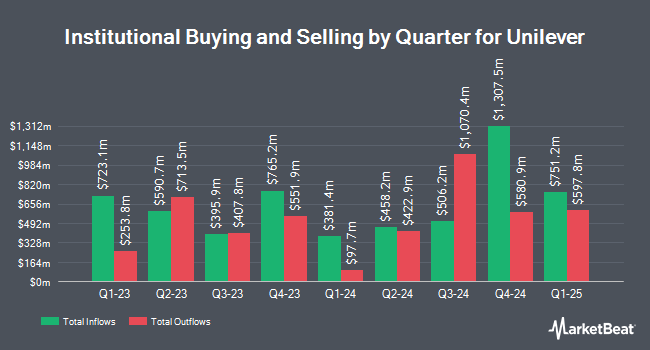

Mutual Advisors LLC lessened its position in Unilever PLC (NYSE:UL - Free Report) by 8.2% during the 2nd quarter, according to the company in its most recent Form 13F filing with the SEC. The institutional investor owned 56,422 shares of the company's stock after selling 5,071 shares during the period. Mutual Advisors LLC's holdings in Unilever were worth $3,410,000 as of its most recent SEC filing.

Several other hedge funds and other institutional investors have also recently made changes to their positions in the company. Wellington Management Group LLP lifted its stake in shares of Unilever by 13.9% in the first quarter. Wellington Management Group LLP now owns 28,100,442 shares of the company's stock worth $1,673,381,000 after buying an additional 3,421,054 shares in the last quarter. Envestnet Asset Management Inc. lifted its stake in shares of Unilever by 2.5% in the first quarter. Envestnet Asset Management Inc. now owns 3,925,891 shares of the company's stock worth $233,787,000 after buying an additional 95,359 shares in the last quarter. Raymond James Financial Inc. lifted its stake in shares of Unilever by 7.1% in the first quarter. Raymond James Financial Inc. now owns 3,340,231 shares of the company's stock worth $198,911,000 after buying an additional 221,958 shares in the last quarter. Hamlin Capital Management LLC lifted its stake in shares of Unilever by 6.8% in the first quarter. Hamlin Capital Management LLC now owns 3,070,860 shares of the company's stock worth $182,870,000 after buying an additional 195,931 shares in the last quarter. Finally, Northern Trust Corp lifted its stake in shares of Unilever by 4.3% in the first quarter. Northern Trust Corp now owns 2,260,133 shares of the company's stock worth $134,591,000 after buying an additional 93,677 shares in the last quarter. Institutional investors own 9.67% of the company's stock.

Wall Street Analysts Forecast Growth

Several research analysts have recently weighed in on UL shares. Zacks Research raised shares of Unilever from a "hold" rating to a "strong-buy" rating in a report on Wednesday, September 17th. Jefferies Financial Group reissued an "underperform" rating on shares of Unilever in a report on Sunday, August 3rd. Weiss Ratings reissued a "buy (b)" rating on shares of Unilever in a report on Wednesday, October 8th. Finally, CICC Research started coverage on shares of Unilever in a report on Thursday, August 21st. They set an "outperform" rating for the company. Three research analysts have rated the stock with a Strong Buy rating, four have assigned a Buy rating, two have issued a Hold rating and two have assigned a Sell rating to the company's stock. Based on data from MarketBeat.com, Unilever has a consensus rating of "Moderate Buy" and an average target price of $73.00.

Read Our Latest Research Report on Unilever

Unilever Trading Down 0.1%

Shares of UL stock opened at $60.92 on Thursday. Unilever PLC has a 12 month low of $54.32 and a 12 month high of $65.66. The stock has a market cap of $149.46 billion, a P/E ratio of 17.45, a P/E/G ratio of 4.59 and a beta of 0.40. The company has a 50 day simple moving average of $61.46 and a two-hundred day simple moving average of $61.64.

Unilever Increases Dividend

The firm also recently announced a quarterly dividend, which was paid on Friday, September 12th. Shareholders of record on Friday, August 15th were issued a dividend of $0.5175 per share. This is an increase from Unilever's previous quarterly dividend of $0.52. This represents a $2.07 dividend on an annualized basis and a yield of 3.4%. The ex-dividend date of this dividend was Friday, August 15th. Unilever's dividend payout ratio is currently 59.31%.

About Unilever

(

Free Report)

Unilever PLC operates as a fast-moving consumer goods company in the Asia Pacific, Africa, the Americas, and Europe. It operates through five segments: Beauty & Wellbeing, Personal Care, Home Care, Nutrition, and Ice Cream. The Beauty & Wellbeing segment engages in the sale of hair care products, such as shampoo, conditioner, and styling; skin care products including face, hand, and body moisturizer; and prestige beauty and health & wellbeing products consist of the vitamins, minerals, and supplements.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Unilever, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Unilever wasn't on the list.

While Unilever currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.