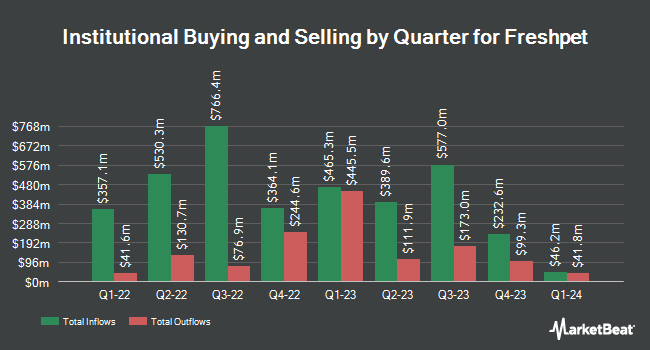

Mutual of America Capital Management LLC increased its stake in shares of Freshpet, Inc. (NASDAQ:FRPT - Free Report) by 13.9% in the 1st quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 55,764 shares of the company's stock after purchasing an additional 6,823 shares during the quarter. Mutual of America Capital Management LLC owned 0.11% of Freshpet worth $4,638,000 at the end of the most recent quarter.

Several other institutional investors and hedge funds also recently added to or reduced their stakes in FRPT. Elequin Capital LP purchased a new stake in shares of Freshpet during the 4th quarter worth approximately $29,000. Morse Asset Management Inc purchased a new stake in shares of Freshpet during the 4th quarter worth approximately $70,000. GeoWealth Management LLC purchased a new stake in shares of Freshpet during the 4th quarter worth approximately $122,000. Teza Capital Management LLC purchased a new stake in shares of Freshpet during the 4th quarter worth approximately $211,000. Finally, Forum Financial Management LP purchased a new stake in shares of Freshpet during the 4th quarter worth approximately $215,000.

Analysts Set New Price Targets

FRPT has been the subject of several research reports. Stifel Nicolaus set a $90.00 price target on shares of Freshpet and gave the company a "buy" rating in a research report on Thursday, June 12th. DA Davidson set a $101.00 price target on shares of Freshpet in a research report on Thursday. JPMorgan Chase & Co. reduced their price target on shares of Freshpet from $91.00 to $85.00 and set a "neutral" rating for the company in a research report on Tuesday, May 6th. Robert W. Baird cut their price objective on shares of Freshpet from $125.00 to $115.00 and set an "outperform" rating for the company in a research report on Tuesday, May 6th. Finally, Wells Fargo & Company cut their price objective on shares of Freshpet from $100.00 to $88.00 and set an "overweight" rating for the company in a research report on Wednesday, July 9th. One research analyst has rated the stock with a sell rating, six have given a hold rating and eight have given a buy rating to the company. Based on data from MarketBeat, the stock has a consensus rating of "Hold" and a consensus target price of $110.36.

View Our Latest Research Report on Freshpet

Freshpet Price Performance

Freshpet stock traded down $0.37 during midday trading on Monday, hitting $62.37. The company's stock had a trading volume of 1,168,395 shares, compared to its average volume of 1,354,830. The company has a quick ratio of 3.75, a current ratio of 4.81 and a debt-to-equity ratio of 0.40. The stock's 50-day moving average price is $71.77 and its 200-day moving average price is $88.21. Freshpet, Inc. has a 12 month low of $61.60 and a 12 month high of $164.07. The company has a market capitalization of $3.04 billion, a PE ratio of 93.09, a price-to-earnings-growth ratio of 1.11 and a beta of 1.77.

Freshpet (NASDAQ:FRPT - Get Free Report) last issued its quarterly earnings results on Monday, August 4th. The company reported $0.33 earnings per share for the quarter, topping analysts' consensus estimates of $0.12 by $0.21. The firm had revenue of $264.69 million for the quarter, compared to analysts' expectations of $269.75 million. Freshpet had a return on equity of 4.82% and a net margin of 3.23%. Freshpet's revenue was up 12.5% on a year-over-year basis. During the same quarter last year, the business posted ($0.03) EPS. Analysts anticipate that Freshpet, Inc. will post 1.55 earnings per share for the current fiscal year.

Freshpet Profile

(

Free Report)

Freshpet, Inc, together with its subsidiaries, manufactures, distributes, and markets natural fresh meals and treats for dogs and cats in the United States, Canada, and Europe. It sells dog food, cat food, and dog treats under the Freshpet brand name; and Dognation and Dog Joy labels through various classes of retail, including grocery, mass, club, pet specialty, and natural, as well as online.

Read More

Before you consider Freshpet, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Freshpet wasn't on the list.

While Freshpet currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for August 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.