National Bank of Canada FI cut its position in Tilray Brands, Inc. (NASDAQ:TLRY - Free Report) by 70.6% during the first quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The fund owned 317,155 shares of the company's stock after selling 763,247 shares during the period. National Bank of Canada FI's holdings in Tilray Brands were worth $207,000 as of its most recent filing with the Securities and Exchange Commission.

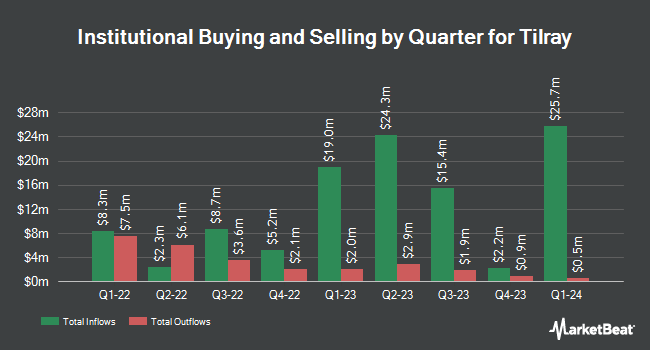

Other large investors also recently modified their holdings of the company. Dimensional Fund Advisors LP increased its position in shares of Tilray Brands by 54.8% in the 4th quarter. Dimensional Fund Advisors LP now owns 2,172,935 shares of the company's stock valued at $2,890,000 after purchasing an additional 769,569 shares during the last quarter. JPMorgan Chase & Co. increased its position in shares of Tilray Brands by 112.7% in the 4th quarter. JPMorgan Chase & Co. now owns 919,082 shares of the company's stock valued at $1,222,000 after purchasing an additional 487,051 shares during the last quarter. Millennium Management LLC purchased a new stake in shares of Tilray Brands in the 4th quarter valued at approximately $879,000. Raymond James Financial Inc. purchased a new stake in shares of Tilray Brands in the 4th quarter valued at approximately $255,000. Finally, Tidal Investments LLC increased its position in shares of Tilray Brands by 9.2% in the 4th quarter. Tidal Investments LLC now owns 10,595,264 shares of the company's stock valued at $14,092,000 after purchasing an additional 889,086 shares during the last quarter. 9.35% of the stock is owned by hedge funds and other institutional investors.

Analyst Upgrades and Downgrades

A number of brokerages have commented on TLRY. Wall Street Zen downgraded shares of Tilray Brands to a "strong sell" rating in a research report on Saturday, July 5th. Zelman & Associates reaffirmed a "neutral" rating on shares of Tilray Brands in a research report on Tuesday, July 29th. One research analyst has rated the stock with a Buy rating and four have assigned a Hold rating to the company. According to MarketBeat.com, the company currently has a consensus rating of "Hold" and an average price target of $1.92.

Get Our Latest Stock Analysis on TLRY

Tilray Brands Stock Up 4.7%

Shares of NASDAQ TLRY traded up $0.05 during mid-day trading on Thursday, reaching $1.11. The company had a trading volume of 45,889,382 shares, compared to its average volume of 75,399,952. The company has a current ratio of 2.46, a quick ratio of 1.49 and a debt-to-equity ratio of 0.20. The firm has a 50 day simple moving average of $0.64 and a two-hundred day simple moving average of $0.61. The stock has a market cap of $1.22 billion, a P/E ratio of -0.48 and a beta of 1.85. Tilray Brands, Inc. has a 52-week low of $0.3507 and a 52-week high of $1.95.

Tilray Brands (NASDAQ:TLRY - Get Free Report) last issued its quarterly earnings results on Monday, July 28th. The company reported $0.02 earnings per share for the quarter, topping analysts' consensus estimates of ($0.03) by $0.05. The firm had revenue of $224.54 million during the quarter, compared to analysts' expectations of $250.41 million. Tilray Brands had a negative net margin of 265.69% and a negative return on equity of 6.83%. Sell-side analysts predict that Tilray Brands, Inc. will post -0.2 earnings per share for the current year.

Insiders Place Their Bets

In other Tilray Brands news, CEO Irwin D. Simon purchased 165,000 shares of the firm's stock in a transaction that occurred on Wednesday, July 30th. The stock was purchased at an average price of $0.61 per share, for a total transaction of $100,650.00. Following the purchase, the chief executive officer directly owned 3,941,633 shares in the company, valued at approximately $2,404,396.13. This trade represents a 4.37% increase in their ownership of the stock. The acquisition was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through the SEC website. 0.60% of the stock is currently owned by corporate insiders.

Tilray Brands Company Profile

(

Free Report)

Tilray, Inc engages in the research, cultivation, processing, and distribution of medical cannabis. The company offers its products in Argentina, Australia, Canada, Chile, Croatia, Cyprus, the Czech Republic, Germany, New Zealand, and South Africa. Tilray, Inc is headquartered in Canada.

See Also

Before you consider Tilray Brands, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Tilray Brands wasn't on the list.

While Tilray Brands currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.