M&T Bank Corp lessened its stake in Agilysys, Inc. (NASDAQ:AGYS - Free Report) by 66.7% in the 1st quarter, according to the company in its most recent filing with the SEC. The institutional investor owned 6,832 shares of the software maker's stock after selling 13,704 shares during the quarter. M&T Bank Corp's holdings in Agilysys were worth $495,000 at the end of the most recent reporting period.

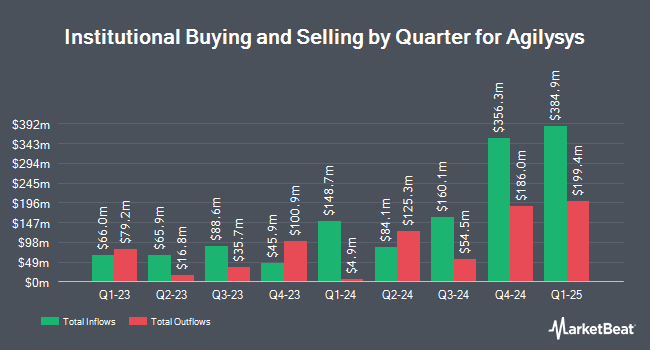

Other institutional investors and hedge funds also recently added to or reduced their stakes in the company. Harbor Investment Advisory LLC boosted its position in shares of Agilysys by 64.6% during the 1st quarter. Harbor Investment Advisory LLC now owns 609 shares of the software maker's stock valued at $44,000 after acquiring an additional 239 shares during the last quarter. Mpwm Advisory Solutions LLC purchased a new position in Agilysys in the fourth quarter valued at approximately $64,000. Cloud Capital Management LLC purchased a new position in Agilysys in the first quarter valued at approximately $86,000. Huntington National Bank grew its position in shares of Agilysys by 319.1% during the fourth quarter. Huntington National Bank now owns 922 shares of the software maker's stock worth $121,000 after acquiring an additional 702 shares during the last quarter. Finally, Canada Pension Plan Investment Board purchased a new position in shares of Agilysys during the fourth quarter worth approximately $145,000. Hedge funds and other institutional investors own 88.00% of the company's stock.

Analysts Set New Price Targets

A number of brokerages have recently weighed in on AGYS. Cantor Fitzgerald initiated coverage on Agilysys in a research report on Tuesday, June 3rd. They issued an "overweight" rating and a $125.00 price target for the company. Needham & Company LLC reaffirmed a "buy" rating and issued a $105.00 price objective (up from $100.00) on shares of Agilysys in a research note on Tuesday, May 20th. Northland Securities set a $152.00 price objective on Agilysys in a research note on Tuesday, May 20th. Finally, Oppenheimer reduced their price target on Agilysys from $135.00 to $90.00 and set an "outperform" rating on the stock in a research report on Wednesday, April 9th. One analyst has rated the stock with a hold rating and six have given a buy rating to the company's stock. According to MarketBeat.com, the company currently has an average rating of "Moderate Buy" and a consensus target price of $116.57.

Check Out Our Latest Stock Report on Agilysys

Insider Buying and Selling

In other Agilysys news, CFO William David Wood III sold 321 shares of the company's stock in a transaction that occurred on Tuesday, July 1st. The stock was sold at an average price of $113.39, for a total value of $36,398.19. Following the sale, the chief financial officer owned 47,288 shares in the company, valued at $5,361,986.32. This represents a 0.67% decrease in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available at this link. Also, Director John Mutch sold 500 shares of the stock in a transaction that occurred on Thursday, June 5th. The stock was sold at an average price of $110.83, for a total value of $55,415.00. Following the transaction, the director owned 31,404 shares in the company, valued at approximately $3,480,505.32. This trade represents a 1.57% decrease in their position. The disclosure for this sale can be found here. Over the last three months, insiders sold 1,405 shares of company stock valued at $158,033. 19.30% of the stock is currently owned by company insiders.

Agilysys Price Performance

AGYS traded down $4.18 during trading on Friday, hitting $115.21. The company's stock had a trading volume of 288,439 shares, compared to its average volume of 271,011. The firm's 50 day moving average price is $107.79 and its two-hundred day moving average price is $93.43. The company has a quick ratio of 1.07, a current ratio of 1.11 and a debt-to-equity ratio of 0.09. Agilysys, Inc. has a 12 month low of $63.71 and a 12 month high of $142.64. The stock has a market capitalization of $3.23 billion, a price-to-earnings ratio of 138.81 and a beta of 0.75.

Agilysys (NASDAQ:AGYS - Get Free Report) last released its earnings results on Monday, May 19th. The software maker reported $0.54 earnings per share for the quarter, topping analysts' consensus estimates of $0.26 by $0.28. Agilysys had a return on equity of 11.24% and a net margin of 8.43%. The company had revenue of $74.27 million during the quarter, compared to the consensus estimate of $71.43 million. During the same quarter in the previous year, the company posted $0.32 earnings per share. The firm's quarterly revenue was up 19.4% on a year-over-year basis. Sell-side analysts forecast that Agilysys, Inc. will post 0.8 earnings per share for the current fiscal year.

Agilysys Company Profile

(

Free Report)

Agilysys, Inc operates as a developer and marketer of software-enabled solutions and services to the hospitality industry in North America, Europe, the Asia-Pacific, and India. It offers software solutions fully integrated with third party hardware and operating systems; cloud applications, support, and maintenance; subscription and maintenance; and professional services.

Featured Stories

Before you consider Agilysys, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Agilysys wasn't on the list.

While Agilysys currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.