Mutual of America Capital Management LLC acquired a new position in Pegasystems Inc. (NASDAQ:PEGA - Free Report) during the second quarter, according to its most recent disclosure with the Securities & Exchange Commission. The fund acquired 44,261 shares of the technology company's stock, valued at approximately $2,396,000.

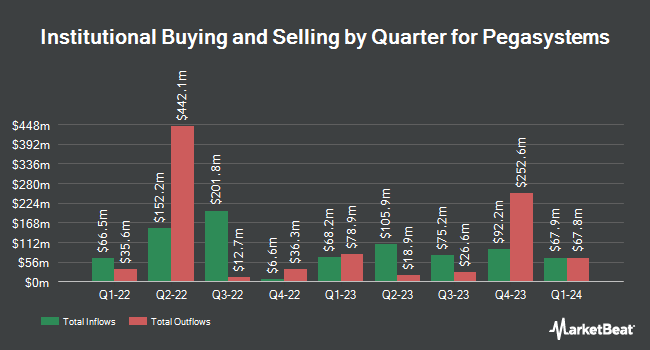

Other hedge funds and other institutional investors also recently made changes to their positions in the company. Nordea Investment Management AB lifted its stake in shares of Pegasystems by 100.9% in the second quarter. Nordea Investment Management AB now owns 196,065 shares of the technology company's stock worth $10,492,000 after acquiring an additional 98,468 shares during the period. Herald Investment Management Ltd lifted its stake in shares of Pegasystems by 100.0% in the second quarter. Herald Investment Management Ltd now owns 703,600 shares of the technology company's stock worth $38,086,000 after acquiring an additional 351,800 shares during the period. Allianz Asset Management GmbH lifted its stake in shares of Pegasystems by 60.3% in the second quarter. Allianz Asset Management GmbH now owns 240,225 shares of the technology company's stock worth $13,003,000 after acquiring an additional 90,404 shares during the period. Veracity Capital LLC lifted its stake in shares of Pegasystems by 117.3% in the second quarter. Veracity Capital LLC now owns 8,031 shares of the technology company's stock worth $435,000 after acquiring an additional 4,335 shares during the period. Finally, State of Alaska Department of Revenue acquired a new stake in shares of Pegasystems during the 2nd quarter worth approximately $542,000. 46.89% of the stock is owned by institutional investors and hedge funds.

Pegasystems Price Performance

Shares of NASDAQ:PEGA opened at $66.27 on Friday. The company has a market capitalization of $11.25 billion, a PE ratio of 44.48 and a beta of 1.08. The business has a fifty day moving average price of $56.49 and a two-hundred day moving average price of $51.68. Pegasystems Inc. has a 1 year low of $29.84 and a 1 year high of $67.19.

Pegasystems (NASDAQ:PEGA - Get Free Report) last announced its quarterly earnings data on Tuesday, October 21st. The technology company reported $0.30 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $0.18 by $0.12. The firm had revenue of $381.35 million during the quarter, compared to the consensus estimate of $351.95 million. Pegasystems had a return on equity of 43.49% and a net margin of 16.05%.The business's revenue for the quarter was up 17.3% on a year-over-year basis. During the same quarter in the prior year, the company earned $0.39 EPS. Sell-side analysts anticipate that Pegasystems Inc. will post 1.89 earnings per share for the current year.

Pegasystems Announces Dividend

The firm also recently disclosed a quarterly dividend, which was paid on Wednesday, October 15th. Shareholders of record on Wednesday, October 1st were paid a $0.03 dividend. This represents a $0.12 dividend on an annualized basis and a yield of 0.2%. The ex-dividend date was Wednesday, October 1st. Pegasystems's dividend payout ratio is 8.05%.

Analyst Ratings Changes

Several research firms have recently weighed in on PEGA. Royal Bank Of Canada reiterated an "outperform" rating and issued a $80.00 price objective (up previously from $70.00) on shares of Pegasystems in a research note on Wednesday. Rosenblatt Securities upped their price target on Pegasystems from $65.00 to $70.00 and gave the stock a "buy" rating in a report on Thursday. Citigroup upped their price target on Pegasystems from $66.00 to $70.00 and gave the stock a "buy" rating in a report on Thursday, July 24th. DA Davidson upgraded Pegasystems from a "neutral" rating to a "buy" rating and upped their price target for the stock from $60.00 to $85.00 in a report on Wednesday. Finally, Weiss Ratings upgraded Pegasystems from a "hold (c+)" rating to a "buy (b-)" rating in a report on Saturday. Nine analysts have rated the stock with a Buy rating and one has given a Hold rating to the company's stock. Based on data from MarketBeat.com, the company has an average rating of "Moderate Buy" and a consensus price target of $69.61.

Get Our Latest Stock Report on Pegasystems

Insider Transactions at Pegasystems

In other news, CFO Kenneth Stillwell sold 11,147 shares of the stock in a transaction on Monday, August 4th. The stock was sold at an average price of $58.19, for a total transaction of $648,643.93. Following the completion of the transaction, the chief financial officer owned 119,868 shares in the company, valued at approximately $6,975,118.92. This represents a 8.51% decrease in their position. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through this hyperlink. Also, CAO Efstathios A. Kouninis sold 2,544 shares of the stock in a transaction on Monday, September 15th. The stock was sold at an average price of $59.00, for a total value of $150,096.00. The disclosure for this sale can be found here. Over the last three months, insiders have sold 167,728 shares of company stock worth $9,625,920. Company insiders own 49.70% of the company's stock.

Pegasystems Company Profile

(

Free Report)

Pegasystems Inc develops, markets, licenses, hosts, and supports enterprise software in the United States, rest of the Americas, the United Kingdom, rest of Europe, the Middle East, Africa, and the Asia-Pacific. The company provides Pega Infinity, a software portfolio comprising of Pega Customer Decision Hub, a real-time AI-powered decision engine to enhance customer acquisition and experiences across inbound, outbound, and paid media channels; Pega Customer Service to anticipate customer needs, connect customers to people and systems, and automate customer interactions to evolve the customer service experience, as well as to allow enterprises to deliver interactions across channels and enhance employee productivity; and Pega Platform, an intelligent automation software for increasing efficiency of clients' processes and workflows.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Pegasystems, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Pegasystems wasn't on the list.

While Pegasystems currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.