ARK Investment Management LLC boosted its stake in shares of Nano Dimension Ltd. (NASDAQ:NNDM - Free Report) by 23.6% in the second quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The firm owned 1,777,845 shares of the technology company's stock after purchasing an additional 339,437 shares during the quarter. ARK Investment Management LLC owned approximately 0.82% of Nano Dimension worth $2,880,000 at the end of the most recent reporting period.

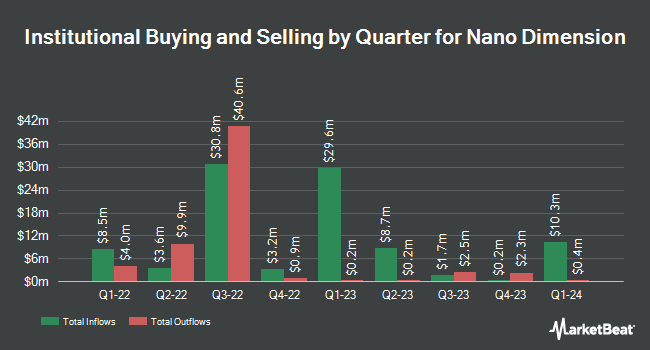

A number of other hedge funds and other institutional investors have also added to or reduced their stakes in NNDM. Rhumbline Advisers boosted its position in Nano Dimension by 87.1% during the 1st quarter. Rhumbline Advisers now owns 40,587 shares of the technology company's stock valued at $65,000 after purchasing an additional 18,889 shares during the period. Y Intercept Hong Kong Ltd acquired a new position in Nano Dimension during the 1st quarter worth $842,000. Invesco Ltd. acquired a new position in Nano Dimension during the 1st quarter worth $63,000. Virtu Financial LLC boosted its position in Nano Dimension by 40.1% during the 1st quarter. Virtu Financial LLC now owns 128,852 shares of the technology company's stock worth $205,000 after acquiring an additional 36,867 shares during the period. Finally, Credit Agricole S A lifted its holdings in shares of Nano Dimension by 32.0% in the first quarter. Credit Agricole S A now owns 412,500 shares of the technology company's stock valued at $656,000 after buying an additional 100,000 shares during the period. Institutional investors and hedge funds own 33.89% of the company's stock.

Nano Dimension Stock Down 5.0%

Shares of Nano Dimension stock opened at $1.70 on Thursday. The stock's fifty day moving average is $1.54 and its 200-day moving average is $1.52. The firm has a market capitalization of $371.21 million, a PE ratio of -1.65 and a beta of 1.64. Nano Dimension Ltd. has a 12-month low of $1.31 and a 12-month high of $2.74.

Wall Street Analyst Weigh In

Separately, Weiss Ratings restated a "sell (d)" rating on shares of Nano Dimension in a report on Wednesday, October 8th. One research analyst has rated the stock with a Sell rating, Based on data from MarketBeat.com, Nano Dimension presently has a consensus rating of "Sell".

View Our Latest Report on NNDM

Nano Dimension Company Profile

(

Free Report)

Nano Dimension Ltd., together with its subsidiaries, engages in additive manufacturing solutions in Israel and internationally. The company offers 3D printers, comprising AME systems, which are inkjet printers, that produces Hi-PEDs by depositing proprietary conductive and dielectric substances, as well as integrates in-situ capacitors, antennas, coils, transformers, and electromechanical components; micro additive manufacturing systems, a digital light processing printers (DLP) that achieves production-grade polymer and composite parts; and industrial additive manufacturing systems, that utilizes a patented foil system that fabricates ceramic and metal parts.

See Also

Want to see what other hedge funds are holding NNDM? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Nano Dimension Ltd. (NASDAQ:NNDM - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Nano Dimension, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Nano Dimension wasn't on the list.

While Nano Dimension currently has a Sell rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.