Motley Fool Wealth Management LLC lowered its position in shares of GXO Logistics, Inc. (NYSE:GXO - Free Report) by 5.4% in the 1st quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The firm owned 168,783 shares of the company's stock after selling 9,686 shares during the quarter. Motley Fool Wealth Management LLC owned about 0.14% of GXO Logistics worth $6,596,000 at the end of the most recent quarter.

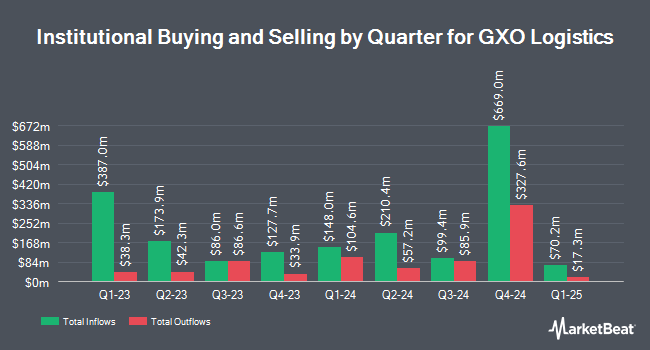

Several other institutional investors and hedge funds have also added to or reduced their stakes in the company. Vanguard Group Inc. lifted its position in GXO Logistics by 0.3% during the first quarter. Vanguard Group Inc. now owns 11,370,657 shares of the company's stock valued at $444,365,000 after buying an additional 37,852 shares during the period. Dimensional Fund Advisors LP lifted its position in GXO Logistics by 1.8% during the fourth quarter. Dimensional Fund Advisors LP now owns 2,798,170 shares of the company's stock valued at $121,718,000 after buying an additional 50,682 shares during the period. Kovitz Investment Group Partners LLC lifted its position in GXO Logistics by 28,112.6% during the fourth quarter. Kovitz Investment Group Partners LLC now owns 2,621,515 shares of the company's stock valued at $114,036,000 after buying an additional 2,612,223 shares during the period. Spruce House Investment Management LLC lifted its position in GXO Logistics by 133.3% during the fourth quarter. Spruce House Investment Management LLC now owns 2,100,000 shares of the company's stock valued at $91,350,000 after buying an additional 1,200,000 shares during the period. Finally, Vaughan Nelson Investment Management L.P. lifted its position in GXO Logistics by 66.2% during the first quarter. Vaughan Nelson Investment Management L.P. now owns 1,819,395 shares of the company's stock valued at $71,102,000 after buying an additional 724,535 shares during the period. Hedge funds and other institutional investors own 90.67% of the company's stock.

Analyst Upgrades and Downgrades

Several equities analysts have commented on GXO shares. JPMorgan Chase & Co. raised their price objective on GXO Logistics from $56.00 to $65.00 and gave the company an "overweight" rating in a research report on Thursday. Susquehanna raised their price target on GXO Logistics from $58.00 to $60.00 and gave the company a "positive" rating in a report on Thursday. Barclays raised their price target on GXO Logistics from $45.00 to $52.00 and gave the company an "equal weight" rating in a report on Thursday, July 10th. Wells Fargo & Company raised their price target on GXO Logistics from $57.00 to $60.00 and gave the company an "overweight" rating in a report on Thursday. Finally, UBS Group raised their price target on GXO Logistics from $50.00 to $58.00 and gave the company a "buy" rating in a report on Thursday. Four research analysts have rated the stock with a hold rating and ten have given a buy rating to the stock. Based on data from MarketBeat.com, the company currently has an average rating of "Moderate Buy" and a consensus price target of $59.50.

View Our Latest Analysis on GXO Logistics

GXO Logistics Price Performance

NYSE GXO opened at $50.35 on Monday. GXO Logistics, Inc. has a one year low of $30.46 and a one year high of $63.33. The stock has a 50-day moving average of $48.13 and a 200 day moving average of $42.32. The company has a market capitalization of $5.76 billion, a price-to-earnings ratio of 95.00, a PEG ratio of 1.83 and a beta of 1.64. The company has a debt-to-equity ratio of 0.87, a quick ratio of 0.76 and a current ratio of 0.76.

GXO Logistics (NYSE:GXO - Get Free Report) last released its quarterly earnings data on Tuesday, August 5th. The company reported $0.57 EPS for the quarter, topping the consensus estimate of $0.56 by $0.01. GXO Logistics had a return on equity of 10.45% and a net margin of 0.50%. The company had revenue of $3.30 billion during the quarter, compared to the consensus estimate of $3.09 billion. During the same period last year, the company earned $0.55 EPS. GXO Logistics's revenue for the quarter was up 15.9% on a year-over-year basis. On average, sell-side analysts forecast that GXO Logistics, Inc. will post 2.49 EPS for the current year.

About GXO Logistics

(

Free Report)

GXO Logistics, Inc, together with its subsidiaries, provides logistics services worldwide. The company provides warehousing and distribution, order fulfilment, e-commerce, reverse logistics, and other supply chain services. As of December 31, 2023, it operated in approximately 974 facilities. The company serves various customers in the e-commerce, omnichannel retail, technology and consumer electronics, food and beverage, industrial and manufacturing, consumer packaged goods, and others.

Recommended Stories

Want to see what other hedge funds are holding GXO? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for GXO Logistics, Inc. (NYSE:GXO - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider GXO Logistics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and GXO Logistics wasn't on the list.

While GXO Logistics currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for August 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.