Texas Yale Capital Corp. lifted its holdings in MPLX LP (NYSE:MPLX - Free Report) by 17.9% in the 1st quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The fund owned 283,353 shares of the pipeline company's stock after purchasing an additional 43,115 shares during the period. MPLX accounts for about 0.6% of Texas Yale Capital Corp.'s investment portfolio, making the stock its 17th biggest holding. Texas Yale Capital Corp.'s holdings in MPLX were worth $15,165,000 as of its most recent SEC filing.

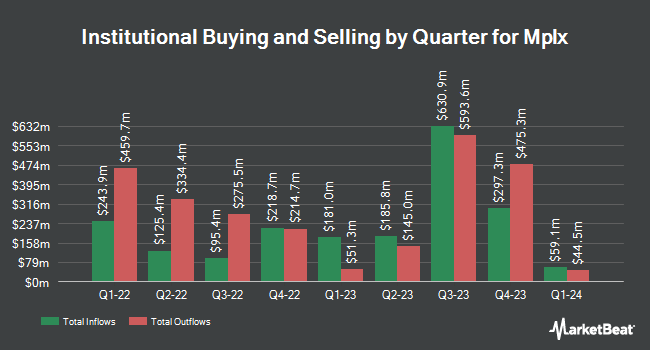

Other hedge funds have also recently bought and sold shares of the company. Rossby Financial LCC acquired a new stake in shares of MPLX in the first quarter worth $33,000. JFS Wealth Advisors LLC acquired a new stake in shares of MPLX in the first quarter worth $37,000. MorganRosel Wealth Management LLC acquired a new stake in shares of MPLX in the first quarter worth $48,000. PSI Advisors LLC grew its stake in shares of MPLX by 32.5% in the first quarter. PSI Advisors LLC now owns 1,100 shares of the pipeline company's stock worth $59,000 after acquiring an additional 270 shares during the last quarter. Finally, Private Trust Co. NA acquired a new stake in shares of MPLX in the first quarter worth $65,000. 24.25% of the stock is owned by institutional investors and hedge funds.

Analyst Upgrades and Downgrades

Separately, Barclays increased their price objective on MPLX from $52.00 to $53.00 and gave the stock an "overweight" rating in a research note on Friday, July 11th. One research analyst has rated the stock with a sell rating, one has issued a hold rating and seven have assigned a buy rating to the company. According to MarketBeat.com, MPLX has an average rating of "Moderate Buy" and an average target price of $55.63.

View Our Latest Analysis on MPLX

MPLX Trading Up 0.2%

NYSE:MPLX traded up $0.09 during trading hours on Monday, hitting $51.04. The stock had a trading volume of 1,094,162 shares, compared to its average volume of 959,775. The company has a market cap of $52.10 billion, a price-to-earnings ratio of 11.77, a P/E/G ratio of 1.33 and a beta of 0.73. The business's 50 day moving average is $51.09 and its 200-day moving average is $51.53. The company has a debt-to-equity ratio of 1.40, a quick ratio of 1.04 and a current ratio of 1.08. MPLX LP has a one year low of $39.95 and a one year high of $54.87.

MPLX (NYSE:MPLX - Get Free Report) last posted its quarterly earnings results on Tuesday, May 6th. The pipeline company reported $1.10 earnings per share for the quarter, beating analysts' consensus estimates of $1.07 by $0.03. The business had revenue of $2.89 billion for the quarter, compared to analysts' expectations of $3.15 billion. MPLX had a return on equity of 32.08% and a net margin of 36.34%. The firm's revenue for the quarter was up 9.8% on a year-over-year basis. During the same quarter in the prior year, the business earned $0.98 EPS. Sell-side analysts anticipate that MPLX LP will post 4.41 EPS for the current fiscal year.

MPLX Announces Dividend

The business also recently declared a quarterly dividend, which was paid on Friday, May 16th. Investors of record on Friday, May 9th were paid a $0.9565 dividend. This represents a $3.83 dividend on an annualized basis and a yield of 7.50%. The ex-dividend date of this dividend was Friday, May 9th. MPLX's dividend payout ratio (DPR) is presently 88.45%.

MPLX Profile

(

Free Report)

MPLX LP engages in the operation of midstream energy infrastructure and logistics assets, and distribution fuels services. It operates through the Crude Oil and Products Logistics and Natural Gas and NGL Services segments. The Crude Oil and Products Logistics segment transports, stores, distributes, and markets crude oil, asphalt, refined petroleum products, and water.

Featured Articles

Before you consider Mplx, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Mplx wasn't on the list.

While Mplx currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.