MYDA Advisors LLC trimmed its stake in Citigroup Inc. (NYSE:C - Free Report) by 30.1% during the 1st quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The fund owned 58,000 shares of the company's stock after selling 25,000 shares during the period. Citigroup comprises about 0.7% of MYDA Advisors LLC's investment portfolio, making the stock its 25th biggest position. MYDA Advisors LLC's holdings in Citigroup were worth $4,117,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

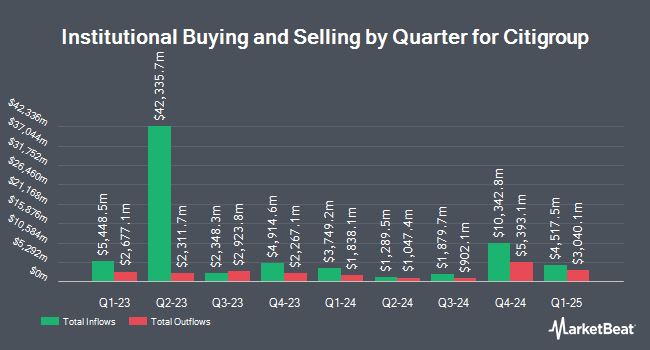

Other hedge funds and other institutional investors also recently bought and sold shares of the company. True Wealth Design LLC boosted its position in shares of Citigroup by 11.1% during the 4th quarter. True Wealth Design LLC now owns 1,195 shares of the company's stock valued at $84,000 after acquiring an additional 119 shares in the last quarter. Continuum Advisory LLC boosted its position in shares of Citigroup by 1.9% during the 4th quarter. Continuum Advisory LLC now owns 6,519 shares of the company's stock valued at $459,000 after acquiring an additional 120 shares in the last quarter. Solitude Financial Services boosted its position in shares of Citigroup by 0.9% during the 1st quarter. Solitude Financial Services now owns 16,496 shares of the company's stock valued at $1,171,000 after acquiring an additional 140 shares in the last quarter. Dorsey & Whitney Trust CO LLC boosted its position in shares of Citigroup by 2.1% during the 1st quarter. Dorsey & Whitney Trust CO LLC now owns 6,902 shares of the company's stock valued at $490,000 after acquiring an additional 142 shares in the last quarter. Finally, Insight Inv LLC boosted its position in Citigroup by 0.5% in the first quarter. Insight Inv LLC now owns 27,268 shares of the company's stock valued at $1,936,000 after buying an additional 146 shares in the last quarter. 71.72% of the stock is currently owned by institutional investors and hedge funds.

Insider Buying and Selling

In other Citigroup news, Director Peter B. Henry sold 3,000 shares of the company's stock in a transaction that occurred on Wednesday, July 16th. The shares were sold at an average price of $90.40, for a total value of $271,200.00. Following the completion of the sale, the director owned 2,140 shares of the company's stock, valued at approximately $193,456. This represents a 58.37% decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through the SEC website. Insiders own 0.08% of the company's stock.

Citigroup Trading Down 0.3%

Shares of C traded down $0.28 on Monday, reaching $96.54. 8,361,286 shares of the company's stock were exchanged, compared to its average volume of 13,257,021. The company has a current ratio of 0.99, a quick ratio of 0.99 and a debt-to-equity ratio of 1.61. The stock has a market capitalization of $177.72 billion, a P/E ratio of 14.26, a price-to-earnings-growth ratio of 0.83 and a beta of 1.41. The business has a 50 day moving average price of $91.23 and a two-hundred day moving average price of $78.80. Citigroup Inc. has a 12 month low of $55.51 and a 12 month high of $97.49.

Citigroup (NYSE:C - Get Free Report) last posted its quarterly earnings results on Tuesday, July 15th. The company reported $1.96 earnings per share for the quarter, topping analysts' consensus estimates of $1.61 by $0.35. The business had revenue of $21.67 billion during the quarter, compared to the consensus estimate of $20.75 billion. Citigroup had a net margin of 8.44% and a return on equity of 7.29%. Citigroup's revenue for the quarter was up 8.2% compared to the same quarter last year. During the same period in the previous year, the firm posted $1.52 earnings per share. Citigroup has set its FY 2025 guidance at EPS. Research analysts anticipate that Citigroup Inc. will post 7.53 earnings per share for the current year.

Citigroup Increases Dividend

The company also recently announced a quarterly dividend, which was paid on Friday, August 22nd. Shareholders of record on Monday, August 4th were paid a $0.60 dividend. The ex-dividend date of this dividend was Monday, August 4th. This is a boost from Citigroup's previous quarterly dividend of $0.56. This represents a $2.40 annualized dividend and a yield of 2.5%. Citigroup's payout ratio is currently 35.45%.

Wall Street Analysts Forecast Growth

A number of equities analysts have commented on the stock. Piper Sandler boosted their price target on shares of Citigroup from $84.00 to $104.00 and gave the company an "overweight" rating in a research report on Wednesday, July 16th. Keefe, Bruyette & Woods restated a "buy" rating on shares of Citigroup in a research report on Wednesday, July 16th. Bank of America boosted their price target on shares of Citigroup from $89.00 to $100.00 and gave the company a "buy" rating in a research report on Thursday, June 26th. Oppenheimer boosted their price target on shares of Citigroup from $123.00 to $124.00 and gave the company an "outperform" rating in a research report on Wednesday, July 30th. Finally, Morgan Stanley boosted their price target on shares of Citigroup from $103.00 to $107.00 and gave the company an "overweight" rating in a research report on Wednesday, July 16th. Ten analysts have rated the stock with a Buy rating and five have assigned a Hold rating to the company. Based on data from MarketBeat.com, the company has an average rating of "Moderate Buy" and a consensus target price of $96.54.

View Our Latest Report on C

Citigroup Company Profile

(

Free Report)

Citigroup Inc, a diversified financial service holding company, provides various financial product and services to consumers, corporations, governments, and institutions worldwide. It operates through five segments: Services, Markets, Banking, U.S. Personal Banking, and Wealth. The Services segment includes Treasury and Trade Solutions, which provides cash management, trade, and working capital solutions to multinational corporations, financial institutions, and public sector organizations; and Securities Services, such as cross-border support for clients, local market expertise, post-trade technologies, data solutions, and various securities services solutions.

Featured Stories

Before you consider Citigroup, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Citigroup wasn't on the list.

While Citigroup currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Learn the basics of options trading and how to use them to boost returns and manage risk with this free report from MarketBeat. Click the link below to get your free copy.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.