National Bank of Canada FI trimmed its holdings in shares of Lucid Group, Inc. (NASDAQ:LCID - Free Report) by 97.1% in the first quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The fund owned 13,735 shares of the company's stock after selling 461,952 shares during the period. National Bank of Canada FI's holdings in Lucid Group were worth $33,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

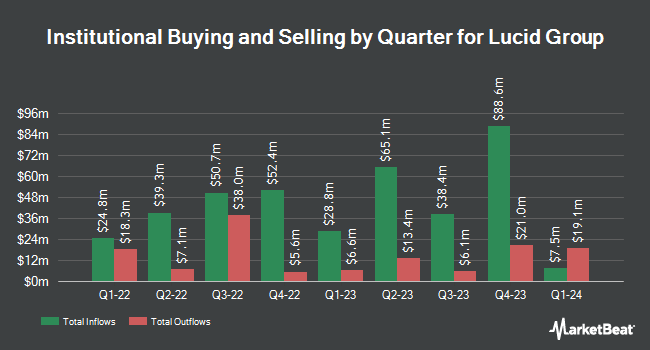

A number of other institutional investors also recently bought and sold shares of LCID. Bank of New York Mellon Corp increased its position in shares of Lucid Group by 4.5% during the first quarter. Bank of New York Mellon Corp now owns 3,091,063 shares of the company's stock worth $7,480,000 after purchasing an additional 132,497 shares in the last quarter. Swiss National Bank increased its position in shares of Lucid Group by 26.9% during the first quarter. Swiss National Bank now owns 2,334,000 shares of the company's stock worth $5,648,000 after purchasing an additional 495,000 shares in the last quarter. Vanguard Group Inc. increased its position in shares of Lucid Group by 0.6% during the first quarter. Vanguard Group Inc. now owns 110,933,835 shares of the company's stock worth $268,460,000 after purchasing an additional 615,108 shares in the last quarter. Vontobel Holding Ltd. increased its position in shares of Lucid Group by 119.5% during the first quarter. Vontobel Holding Ltd. now owns 532,459 shares of the company's stock worth $1,289,000 after purchasing an additional 289,880 shares in the last quarter. Finally, Two Sigma Investments LP increased its position in shares of Lucid Group by 4,320.7% during the fourth quarter. Two Sigma Investments LP now owns 15,851,907 shares of the company's stock worth $47,873,000 after purchasing an additional 15,493,320 shares in the last quarter. 75.17% of the stock is owned by hedge funds and other institutional investors.

Lucid Group Price Performance

Shares of NASDAQ:LCID traded down $0.0650 during trading on Friday, hitting $2.0250. 124,484,260 shares of the stock were exchanged, compared to its average volume of 115,790,984. The company has a fifty day moving average price of $2.35 and a two-hundred day moving average price of $2.44. The company has a market cap of $6.22 billion, a PE ratio of -1.76 and a beta of 0.79. The company has a current ratio of 2.58, a quick ratio of 2.11 and a debt-to-equity ratio of 0.92. Lucid Group, Inc. has a 12-month low of $1.93 and a 12-month high of $4.43.

Lucid Group (NASDAQ:LCID - Get Free Report) last announced its quarterly earnings results on Tuesday, August 5th. The company reported ($0.28) EPS for the quarter, missing the consensus estimate of ($0.22) by ($0.06). The firm had revenue of $259.43 million for the quarter, compared to analysts' expectations of $288.10 million. Lucid Group had a negative return on equity of 79.40% and a negative net margin of 259.57%.Lucid Group's revenue was up 29.3% compared to the same quarter last year. During the same period last year, the firm earned ($0.29) EPS. On average, analysts forecast that Lucid Group, Inc. will post -1.25 EPS for the current year.

Wall Street Analysts Forecast Growth

Separately, Cantor Fitzgerald reiterated a "neutral" rating and set a $3.00 target price on shares of Lucid Group in a research report on Wednesday, May 7th. Two research analysts have rated the stock with a Buy rating, eight have assigned a Hold rating and two have issued a Sell rating to the stock. Based on data from MarketBeat.com, Lucid Group currently has a consensus rating of "Hold" and a consensus target price of $2.68.

View Our Latest Stock Report on LCID

Lucid Group Profile

(

Free Report)

Lucid Group, Inc a technology company, designs, engineers, manufactures, and sells electric vehicles (EV), EV powertrains, and battery systems. It also designs and develops proprietary software in-house for Lucid vehicles. The company sells vehicles directly to consumers through its retail sales network and direct online sales, including Lucid Financial Services.

Read More

Before you consider Lucid Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Lucid Group wasn't on the list.

While Lucid Group currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.