Natixis Advisors LLC grew its stake in Norwegian Cruise Line Holdings Ltd. (NYSE:NCLH - Free Report) by 8.7% in the 1st quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The institutional investor owned 179,139 shares of the company's stock after buying an additional 14,308 shares during the period. Natixis Advisors LLC's holdings in Norwegian Cruise Line were worth $3,396,000 at the end of the most recent reporting period.

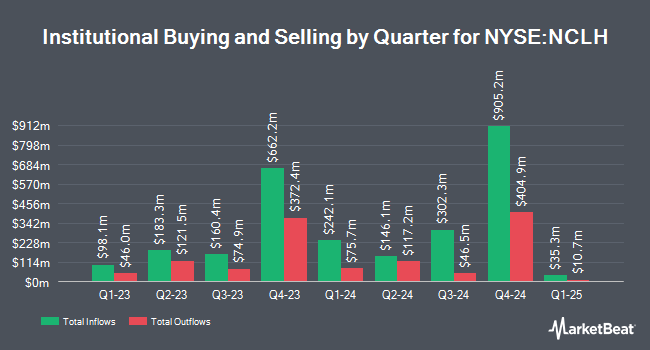

Other large investors have also modified their holdings of the company. Versant Capital Management Inc boosted its holdings in shares of Norwegian Cruise Line by 147.7% in the 1st quarter. Versant Capital Management Inc now owns 1,880 shares of the company's stock valued at $36,000 after buying an additional 1,121 shares in the last quarter. Raiffeisen Bank International AG purchased a new position in Norwegian Cruise Line during the 4th quarter worth $40,000. Bogart Wealth LLC grew its position in Norwegian Cruise Line by 1,012.0% during the 1st quarter. Bogart Wealth LLC now owns 2,224 shares of the company's stock worth $42,000 after purchasing an additional 2,024 shares during the last quarter. LRI Investments LLC purchased a new position in Norwegian Cruise Line during the 4th quarter worth $47,000. Finally, CENTRAL TRUST Co grew its position in Norwegian Cruise Line by 2,621.0% during the 1st quarter. CENTRAL TRUST Co now owns 2,721 shares of the company's stock worth $52,000 after purchasing an additional 2,621 shares during the last quarter. Institutional investors and hedge funds own 69.58% of the company's stock.

Norwegian Cruise Line Price Performance

NYSE:NCLH traded down $0.48 during mid-day trading on Friday, hitting $23.99. 12,277,165 shares of the company's stock traded hands, compared to its average volume of 15,176,232. The company has a debt-to-equity ratio of 8.05, a quick ratio of 0.16 and a current ratio of 0.18. The firm's 50 day simple moving average is $21.48 and its 200 day simple moving average is $20.86. Norwegian Cruise Line Holdings Ltd. has a 1 year low of $14.21 and a 1 year high of $29.29. The company has a market cap of $10.84 billion, a PE ratio of 16.54, a price-to-earnings-growth ratio of 1.09 and a beta of 2.24.

Norwegian Cruise Line (NYSE:NCLH - Get Free Report) last posted its earnings results on Thursday, July 31st. The company reported $0.51 earnings per share for the quarter, missing the consensus estimate of $0.52 by ($0.01). Norwegian Cruise Line had a net margin of 7.52% and a return on equity of 59.88%. The business had revenue of $2.52 billion for the quarter, compared to analysts' expectations of $2.55 billion. During the same quarter last year, the business posted $0.40 earnings per share. The business's revenue was up 6.1% compared to the same quarter last year. Sell-side analysts expect that Norwegian Cruise Line Holdings Ltd. will post 1.48 EPS for the current year.

Analysts Set New Price Targets

Several brokerages have issued reports on NCLH. Jefferies Financial Group raised their price objective on shares of Norwegian Cruise Line from $24.00 to $29.00 and gave the stock a "buy" rating in a research report on Monday, July 7th. Bank of America raised their price objective on shares of Norwegian Cruise Line from $20.00 to $27.00 and gave the stock a "neutral" rating in a research report on Wednesday, July 23rd. Barclays raised their price objective on shares of Norwegian Cruise Line from $25.00 to $31.00 and gave the stock an "overweight" rating in a research report on Friday, August 1st. UBS Group lowered their price objective on shares of Norwegian Cruise Line from $29.00 to $23.00 and set a "neutral" rating on the stock in a research report on Monday, June 30th. Finally, Melius Research upgraded shares of Norwegian Cruise Line to a "strong-buy" rating in a research note on Monday, April 21st. Nine equities research analysts have rated the stock with a hold rating, twelve have issued a buy rating and two have issued a strong buy rating to the stock. According to MarketBeat.com, the company has a consensus rating of "Moderate Buy" and an average price target of $27.20.

Check Out Our Latest Stock Analysis on Norwegian Cruise Line

Norwegian Cruise Line Profile

(

Free Report)

Norwegian Cruise Line Holdings Ltd., together with its subsidiaries, operates as a cruise company in North America, Europe, the Asia-Pacific, and internationally. The company operates through the Norwegian Cruise Line, Oceania Cruises, and Regent Seven Seas Cruises brands. It offers itineraries ranging from three days to a 180-days calling on various ports, including Scandinavia, Northern Europe, the Mediterranean, the Greek Isles, Alaska, Canada and New England, Hawaii, Asia, Tahiti and the South Pacific, Australia and New Zealand, Africa, India, South America, the Panama Canal, and the Caribbean.

Further Reading

Before you consider Norwegian Cruise Line, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Norwegian Cruise Line wasn't on the list.

While Norwegian Cruise Line currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.