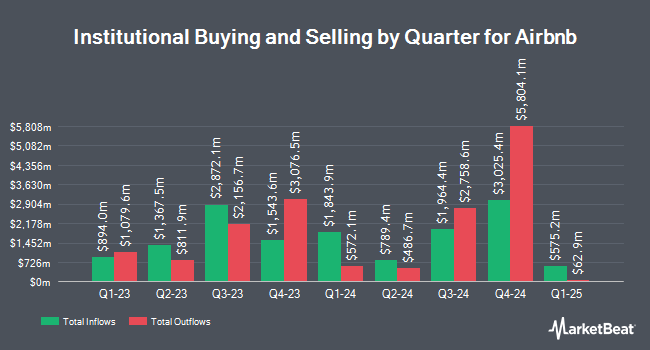

National Pension Service raised its stake in Airbnb, Inc. (NASDAQ:ABNB - Free Report) by 6.9% in the 1st quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The institutional investor owned 1,059,779 shares of the company's stock after buying an additional 68,716 shares during the quarter. National Pension Service owned approximately 0.17% of Airbnb worth $126,601,000 at the end of the most recent quarter.

Several other large investors also recently added to or reduced their stakes in ABNB. Ritholtz Wealth Management lifted its stake in shares of Airbnb by 10.0% in the 1st quarter. Ritholtz Wealth Management now owns 5,328 shares of the company's stock valued at $636,000 after purchasing an additional 484 shares during the last quarter. Janney Montgomery Scott LLC lifted its stake in shares of Airbnb by 0.4% in the 1st quarter. Janney Montgomery Scott LLC now owns 51,192 shares of the company's stock valued at $6,115,000 after purchasing an additional 228 shares during the last quarter. Spire Wealth Management lifted its stake in shares of Airbnb by 40.1% in the 1st quarter. Spire Wealth Management now owns 909 shares of the company's stock valued at $109,000 after purchasing an additional 260 shares during the last quarter. Golden State Wealth Management LLC lifted its stake in shares of Airbnb by 366.3% in the 1st quarter. Golden State Wealth Management LLC now owns 886 shares of the company's stock valued at $106,000 after purchasing an additional 696 shares during the last quarter. Finally, Wealth Enhancement Advisory Services LLC lifted its stake in shares of Airbnb by 39.5% in the 1st quarter. Wealth Enhancement Advisory Services LLC now owns 73,246 shares of the company's stock valued at $8,750,000 after purchasing an additional 20,753 shares during the last quarter. 80.76% of the stock is currently owned by hedge funds and other institutional investors.

Wall Street Analysts Forecast Growth

Several equities analysts have recently commented on ABNB shares. Royal Bank Of Canada upped their price target on Airbnb from $140.00 to $145.00 and gave the company a "sector perform" rating in a research note on Thursday, August 7th. Truist Financial reaffirmed a "sell" rating and issued a $106.00 price target (down previously from $112.00) on shares of Airbnb in a research note on Friday, May 30th. B. Riley decreased their price target on Airbnb from $145.00 to $140.00 and set a "neutral" rating on the stock in a research note on Friday, May 2nd. Wedbush decreased their price target on Airbnb from $135.00 to $130.00 and set a "neutral" rating on the stock in a research note on Thursday, August 7th. Finally, Wells Fargo & Company set a $110.00 target price on Airbnb and gave the stock an "underweight" rating in a research note on Thursday, August 7th. Five equities research analysts have rated the stock with a sell rating, nineteen have issued a hold rating, thirteen have given a buy rating and two have issued a strong buy rating to the company's stock. According to data from MarketBeat, the stock has a consensus rating of "Hold" and a consensus target price of $142.72.

Get Our Latest Stock Analysis on ABNB

Airbnb Price Performance

Shares of ABNB traded up $0.46 during mid-day trading on Friday, reaching $125.10. The company's stock had a trading volume of 4,307,326 shares, compared to its average volume of 5,404,998. Airbnb, Inc. has a 12-month low of $99.88 and a 12-month high of $163.93. The stock has a market cap of $77.74 billion, a PE ratio of 30.29, a price-to-earnings-growth ratio of 2.28 and a beta of 1.13. The company's 50 day moving average is $133.76 and its 200 day moving average is $130.70.

Airbnb (NASDAQ:ABNB - Get Free Report) last released its quarterly earnings data on Wednesday, August 6th. The company reported $1.03 EPS for the quarter, beating analysts' consensus estimates of $0.92 by $0.11. Airbnb had a return on equity of 32.19% and a net margin of 22.67%. The business had revenue of $3.10 billion for the quarter, compared to the consensus estimate of $3.02 billion. During the same quarter in the prior year, the business posted $0.86 EPS. The business's revenue for the quarter was up 12.7% on a year-over-year basis. As a group, sell-side analysts anticipate that Airbnb, Inc. will post 4.31 EPS for the current fiscal year.

Insider Activity

In related news, Director Joseph Gebbia sold 236,000 shares of the firm's stock in a transaction that occurred on Monday, June 9th. The stock was sold at an average price of $139.40, for a total transaction of $32,898,400.00. Following the transaction, the director owned 1,180,015 shares in the company, valued at $164,494,091. This trade represents a 16.67% decrease in their position. The transaction was disclosed in a filing with the SEC, which is available through the SEC website. Also, CEO Brian Chesky sold 8,000 shares of the firm's stock in a transaction that occurred on Thursday, May 29th. The stock was sold at an average price of $128.33, for a total value of $1,026,640.00. Following the transaction, the chief executive officer owned 40,800 shares in the company, valued at $5,235,864. This represents a 16.39% decrease in their position. The disclosure for this sale can be found here. In the last 90 days, insiders have sold 1,671,023 shares of company stock worth $223,195,427. 27.91% of the stock is currently owned by insiders.

Airbnb Profile

(

Free Report)

Airbnb, Inc, together with its subsidiaries, operates a platform that enables hosts to offer stays and experiences to guests worldwide. The company's marketplace connects hosts and guests online or through mobile devices to book spaces and experiences. It primarily offers private rooms, primary homes, and vacation homes.

See Also

Before you consider Airbnb, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Airbnb wasn't on the list.

While Airbnb currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.