Pacer Advisors Inc. lessened its holdings in Morningstar, Inc. (NASDAQ:MORN - Free Report) by 74.6% during the 1st quarter, according to its most recent filing with the Securities & Exchange Commission. The fund owned 1,260 shares of the business services provider's stock after selling 3,691 shares during the quarter. Pacer Advisors Inc.'s holdings in Morningstar were worth $378,000 as of its most recent filing with the Securities & Exchange Commission.

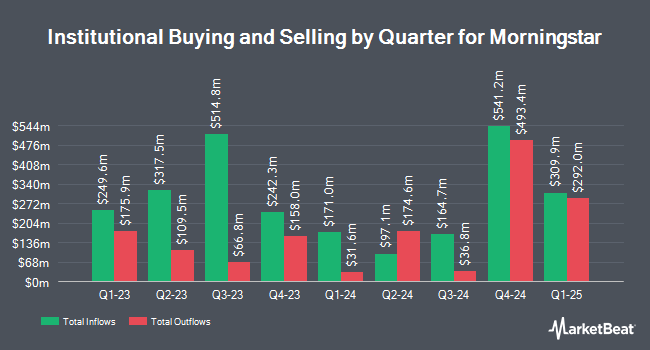

Several other hedge funds also recently bought and sold shares of MORN. Commonwealth Equity Services LLC grew its position in shares of Morningstar by 27.5% during the 4th quarter. Commonwealth Equity Services LLC now owns 1,821 shares of the business services provider's stock worth $613,000 after buying an additional 393 shares in the last quarter. American Century Companies Inc. grew its position in shares of Morningstar by 22.4% during the 4th quarter. American Century Companies Inc. now owns 8,111 shares of the business services provider's stock worth $2,731,000 after buying an additional 1,482 shares in the last quarter. LPL Financial LLC grew its position in shares of Morningstar by 13.6% during the 4th quarter. LPL Financial LLC now owns 5,092 shares of the business services provider's stock worth $1,715,000 after buying an additional 610 shares in the last quarter. Pictet Asset Management Holding SA grew its position in shares of Morningstar by 4.9% during the 4th quarter. Pictet Asset Management Holding SA now owns 3,860 shares of the business services provider's stock worth $1,300,000 after buying an additional 181 shares in the last quarter. Finally, O Shaughnessy Asset Management LLC grew its position in shares of Morningstar by 3.5% during the 4th quarter. O Shaughnessy Asset Management LLC now owns 3,031 shares of the business services provider's stock worth $1,021,000 after buying an additional 102 shares in the last quarter. Institutional investors own 57.02% of the company's stock.

Analyst Upgrades and Downgrades

A number of equities analysts have recently issued reports on the company. BMO Capital Markets increased their price target on Morningstar from $339.00 to $355.00 and gave the stock an "outperform" rating in a research report on Monday, May 12th. Wall Street Zen cut Morningstar from a "buy" rating to a "hold" rating in a research note on Saturday, July 5th.

View Our Latest Research Report on Morningstar

Insider Activity at Morningstar

In other news, Chairman Joseph D. Mansueto sold 1,246 shares of the firm's stock in a transaction that occurred on Tuesday, May 27th. The stock was sold at an average price of $306.52, for a total value of $381,923.92. Following the transaction, the chairman owned 9,427,836 shares in the company, valued at $2,889,820,290.72. This trade represents a 0.01% decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which is available through this link. Also, Director Caroline J. Tsay sold 200 shares of the firm's stock in a transaction that occurred on Friday, May 16th. The shares were sold at an average price of $309.84, for a total value of $61,968.00. Following the completion of the transaction, the director owned 4,345 shares in the company, valued at approximately $1,346,254.80. This trade represents a 4.40% decrease in their position. The disclosure for this sale can be found here. Over the last three months, insiders sold 39,069 shares of company stock worth $12,038,574. 36.20% of the stock is owned by corporate insiders.

Morningstar Stock Down 1.1%

Morningstar stock traded down $2.81 during midday trading on Wednesday, reaching $259.26. The company's stock had a trading volume of 189,011 shares, compared to its average volume of 217,298. The stock's 50-day simple moving average is $297.57 and its 200-day simple moving average is $300.42. The company has a debt-to-equity ratio of 0.52, a current ratio of 1.13 and a quick ratio of 1.13. Morningstar, Inc. has a 52-week low of $250.34 and a 52-week high of $365.00. The stock has a market capitalization of $10.94 billion, a P/E ratio of 27.59 and a beta of 0.96.

Morningstar (NASDAQ:MORN - Get Free Report) last announced its quarterly earnings data on Wednesday, July 30th. The business services provider reported $2.40 earnings per share for the quarter, beating analysts' consensus estimates of $2.21 by $0.19. The business had revenue of $605.10 million for the quarter, compared to analyst estimates of $605.84 million. Morningstar had a return on equity of 23.54% and a net margin of 17.22%.

Morningstar Announces Dividend

The firm also recently disclosed a quarterly dividend, which was paid on Thursday, July 31st. Shareholders of record on Friday, July 11th were issued a $0.455 dividend. This represents a $1.82 annualized dividend and a yield of 0.7%. The ex-dividend date of this dividend was Friday, July 11th. Morningstar's dividend payout ratio (DPR) is presently 19.38%.

Morningstar Profile

(

Free Report)

Morningstar, Inc provides independent investment insights in the United States, Asia. Australia, Continental Europe, the United Kingdom, and internationally. The company operates in five segments: Morningstar Data and Analytics; PitchBook; Morningstar Wealth; Morningstar Credit; and Morningstar Retirement.

Recommended Stories

Before you consider Morningstar, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Morningstar wasn't on the list.

While Morningstar currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for August 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.