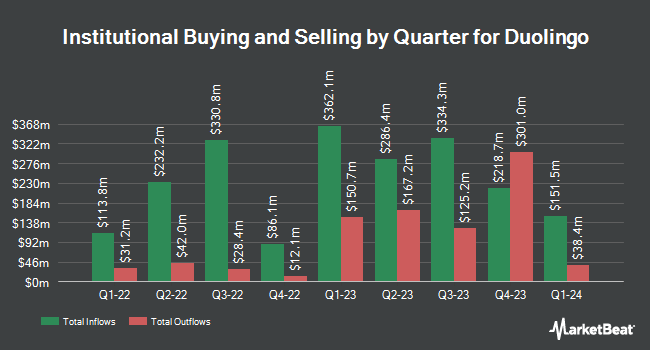

National Bank of Canada FI lifted its holdings in Duolingo, Inc. (NASDAQ:DUOL - Free Report) by 17,100.0% during the first quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The fund owned 4,300 shares of the company's stock after buying an additional 4,275 shares during the period. National Bank of Canada FI's holdings in Duolingo were worth $1,336,000 at the end of the most recent reporting period.

Several other institutional investors have also modified their holdings of DUOL. Lido Advisors LLC raised its holdings in shares of Duolingo by 0.3% in the fourth quarter. Lido Advisors LLC now owns 10,104 shares of the company's stock worth $3,276,000 after buying an additional 30 shares during the period. Crossmark Global Holdings Inc. boosted its stake in shares of Duolingo by 1.2% during the first quarter. Crossmark Global Holdings Inc. now owns 2,942 shares of the company's stock valued at $914,000 after purchasing an additional 34 shares during the period. Larson Financial Group LLC increased its stake in Duolingo by 24.4% in the 1st quarter. Larson Financial Group LLC now owns 199 shares of the company's stock worth $62,000 after buying an additional 39 shares during the period. Fifth Third Bancorp increased its stake in Duolingo by 20.4% in the 1st quarter. Fifth Third Bancorp now owns 313 shares of the company's stock worth $97,000 after buying an additional 53 shares during the period. Finally, Signaturefd LLC lifted its holdings in Duolingo by 90.1% during the 1st quarter. Signaturefd LLC now owns 135 shares of the company's stock valued at $42,000 after buying an additional 64 shares in the last quarter. 91.59% of the stock is owned by institutional investors.

Wall Street Analyst Weigh In

A number of equities analysts have recently commented on DUOL shares. KeyCorp raised shares of Duolingo from a "sector weight" rating to an "overweight" rating and set a $460.00 target price on the stock in a research report on Monday. DA Davidson dropped their price target on Duolingo from $600.00 to $500.00 and set a "buy" rating on the stock in a research report on Wednesday, June 25th. Argus began coverage on shares of Duolingo in a report on Wednesday, June 25th. They set a "buy" rating and a $575.00 target price on the stock. Scotiabank increased their price objective on shares of Duolingo from $405.00 to $470.00 and gave the company a "sector outperform" rating in a research note on Friday, May 2nd. Finally, Citizens Jmp dropped their target price on Duolingo from $475.00 to $450.00 and set a "mkt outperform" rating on the stock in a research report on Monday, July 28th. Thirteen analysts have rated the stock with a Buy rating and five have issued a Hold rating to the company. According to data from MarketBeat.com, the company currently has a consensus rating of "Moderate Buy" and a consensus price target of $451.35.

View Our Latest Stock Analysis on Duolingo

Insiders Place Their Bets

In other news, insider Natalie Glance sold 2,533 shares of the stock in a transaction dated Friday, August 15th. The shares were sold at an average price of $329.03, for a total transaction of $833,432.99. Following the sale, the insider directly owned 122,112 shares of the company's stock, valued at $40,178,511.36. This represents a 2.03% decrease in their position. The transaction was disclosed in a legal filing with the SEC, which is available through this link. Also, General Counsel Stephen C. Chen sold 1,282 shares of the firm's stock in a transaction that occurred on Friday, August 15th. The shares were sold at an average price of $329.03, for a total value of $421,816.46. Following the completion of the sale, the general counsel directly owned 34,153 shares in the company, valued at approximately $11,237,361.59. The trade was a 3.62% decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last 90 days, insiders have sold 58,056 shares of company stock valued at $23,589,966. Insiders own 15.67% of the company's stock.

Duolingo Stock Performance

NASDAQ:DUOL traded down $6.2530 during mid-day trading on Wednesday, hitting $334.4070. The company's stock had a trading volume of 769,087 shares, compared to its average volume of 1,033,644. The business's fifty day moving average is $386.48 and its two-hundred day moving average is $391.84. The stock has a market cap of $15.32 billion, a price-to-earnings ratio of 137.62, a PEG ratio of 2.46 and a beta of 0.87. The company has a debt-to-equity ratio of 0.10, a current ratio of 2.81 and a quick ratio of 2.81. Duolingo, Inc. has a 1 year low of $202.38 and a 1 year high of $544.93.

Duolingo (NASDAQ:DUOL - Get Free Report) last announced its quarterly earnings results on Wednesday, August 6th. The company reported $0.91 earnings per share for the quarter, beating the consensus estimate of $0.55 by $0.36. Duolingo had a return on equity of 13.32% and a net margin of 13.24%.The company had revenue of $252.27 million during the quarter, compared to analysts' expectations of $240.84 million. Duolingo's quarterly revenue was up 41.5% on a year-over-year basis. During the same period last year, the business earned $0.51 earnings per share. Analysts anticipate that Duolingo, Inc. will post 2.03 EPS for the current fiscal year.

About Duolingo

(

Free Report)

Duolingo, Inc operates as a mobile learning platform in the United States, the United Kingdom, and internationally. The company offers courses in 40 different languages, including Spanish, English, French, German, Italian, Portuguese, Japanese, and Chinese through its Duolingo app. It also provides a digital English language proficiency assessment exam.

Read More

Before you consider Duolingo, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Duolingo wasn't on the list.

While Duolingo currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.