Two Sigma Investments LP lessened its stake in shares of MSCI Inc. (NYSE:MSCI - Free Report) by 9.5% in the fourth quarter, according to its most recent filing with the SEC. The fund owned 257,051 shares of the technology company's stock after selling 26,862 shares during the period. Two Sigma Investments LP owned about 0.33% of MSCI worth $154,233,000 at the end of the most recent reporting period.

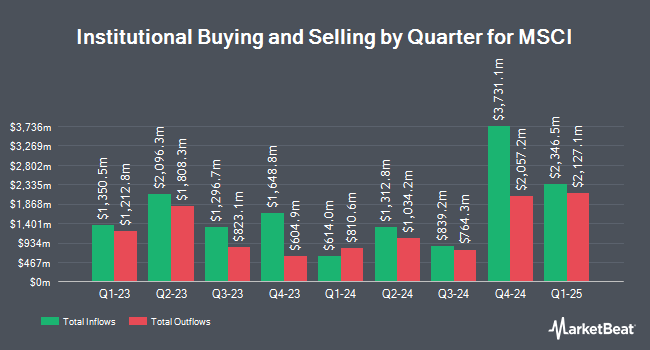

Other large investors have also modified their holdings of the company. JPMorgan Chase & Co. lifted its position in shares of MSCI by 4.5% in the 3rd quarter. JPMorgan Chase & Co. now owns 536,211 shares of the technology company's stock valued at $312,574,000 after acquiring an additional 23,050 shares in the last quarter. Park Avenue Securities LLC raised its stake in MSCI by 9.2% during the 4th quarter. Park Avenue Securities LLC now owns 3,121 shares of the technology company's stock valued at $1,873,000 after purchasing an additional 263 shares during the period. Ritholtz Wealth Management lifted its holdings in shares of MSCI by 5.8% in the fourth quarter. Ritholtz Wealth Management now owns 659 shares of the technology company's stock valued at $395,000 after purchasing an additional 36 shares in the last quarter. Empirical Asset Management LLC acquired a new stake in shares of MSCI in the fourth quarter worth $278,000. Finally, Merit Financial Group LLC grew its holdings in shares of MSCI by 76.3% during the fourth quarter. Merit Financial Group LLC now owns 2,992 shares of the technology company's stock valued at $1,795,000 after buying an additional 1,295 shares in the last quarter. 89.97% of the stock is owned by institutional investors.

MSCI Trading Down 0.7%

MSCI stock opened at $571.26 on Monday. The firm has a market cap of $44.20 billion, a PE ratio of 40.63, a PEG ratio of 2.61 and a beta of 1.33. MSCI Inc. has a 1 year low of $475.32 and a 1 year high of $642.45. The company has a fifty day simple moving average of $550.12 and a 200 day simple moving average of $579.26.

MSCI (NYSE:MSCI - Get Free Report) last announced its quarterly earnings results on Tuesday, April 22nd. The technology company reported $4.00 earnings per share for the quarter, topping analysts' consensus estimates of $3.88 by $0.12. The company had revenue of $745.83 million during the quarter, compared to analysts' expectations of $746.45 million. MSCI had a negative return on equity of 156.08% and a net margin of 38.83%. As a group, analysts forecast that MSCI Inc. will post 16.86 EPS for the current fiscal year.

MSCI Dividend Announcement

The business also recently announced a quarterly dividend, which will be paid on Friday, May 30th. Shareholders of record on Friday, May 16th will be given a dividend of $1.80 per share. The ex-dividend date is Friday, May 16th. This represents a $7.20 dividend on an annualized basis and a yield of 1.26%. MSCI's payout ratio is currently 49.48%.

Wall Street Analyst Weigh In

Several equities research analysts recently issued reports on the company. Evercore ISI reduced their price objective on MSCI from $673.00 to $631.00 and set an "outperform" rating for the company in a research note on Wednesday, April 23rd. JPMorgan Chase & Co. decreased their price target on shares of MSCI from $680.00 to $650.00 and set an "overweight" rating for the company in a report on Wednesday, April 16th. Royal Bank of Canada reiterated an "outperform" rating and issued a $675.00 price objective on shares of MSCI in a research note on Wednesday, April 16th. Bank of America started coverage on shares of MSCI in a research report on Thursday, April 10th. They issued a "neutral" rating and a $585.00 target price for the company. Finally, Barclays lowered their price target on shares of MSCI from $675.00 to $650.00 and set an "overweight" rating on the stock in a report on Friday, April 4th. Three equities research analysts have rated the stock with a hold rating and ten have issued a buy rating to the stock. According to MarketBeat.com, the stock currently has a consensus rating of "Moderate Buy" and an average target price of $645.36.

View Our Latest Report on MSCI

Insider Buying and Selling at MSCI

In other news, CEO Henry A. Fernandez purchased 5,300 shares of the firm's stock in a transaction on Monday, February 24th. The stock was bought at an average cost of $574.51 per share, for a total transaction of $3,044,903.00. Following the completion of the acquisition, the chief executive officer now directly owns 1,269,951 shares of the company's stock, valued at approximately $729,599,549.01. The trade was a 0.42% increase in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through this hyperlink. Also, COO Cd Baer Pettit sold 5,000 shares of the firm's stock in a transaction dated Friday, April 4th. The shares were sold at an average price of $524.25, for a total value of $2,621,250.00. Following the completion of the sale, the chief operating officer now directly owns 294,787 shares in the company, valued at approximately $154,542,084.75. This represents a 1.67% decrease in their ownership of the stock. The disclosure for this sale can be found here. Corporate insiders own 3.31% of the company's stock.

About MSCI

(

Free Report)

MSCI Inc, together with its subsidiaries, provides critical decision support tools and solutions for the investment community to manage investment processes worldwide. The Index segment provides indexes for use in various areas of the investment process, including indexed financial product, such as ETFs, mutual funds, annuities, futures, options, structured products, and over-the-counter derivatives; performance benchmarking; portfolio construction and rebalancing; and asset allocation, as well as licenses GICS and GICS Direct.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider MSCI, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and MSCI wasn't on the list.

While MSCI currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the top 7 AI stocks to invest in right now. This exclusive report highlights the companies leading the AI revolution and shaping the future of technology in 2025.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.