeat, Ralph Lauren currently has a consensus rating of "Moderate Buy" and a consensus target price of $303.00.

Get Our Latest Stock Analysis on Ralph Lauren

Ralph Lauren Stock Down 1.5%

NYSE:RL traded down $4.62 during mid-day trading on Tuesday, hitting $299.83. 766,628 shares of the company's stock traded hands, compared to its average volume of 585,275. The company has a fifty day moving average of $281.43 and a 200 day moving average of $255.25. The company has a debt-to-equity ratio of 0.38, a quick ratio of 1.33 and a current ratio of 1.78. Ralph Lauren Corporation has a twelve month low of $156.69 and a twelve month high of $306.34. The company has a market capitalization of $18.09 billion, a P/E ratio of 25.83, a P/E/G ratio of 2.24 and a beta of 1.53.

Ralph Lauren (NYSE:RL - Get Free Report) last issued its quarterly earnings results on Thursday, May 22nd. The textile maker reported $2.27 earnings per share for the quarter, topping analysts' consensus estimates of $2.00 by $0.27. The business had revenue of $1.70 billion for the quarter, compared to analyst estimates of $1.64 billion. Ralph Lauren had a return on equity of 31.76% and a net margin of 10.49%. The company's revenue was up 8.3% on a year-over-year basis. During the same quarter in the previous year, the firm earned $1.71 earnings per share. On average, analysts forecast that Ralph Lauren Corporation will post 12.01 EPS for the current year.

Ralph Lauren Increases Dividend

The company also recently announced a quarterly dividend, which was paid on Friday, July 11th. Investors of record on Friday, June 27th were paid a $0.9125 dividend. This is a positive change from Ralph Lauren's previous quarterly dividend of $0.83. The ex-dividend date was Friday, June 27th. This represents a $3.65 dividend on an annualized basis and a yield of 1.2%. Ralph Lauren's dividend payout ratio (DPR) is 31.44%.

Ralph Lauren announced that its board has approved a share buyback program on Thursday, May 22nd that permits the company to buyback $1.50 billion in shares. This buyback authorization permits the textile maker to buy up to 8.8% of its shares through open market purchases. Shares buyback programs are usually a sign that the company's leadership believes its stock is undervalued.

Ralph Lauren Profile

(

Free Report)

Ralph Lauren Corporation designs, markets, and distributes lifestyle products in North America, Europe, Asia, and internationally. The company offers apparel, including a range of men's, women's, and children's clothing; footwear and accessories, which comprise casual shoes, dress shoes, boots, sneakers, sandals, eyewear, watches, fashion and fine jewelry, scarves, hats, gloves, and umbrellas, as well as leather goods, such as handbags, luggage, small leather goods, and belts; home products consisting of bed and bath lines, furniture, fabric and wallcoverings, floor coverings, lighting, tabletop, kitchen linens, floor coverings, dining, decorative accessories, and giftware; and fragrances.

Read More

Before you consider Ralph Lauren, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ralph Lauren wasn't on the list.

While Ralph Lauren currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.