Natixis Advisors LLC lifted its holdings in H&R Block, Inc. (NYSE:HRB - Free Report) by 21.4% during the 1st quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The institutional investor owned 31,414 shares of the company's stock after acquiring an additional 5,533 shares during the quarter. Natixis Advisors LLC's holdings in H&R Block were worth $1,725,000 at the end of the most recent reporting period.

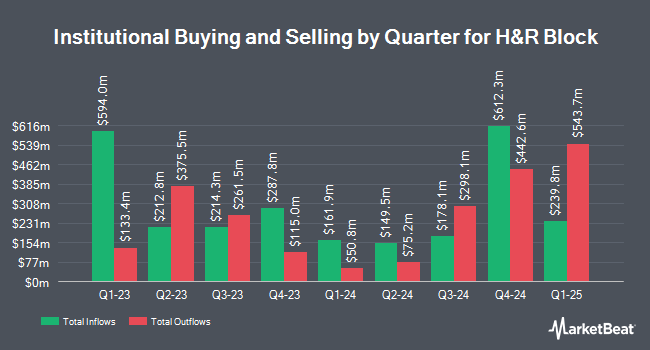

Several other institutional investors and hedge funds have also modified their holdings of HRB. Fuller & Thaler Asset Management Inc. lifted its holdings in H&R Block by 12.5% during the 4th quarter. Fuller & Thaler Asset Management Inc. now owns 4,701,896 shares of the company's stock worth $248,448,000 after buying an additional 523,353 shares in the last quarter. Lazard Asset Management LLC lifted its holdings in H&R Block by 36.8% during the 4th quarter. Lazard Asset Management LLC now owns 2,585,026 shares of the company's stock worth $136,591,000 after buying an additional 695,581 shares in the last quarter. Northern Trust Corp lifted its holdings in H&R Block by 8.9% during the 4th quarter. Northern Trust Corp now owns 2,345,222 shares of the company's stock worth $123,922,000 after buying an additional 191,595 shares in the last quarter. Dimensional Fund Advisors LP lifted its holdings in H&R Block by 1.3% during the 4th quarter. Dimensional Fund Advisors LP now owns 2,335,353 shares of the company's stock worth $123,395,000 after buying an additional 30,244 shares in the last quarter. Finally, AQR Capital Management LLC lifted its holdings in H&R Block by 5.6% during the 4th quarter. AQR Capital Management LLC now owns 2,250,059 shares of the company's stock worth $118,871,000 after buying an additional 120,181 shares in the last quarter. 90.14% of the stock is owned by institutional investors and hedge funds.

Analysts Set New Price Targets

Several research analysts have issued reports on HRB shares. The Goldman Sachs Group upped their price objective on H&R Block from $49.00 to $54.00 and gave the stock a "sell" rating in a report on Thursday, May 8th. Wall Street Zen raised H&R Block from a "hold" rating to a "buy" rating in a report on Friday, May 9th. Barrington Research reaffirmed an "outperform" rating and set a $70.00 price objective on shares of H&R Block in a report on Friday, April 25th. Finally, Northcoast Research downgraded H&R Block from a "buy" rating to a "neutral" rating in a research note on Friday, May 2nd.

Get Our Latest Analysis on HRB

H&R Block Price Performance

Shares of HRB stock traded down $0.83 during trading hours on Monday, reaching $54.52. The company had a trading volume of 1,532,507 shares, compared to its average volume of 1,420,599. The company has a 50 day moving average of $55.67 and a 200 day moving average of $55.81. The firm has a market cap of $7.30 billion, a price-to-earnings ratio of 13.36, a P/E/G ratio of 0.87 and a beta of 0.24. H&R Block, Inc. has a 1-year low of $49.16 and a 1-year high of $68.45.

H&R Block Company Profile

(

Free Report)

H&R Block, Inc engages in the provision of tax return preparation solutions, financial products and small business solutions. The company was founded by Henry W. Bloch and Richard A. Bloch on January 25, 1955, and is headquartered in Kansas City, MO.

Further Reading

Before you consider H&R Block, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and H&R Block wasn't on the list.

While H&R Block currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Learn the basics of options trading and how to use them to boost returns and manage risk with this free report from MarketBeat. Click the link below to get your free copy.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.