Meiji Yasuda Life Insurance Co grew its holdings in MongoDB, Inc. (NASDAQ:MDB - Free Report) by 36.1% during the first quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The firm owned 3,997 shares of the company's stock after purchasing an additional 1,060 shares during the period. Meiji Yasuda Life Insurance Co's holdings in MongoDB were worth $701,000 as of its most recent SEC filing.

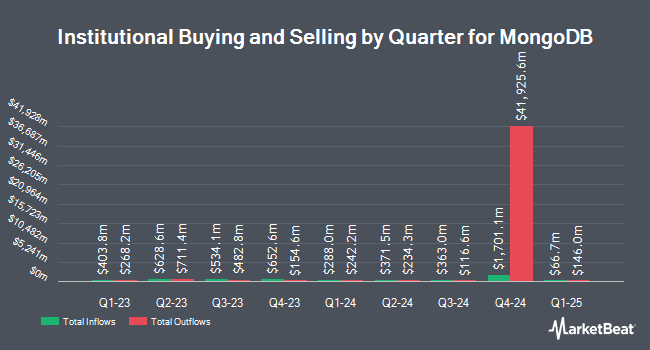

Other large investors also recently made changes to their positions in the company. 111 Capital acquired a new position in shares of MongoDB in the 4th quarter valued at about $390,000. Park Avenue Securities LLC increased its holdings in shares of MongoDB by 52.6% in the 1st quarter. Park Avenue Securities LLC now owns 2,630 shares of the company's stock valued at $461,000 after purchasing an additional 907 shares during the period. Cambridge Investment Research Advisors Inc. increased its holdings in shares of MongoDB by 4.0% in the 1st quarter. Cambridge Investment Research Advisors Inc. now owns 7,748 shares of the company's stock valued at $1,359,000 after purchasing an additional 298 shares during the period. Sowell Financial Services LLC acquired a new position in shares of MongoDB in the 1st quarter valued at about $263,000. Finally, Farther Finance Advisors LLC increased its holdings in shares of MongoDB by 57.2% in the 1st quarter. Farther Finance Advisors LLC now owns 1,242 shares of the company's stock valued at $219,000 after purchasing an additional 452 shares during the period. Institutional investors and hedge funds own 89.29% of the company's stock.

Insider Buying and Selling

In other MongoDB news, CEO Dev Ittycheria sold 33,320 shares of the company's stock in a transaction that occurred on Thursday, August 28th. The stock was sold at an average price of $301.29, for a total transaction of $10,038,982.80. Following the completion of the sale, the chief executive officer owned 203,237 shares of the company's stock, valued at $61,233,275.73. This represents a 14.09% decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available through the SEC website. Also, Director Hope F. Cochran sold 1,174 shares of the stock in a transaction that occurred on Tuesday, June 17th. The shares were sold at an average price of $201.08, for a total value of $236,067.92. Following the completion of the sale, the director directly owned 21,096 shares of the company's stock, valued at $4,241,983.68. This represents a 5.27% decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold 58,730 shares of company stock worth $15,966,159 over the last ninety days. Company insiders own 3.10% of the company's stock.

MongoDB Stock Down 0.4%

Shares of MongoDB stock opened at $323.29 on Tuesday. The stock has a market capitalization of $26.30 billion, a P/E ratio of -329.89 and a beta of 1.49. The stock has a 50 day moving average price of $236.30 and a two-hundred day moving average price of $207.36. MongoDB, Inc. has a 12-month low of $140.78 and a 12-month high of $370.00.

Wall Street Analysts Forecast Growth

Several equities research analysts recently commented on the company. The Goldman Sachs Group boosted their price target on MongoDB from $270.00 to $325.00 and gave the company a "buy" rating in a research note on Wednesday, August 27th. JMP Securities reissued a "market outperform" rating and issued a $345.00 price target on shares of MongoDB in a research note on Wednesday, August 27th. Canaccord Genuity Group boosted their price target on MongoDB from $320.00 to $340.00 and gave the company a "buy" rating in a research note on Thursday, August 28th. Citigroup boosted their price target on MongoDB from $405.00 to $425.00 and gave the company a "buy" rating in a research note on Wednesday, August 27th. Finally, Piper Sandler boosted their price target on MongoDB from $275.00 to $345.00 and gave the company an "overweight" rating in a research note on Wednesday, August 27th. One equities research analyst has rated the stock with a Strong Buy rating, twenty-seven have issued a Buy rating and ten have issued a Hold rating to the stock. According to MarketBeat, MongoDB has a consensus rating of "Moderate Buy" and an average target price of $310.86.

View Our Latest Analysis on MongoDB

MongoDB Profile

(

Free Report)

MongoDB, Inc, together with its subsidiaries, provides general purpose database platform worldwide. The company provides MongoDB Atlas, a hosted multi-cloud database-as-a-service solution; MongoDB Enterprise Advanced, a commercial database server for enterprise customers to run in the cloud, on-premises, or in a hybrid environment; and Community Server, a free-to-download version of its database, which includes the functionality that developers need to get started with MongoDB.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider MongoDB, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and MongoDB wasn't on the list.

While MongoDB currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.