Motley Fool Wealth Management LLC cut its stake in BellRing Brands Inc. (NYSE:BRBR - Free Report) by 7.6% in the first quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission. The fund owned 152,219 shares of the company's stock after selling 12,492 shares during the period. Motley Fool Wealth Management LLC owned 0.12% of BellRing Brands worth $11,334,000 as of its most recent filing with the Securities and Exchange Commission.

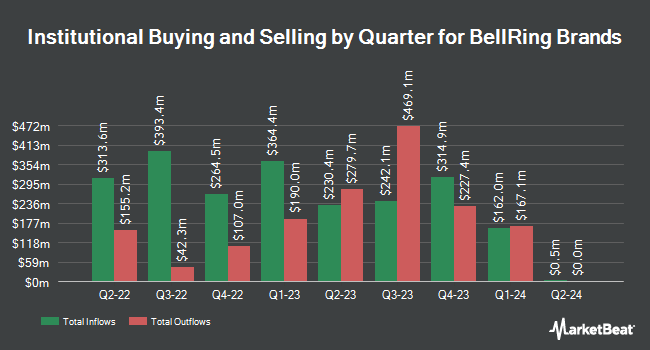

Other institutional investors also recently modified their holdings of the company. Versant Capital Management Inc raised its stake in shares of BellRing Brands by 1,742.9% in the first quarter. Versant Capital Management Inc now owns 387 shares of the company's stock worth $29,000 after acquiring an additional 366 shares during the last quarter. TCTC Holdings LLC grew its position in shares of BellRing Brands by 87.6% during the 1st quarter. TCTC Holdings LLC now owns 407 shares of the company's stock worth $30,000 after buying an additional 190 shares during the period. MassMutual Private Wealth & Trust FSB grew its position in shares of BellRing Brands by 175.8% during the 1st quarter. MassMutual Private Wealth & Trust FSB now owns 444 shares of the company's stock worth $33,000 after buying an additional 283 shares during the period. First Horizon Advisors Inc. grew its position in shares of BellRing Brands by 283.3% during the 1st quarter. First Horizon Advisors Inc. now owns 460 shares of the company's stock worth $34,000 after buying an additional 340 shares during the period. Finally, Colonial Trust Co SC acquired a new stake in shares of BellRing Brands during the 4th quarter worth approximately $44,000. 94.97% of the stock is owned by institutional investors.

Analysts Set New Price Targets

Several equities research analysts have recently commented on the stock. Jefferies Financial Group lifted their price target on shares of BellRing Brands from $80.00 to $82.00 and gave the stock a "buy" rating in a research report on Wednesday, July 23rd. UBS Group lowered their price target on shares of BellRing Brands from $63.00 to $40.00 and set a "neutral" rating for the company in a research report on Wednesday, August 6th. Stephens upgraded shares of BellRing Brands from an "equal weight" rating to an "overweight" rating and decreased their price objective for the company from $68.00 to $50.00 in a report on Wednesday, August 6th. Truist Financial decreased their price objective on shares of BellRing Brands from $60.00 to $40.00 and set a "hold" rating for the company in a report on Wednesday, August 6th. Finally, DA Davidson upgraded shares of BellRing Brands from a "neutral" rating to a "buy" rating and set a $85.00 price objective for the company in a report on Tuesday, May 27th. Two investment analysts have rated the stock with a hold rating and twelve have issued a buy rating to the company. According to data from MarketBeat, the company currently has an average rating of "Moderate Buy" and an average price target of $67.86.

Check Out Our Latest Analysis on BRBR

BellRing Brands Stock Down 3.8%

Shares of BRBR traded down $1.50 during trading hours on Thursday, hitting $38.03. The company had a trading volume of 2,395,944 shares, compared to its average volume of 2,102,871. The business has a fifty day moving average of $55.25 and a 200-day moving average of $65.77. BellRing Brands Inc. has a 12 month low of $34.02 and a 12 month high of $80.67. The firm has a market cap of $4.83 billion, a price-to-earnings ratio of 21.73, a PEG ratio of 1.90 and a beta of 0.72.

BellRing Brands (NYSE:BRBR - Get Free Report) last released its quarterly earnings results on Monday, August 4th. The company reported $0.55 EPS for the quarter, beating the consensus estimate of $0.49 by $0.06. BellRing Brands had a net margin of 10.26% and a negative return on equity of 123.43%. The business had revenue of $547.50 million for the quarter, compared to the consensus estimate of $530.76 million. During the same period in the prior year, the company posted $0.54 earnings per share. BellRing Brands's revenue was up 6.2% compared to the same quarter last year. On average, equities analysts expect that BellRing Brands Inc. will post 2.23 EPS for the current fiscal year.

Insider Activity at BellRing Brands

In other BellRing Brands news, CEO Darcy Horn Davenport sold 1,600 shares of the stock in a transaction dated Friday, August 1st. The shares were sold at an average price of $54.18, for a total transaction of $86,688.00. Following the sale, the chief executive officer directly owned 193,978 shares in the company, valued at $10,509,728.04. This represents a 0.82% decrease in their ownership of the stock. The sale was disclosed in a filing with the SEC, which is available at the SEC website. Also, insider Craig L. Rosenthal acquired 2,600 shares of BellRing Brands stock in a transaction on Wednesday, August 6th. The shares were purchased at an average price of $37.29 per share, for a total transaction of $96,954.00. Following the completion of the purchase, the insider directly owned 33,475 shares of the company's stock, valued at approximately $1,248,282.75. This represents a 8.42% increase in their ownership of the stock. The disclosure for this purchase can be found here. Over the last three months, insiders have sold 14,400 shares of company stock worth $836,224. Corporate insiders own 1.07% of the company's stock.

BellRing Brands Company Profile

(

Free Report)

BellRing Brands, Inc, together with its subsidiaries, provides various nutrition products in the United States. The company offers ready-to-drink (RTD) protein shakes, other RTD beverages, powders, nutrition bars, and other products primarily under the Premier Protein and Dymatize brands. It distributes its products through club, food, drug, mass, eCommerce, specialty, and convenience channels.

Featured Stories

Before you consider BellRing Brands, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and BellRing Brands wasn't on the list.

While BellRing Brands currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.