Moors & Cabot Inc. boosted its stake in shares of Tyler Technologies, Inc. (NYSE:TYL - Free Report) by 24.4% during the first quarter, according to its most recent disclosure with the SEC. The institutional investor owned 2,561 shares of the technology company's stock after purchasing an additional 502 shares during the period. Moors & Cabot Inc.'s holdings in Tyler Technologies were worth $1,489,000 at the end of the most recent reporting period.

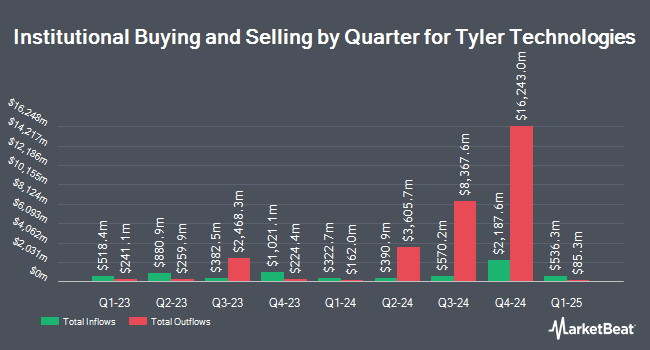

Other institutional investors and hedge funds have also recently added to or reduced their stakes in the company. Retirement Wealth Solutions LLC bought a new stake in Tyler Technologies in the first quarter worth approximately $26,000. Mowery & Schoenfeld Wealth Management LLC grew its position in Tyler Technologies by 820.0% in the first quarter. Mowery & Schoenfeld Wealth Management LLC now owns 46 shares of the technology company's stock worth $27,000 after acquiring an additional 41 shares in the last quarter. Cornerstone Planning Group LLC grew its position in Tyler Technologies by 221.1% in the first quarter. Cornerstone Planning Group LLC now owns 61 shares of the technology company's stock worth $35,000 after acquiring an additional 42 shares in the last quarter. Kapitalo Investimentos Ltda bought a new stake in Tyler Technologies in the fourth quarter worth approximately $40,000. Finally, Whipplewood Advisors LLC grew its position in Tyler Technologies by 255.0% in the first quarter. Whipplewood Advisors LLC now owns 71 shares of the technology company's stock worth $41,000 after acquiring an additional 51 shares in the last quarter. 93.30% of the stock is owned by hedge funds and other institutional investors.

Insider Activity at Tyler Technologies

In related news, CEO H Lynn Moore, Jr. sold 5,250 shares of the company's stock in a transaction on Tuesday, June 10th. The shares were sold at an average price of $585.18, for a total transaction of $3,072,195.00. Following the completion of the transaction, the chief executive officer directly owned 81,775 shares in the company, valued at $47,853,094.50. This represents a 6.03% decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available through this link. Also, CFO Brian K. Miller sold 3,333 shares of the stock in a transaction on Friday, May 23rd. The shares were sold at an average price of $568.46, for a total transaction of $1,894,677.18. Following the completion of the transaction, the chief financial officer owned 11,231 shares of the company's stock, valued at approximately $6,384,374.26. This represents a 22.89% decrease in their position. The disclosure for this sale can be found here. Insiders have sold 31,385 shares of company stock valued at $18,025,522 in the last 90 days. 1.10% of the stock is owned by company insiders.

Wall Street Analyst Weigh In

Several research firms have commented on TYL. Needham & Company LLC reissued a "buy" rating and issued a $750.00 target price on shares of Tyler Technologies in a research report on Tuesday, May 13th. DA Davidson decreased their target price on shares of Tyler Technologies from $595.00 to $570.00 and set a "neutral" rating for the company in a research report on Friday, April 25th. Wells Fargo & Company decreased their target price on shares of Tyler Technologies from $640.00 to $610.00 and set an "equal weight" rating for the company in a research report on Tuesday, April 22nd. Robert W. Baird reduced their price objective on shares of Tyler Technologies from $785.00 to $700.00 and set an "outperform" rating for the company in a research note on Friday, April 25th. Finally, Wall Street Zen cut shares of Tyler Technologies from a "buy" rating to a "hold" rating in a research note on Wednesday, May 21st. Four research analysts have rated the stock with a hold rating and eight have given a buy rating to the company. According to MarketBeat.com, the stock currently has a consensus rating of "Moderate Buy" and a consensus price target of $686.91.

Check Out Our Latest Analysis on Tyler Technologies

Tyler Technologies Trading Down 0.6%

NYSE:TYL traded down $3.84 during trading hours on Tuesday, hitting $599.16. 17,039 shares of the company traded hands, compared to its average volume of 289,816. The stock has a market capitalization of $25.92 billion, a price-to-earnings ratio of 85.56, a P/E/G ratio of 4.50 and a beta of 0.85. Tyler Technologies, Inc. has a twelve month low of $513.52 and a twelve month high of $661.31. The firm has a 50-day moving average of $574.54 and a 200 day moving average of $578.69.

Tyler Technologies (NYSE:TYL - Get Free Report) last released its earnings results on Wednesday, July 30th. The technology company reported $2.91 EPS for the quarter, beating the consensus estimate of $2.78 by $0.13. The firm had revenue of $584.01 million during the quarter, compared to analysts' expectations of $587.59 million. Tyler Technologies had a net margin of 13.66% and a return on equity of 10.34%. The business's quarterly revenue was up 10.2% compared to the same quarter last year. During the same period in the prior year, the company earned $2.40 EPS. Equities research analysts predict that Tyler Technologies, Inc. will post 8.52 earnings per share for the current fiscal year.

Tyler Technologies Profile

(

Free Report)

Tyler Technologies, Inc provides integrated information management solutions and services for the public sector. It operates in two segments, Enterprise Software and Platform Technologies. The company offers platform and transformative technology solutions, including cybersecurity for government agencies; data and insights solutions; digital solutions that helps workers and policymakers to share, communicate, and leverage data; payments solutions, such as billing, presentment, merchant onboarding, collections, reconciliation, and disbursements; platform technologies, an application development platform that enables government workers to build solutions and applications; and outdoor recreation solutions, including campsite reservations, activity registrations, licensing sales and renewals, and real-time data for conservation and park management.

Further Reading

Before you consider Tyler Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Tyler Technologies wasn't on the list.

While Tyler Technologies currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.