Mutual of America Capital Management LLC reduced its position in Morgan Stanley (NYSE:MS - Free Report) by 3.3% during the 1st quarter, according to its most recent filing with the Securities and Exchange Commission. The firm owned 165,633 shares of the financial services provider's stock after selling 5,569 shares during the quarter. Mutual of America Capital Management LLC's holdings in Morgan Stanley were worth $19,324,000 as of its most recent filing with the Securities and Exchange Commission.

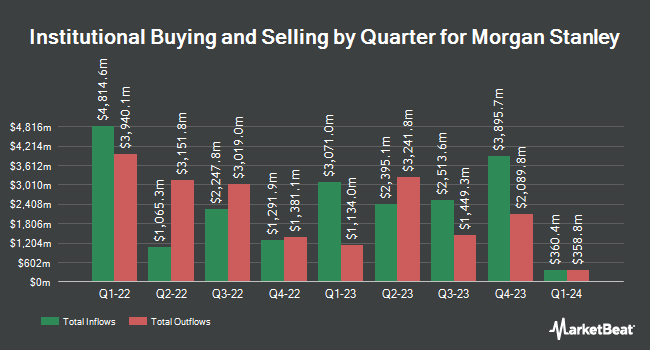

Several other large investors have also made changes to their positions in the company. Capital Research Global Investors increased its position in shares of Morgan Stanley by 44.8% during the fourth quarter. Capital Research Global Investors now owns 21,794,873 shares of the financial services provider's stock worth $2,740,051,000 after acquiring an additional 6,744,333 shares during the last quarter. Price T Rowe Associates Inc. MD grew its stake in Morgan Stanley by 15.5% in the fourth quarter. Price T Rowe Associates Inc. MD now owns 14,112,508 shares of the financial services provider's stock worth $1,774,225,000 after purchasing an additional 1,890,245 shares in the last quarter. Northern Trust Corp boosted its stake in Morgan Stanley by 20.0% in the fourth quarter. Northern Trust Corp now owns 13,403,197 shares of the financial services provider's stock valued at $1,685,050,000 after acquiring an additional 2,233,589 shares during the period. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC boosted its stake in Morgan Stanley by 8.9% in the fourth quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC now owns 9,210,293 shares of the financial services provider's stock valued at $1,157,918,000 after acquiring an additional 756,116 shares during the period. Finally, Capital World Investors boosted its position in shares of Morgan Stanley by 0.5% during the fourth quarter. Capital World Investors now owns 5,655,399 shares of the financial services provider's stock worth $710,997,000 after buying an additional 26,955 shares during the period. 84.19% of the stock is owned by hedge funds and other institutional investors.

Insider Buying and Selling at Morgan Stanley

In related news, insider Eric F. Grossman sold 12,000 shares of Morgan Stanley stock in a transaction dated Thursday, July 17th. The stock was sold at an average price of $141.12, for a total transaction of $1,693,440.00. Following the sale, the insider directly owned 186,420 shares of the company's stock, valued at $26,307,590.40. This trade represents a 6.05% decrease in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available through this hyperlink. Also, insider Daniel A. Simkowitz sold 29,000 shares of Morgan Stanley stock in a transaction dated Thursday, July 17th. The stock was sold at an average price of $141.13, for a total value of $4,092,770.00. Following the sale, the insider directly owned 399,105 shares in the company, valued at approximately $56,325,688.65. This trade represents a 6.77% decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold 148,149 shares of company stock valued at $20,841,628 over the last quarter. Company insiders own 0.19% of the company's stock.

Morgan Stanley Stock Performance

MS stock traded up $2.31 during mid-day trading on Friday, reaching $143.23. 3,942,908 shares of the stock traded hands, compared to its average volume of 6,768,988. The company has a quick ratio of 0.78, a current ratio of 0.78 and a debt-to-equity ratio of 3.30. Morgan Stanley has a 52 week low of $93.54 and a 52 week high of $145.48. The business has a 50-day moving average of $137.93 and a two-hundred day moving average of $128.48. The firm has a market capitalization of $228.64 billion, a PE ratio of 16.22, a P/E/G ratio of 1.77 and a beta of 1.32.

Morgan Stanley (NYSE:MS - Get Free Report) last released its quarterly earnings results on Wednesday, July 16th. The financial services provider reported $2.13 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $1.98 by $0.15. The company had revenue of $16.79 billion during the quarter, compared to analysts' expectations of $16.15 billion. Morgan Stanley had a net margin of 13.06% and a return on equity of 15.20%. The business's quarterly revenue was up 11.8% compared to the same quarter last year. During the same period in the prior year, the company earned $1.82 earnings per share. As a group, equities analysts predict that Morgan Stanley will post 8.56 EPS for the current fiscal year.

Morgan Stanley declared that its board has initiated a stock buyback program on Tuesday, July 1st that allows the company to repurchase $20.00 billion in shares. This repurchase authorization allows the financial services provider to buy up to 8.9% of its shares through open market purchases. Shares repurchase programs are typically a sign that the company's leadership believes its stock is undervalued.

Morgan Stanley Increases Dividend

The company also recently announced a quarterly dividend, which will be paid on Friday, August 15th. Investors of record on Thursday, July 31st will be given a dividend of $1.00 per share. This represents a $4.00 dividend on an annualized basis and a yield of 2.8%. This is a boost from Morgan Stanley's previous quarterly dividend of $0.93. The ex-dividend date of this dividend is Thursday, July 31st. Morgan Stanley's dividend payout ratio (DPR) is 45.30%.

Analyst Ratings Changes

Several equities analysts have recently issued reports on MS shares. Wells Fargo & Company boosted their price objective on Morgan Stanley from $120.00 to $145.00 and gave the stock an "equal weight" rating in a research report on Tuesday, July 8th. JPMorgan Chase & Co. dropped their price target on Morgan Stanley from $125.00 to $122.00 and set a "neutral" rating on the stock in a report on Monday, April 14th. Keefe, Bruyette & Woods raised Morgan Stanley from a "market perform" rating to an "outperform" rating and upped their price target for the company from $127.00 to $160.00 in a report on Wednesday, July 9th. Erste Group Bank upgraded shares of Morgan Stanley from a "hold" rating to a "strong-buy" rating in a research report on Saturday, May 24th. Finally, Citigroup reaffirmed a "neutral" rating and issued a $130.00 price target (up from $125.00) on shares of Morgan Stanley in a research note on Wednesday, June 18th. Nine investment analysts have rated the stock with a hold rating, five have assigned a buy rating and one has issued a strong buy rating to the stock. Based on data from MarketBeat, the stock currently has a consensus rating of "Hold" and a consensus target price of $138.25.

View Our Latest Stock Analysis on Morgan Stanley

Morgan Stanley Company Profile

(

Free Report)

Morgan Stanley, a financial holding company, provides various financial products and services to corporations, governments, financial institutions, and individuals in the Americas, Europe, the Middle East, Africa, and Asia. It operates through Institutional Securities, Wealth Management, and Investment Management segments.

Further Reading

Before you consider Morgan Stanley, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Morgan Stanley wasn't on the list.

While Morgan Stanley currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report