Bank of America Corp DE lowered its position in MSC Industrial Direct Co., Inc. (NYSE:MSM - Free Report) by 65.6% during the 4th quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The firm owned 172,001 shares of the industrial products company's stock after selling 327,380 shares during the quarter. Bank of America Corp DE owned about 0.31% of MSC Industrial Direct worth $12,847,000 at the end of the most recent reporting period.

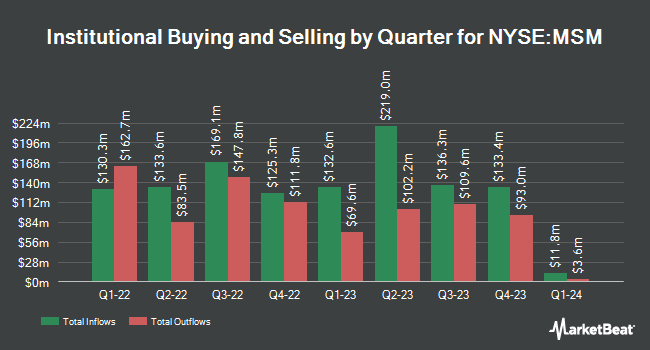

Several other institutional investors have also recently made changes to their positions in the company. American Century Companies Inc. raised its position in MSC Industrial Direct by 6.0% in the 4th quarter. American Century Companies Inc. now owns 3,418,260 shares of the industrial products company's stock worth $255,310,000 after purchasing an additional 193,860 shares during the period. First Trust Advisors LP boosted its holdings in MSC Industrial Direct by 29.2% during the 4th quarter. First Trust Advisors LP now owns 1,987,455 shares of the industrial products company's stock valued at $148,443,000 after acquiring an additional 448,708 shares during the period. Charles Schwab Investment Management Inc. grew its position in MSC Industrial Direct by 8.1% in the 4th quarter. Charles Schwab Investment Management Inc. now owns 1,693,256 shares of the industrial products company's stock valued at $126,469,000 after acquiring an additional 126,218 shares during the last quarter. Boston Partners boosted its stake in shares of MSC Industrial Direct by 7.2% during the fourth quarter. Boston Partners now owns 1,434,415 shares of the industrial products company's stock valued at $107,168,000 after purchasing an additional 96,335 shares during the period. Finally, Invesco Ltd. grew its holdings in shares of MSC Industrial Direct by 127.5% in the fourth quarter. Invesco Ltd. now owns 1,206,811 shares of the industrial products company's stock worth $90,137,000 after purchasing an additional 676,238 shares during the last quarter. Institutional investors own 79.26% of the company's stock.

MSC Industrial Direct Stock Down 0.3%

Shares of NYSE MSM traded down $0.24 during mid-day trading on Wednesday, reaching $83.58. 46,831 shares of the company were exchanged, compared to its average volume of 604,436. MSC Industrial Direct Co., Inc. has a 1 year low of $68.10 and a 1 year high of $90.81. The firm has a 50-day moving average of $77.28 and a 200 day moving average of $79.71. The stock has a market cap of $4.66 billion, a price-to-earnings ratio of 19.95 and a beta of 0.90. The company has a quick ratio of 0.91, a current ratio of 1.93 and a debt-to-equity ratio of 0.21.

MSC Industrial Direct (NYSE:MSM - Get Free Report) last released its quarterly earnings results on Thursday, April 3rd. The industrial products company reported $0.72 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.68 by $0.04. MSC Industrial Direct had a net margin of 6.21% and a return on equity of 17.80%. The business had revenue of $891.70 million for the quarter, compared to analyst estimates of $908.30 million. During the same period in the previous year, the company earned $1.18 earnings per share. The business's revenue for the quarter was down 4.7% on a year-over-year basis. On average, research analysts expect that MSC Industrial Direct Co., Inc. will post 3.57 earnings per share for the current year.

MSC Industrial Direct Announces Dividend

The company also recently announced a quarterly dividend, which was paid on Wednesday, April 23rd. Investors of record on Wednesday, April 9th were given a $0.85 dividend. The ex-dividend date of this dividend was Wednesday, April 9th. This represents a $3.40 dividend on an annualized basis and a yield of 4.07%. MSC Industrial Direct's dividend payout ratio is currently 89.71%.

Insider Buying and Selling

In other news, Director Mitchell Jacobson purchased 27,642 shares of the company's stock in a transaction that occurred on Tuesday, April 8th. The shares were bought at an average price of $69.77 per share, for a total transaction of $1,928,582.34. Following the completion of the transaction, the director now owns 1,951,725 shares in the company, valued at $136,171,853.25. This represents a 1.44% increase in their ownership of the stock. The purchase was disclosed in a document filed with the SEC, which is accessible through this link. 18.30% of the stock is currently owned by corporate insiders.

Wall Street Analyst Weigh In

Several equities research analysts have issued reports on MSM shares. Loop Capital lowered their price objective on shares of MSC Industrial Direct from $83.00 to $74.00 and set a "hold" rating for the company in a research report on Friday, April 4th. Robert W. Baird lowered their price target on MSC Industrial Direct from $90.00 to $84.00 and set a "neutral" rating for the company in a report on Friday, April 4th. JPMorgan Chase & Co. raised MSC Industrial Direct from a "neutral" rating to an "overweight" rating and increased their price objective for the stock from $73.00 to $89.00 in a research note on Tuesday. Finally, Wolfe Research raised MSC Industrial Direct to a "strong-buy" rating in a research report on Sunday, April 6th. Six equities research analysts have rated the stock with a hold rating, one has given a buy rating and one has given a strong buy rating to the stock. According to data from MarketBeat.com, the company currently has a consensus rating of "Hold" and a consensus price target of $85.40.

View Our Latest Stock Analysis on MSM

MSC Industrial Direct Company Profile

(

Free Report)

MSC Industrial Direct Co, Inc, together with its subsidiaries, distributes metalworking and maintenance, repair, and operations (MRO) products and services in the United States, Canada, Mexico, the United Kingdom, and internationally. The company's MRO products include cutting tools, measuring instruments, tooling components, metalworking products, fasteners, flat stock products, raw materials, abrasives, machinery hand and power tools, safety and janitorial supplies, plumbing supplies, materials handling products, power transmission components, and electrical supplies.

Featured Articles

Before you consider MSC Industrial Direct, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and MSC Industrial Direct wasn't on the list.

While MSC Industrial Direct currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Enter your email address and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report