National Pension Service boosted its position in AvalonBay Communities, Inc. (NYSE:AVB - Free Report) by 10.6% in the first quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The firm owned 218,700 shares of the real estate investment trust's stock after purchasing an additional 21,031 shares during the period. National Pension Service owned approximately 0.15% of AvalonBay Communities worth $46,937,000 as of its most recent SEC filing.

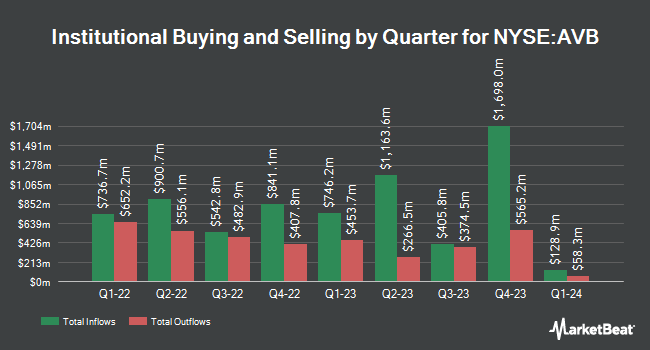

Other institutional investors have also recently added to or reduced their stakes in the company. Hsbc Holdings PLC lifted its position in AvalonBay Communities by 1.4% in the fourth quarter. Hsbc Holdings PLC now owns 604,010 shares of the real estate investment trust's stock worth $132,751,000 after purchasing an additional 8,439 shares during the period. Achmea Investment Management B.V. lifted its position in AvalonBay Communities by 33.5% in the first quarter. Achmea Investment Management B.V. now owns 23,068 shares of the real estate investment trust's stock worth $4,951,000 after purchasing an additional 5,791 shares during the period. Sumitomo Mitsui DS Asset Management Company Ltd lifted its position in AvalonBay Communities by 4.9% in the first quarter. Sumitomo Mitsui DS Asset Management Company Ltd now owns 48,476 shares of the real estate investment trust's stock worth $10,404,000 after purchasing an additional 2,243 shares during the period. Vert Asset Management LLC lifted its position in AvalonBay Communities by 5.0% in the first quarter. Vert Asset Management LLC now owns 66,660 shares of the real estate investment trust's stock worth $14,307,000 after purchasing an additional 3,199 shares during the period. Finally, Mitsubishi UFJ Asset Management Co. Ltd. lifted its position in shares of AvalonBay Communities by 9.1% during the 1st quarter. Mitsubishi UFJ Asset Management Co. Ltd. now owns 344,505 shares of the real estate investment trust's stock valued at $73,938,000 after acquiring an additional 28,608 shares during the last quarter. 92.61% of the stock is currently owned by institutional investors and hedge funds.

AvalonBay Communities Stock Down 1.1%

Shares of NYSE AVB traded down $2.15 during mid-day trading on Monday, reaching $188.43. The company had a trading volume of 687,767 shares, compared to its average volume of 816,624. AvalonBay Communities, Inc. has a twelve month low of $180.40 and a twelve month high of $239.29. The company has a debt-to-equity ratio of 0.71, a quick ratio of 0.70 and a current ratio of 0.70. The stock has a market capitalization of $26.83 billion, a PE ratio of 23.21, a price-to-earnings-growth ratio of 2.73 and a beta of 0.86. The stock's 50 day moving average is $199.66 and its 200-day moving average is $206.26.

AvalonBay Communities (NYSE:AVB - Get Free Report) last posted its quarterly earnings results on Wednesday, July 30th. The real estate investment trust reported $2.82 earnings per share for the quarter, topping analysts' consensus estimates of $2.80 by $0.02. AvalonBay Communities had a net margin of 38.91% and a return on equity of 9.70%. The business had revenue of $689.90 million for the quarter, compared to the consensus estimate of $759.08 million. During the same period in the prior year, the business posted $2.77 earnings per share. As a group, equities analysts anticipate that AvalonBay Communities, Inc. will post 11.48 earnings per share for the current fiscal year.

AvalonBay Communities Dividend Announcement

The business also recently declared a quarterly dividend, which was paid on Tuesday, July 15th. Stockholders of record on Monday, June 30th were paid a $1.75 dividend. The ex-dividend date of this dividend was Monday, June 30th. This represents a $7.00 dividend on an annualized basis and a dividend yield of 3.7%. AvalonBay Communities's dividend payout ratio is 86.21%.

Insiders Place Their Bets

In other AvalonBay Communities news, EVP Edward M. Schulman sold 5,945 shares of the company's stock in a transaction dated Friday, June 13th. The shares were sold at an average price of $205.67, for a total transaction of $1,222,708.15. Following the completion of the sale, the executive vice president directly owned 17,617 shares in the company, valued at $3,623,288.39. This represents a 25.23% decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available at the SEC website. Also, CFO Kevin P. O'shea sold 6,000 shares of the company's stock in a transaction dated Monday, June 16th. The shares were sold at an average price of $207.57, for a total transaction of $1,245,420.00. Following the sale, the chief financial officer owned 22,782 shares of the company's stock, valued at $4,728,859.74. This trade represents a 20.85% decrease in their ownership of the stock. The disclosure for this sale can be found here. Corporate insiders own 0.48% of the company's stock.

Analyst Ratings Changes

A number of equities research analysts have recently commented on AVB shares. Morgan Stanley upgraded AvalonBay Communities from an "equal weight" rating to an "overweight" rating and cut their price objective for the company from $228.00 to $225.00 in a research report on Wednesday, August 13th. Scotiabank cut their price objective on AvalonBay Communities from $236.00 to $226.00 and set a "sector perform" rating for the company in a research report on Thursday. UBS Group cut their price objective on AvalonBay Communities from $238.00 to $216.00 and set a "neutral" rating for the company in a research report on Tuesday, July 15th. Evercore ISI cut their price objective on AvalonBay Communities from $216.00 to $212.00 and set an "in-line" rating for the company in a research report on Tuesday, August 12th. Finally, Piper Sandler reiterated a "neutral" rating and set a $200.00 price objective (down previously from $255.00) on shares of AvalonBay Communities in a research report on Monday, August 4th. Ten analysts have rated the stock with a hold rating and six have given a buy rating to the company's stock. According to MarketBeat.com, the stock currently has a consensus rating of "Hold" and a consensus price target of $225.64.

Check Out Our Latest Stock Analysis on AVB

About AvalonBay Communities

(

Free Report)

AvalonBay Communities, Inc is a real estate investment trust, which engages in the development, acquisition, ownership, and operation of multifamily communities. It operates through the following segments: Same Store, Other Stabilized, and Development or Redevelopment. The Same Store segment refers to the operating communities that were owned and had stabilized occupancy.

See Also

Before you consider AvalonBay Communities, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and AvalonBay Communities wasn't on the list.

While AvalonBay Communities currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report