Natixis Advisors LLC grew its holdings in DTE Energy Company (NYSE:DTE - Free Report) by 21.2% in the first quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The institutional investor owned 122,933 shares of the utilities provider's stock after buying an additional 21,502 shares during the quarter. Natixis Advisors LLC owned 0.06% of DTE Energy worth $16,998,000 as of its most recent SEC filing.

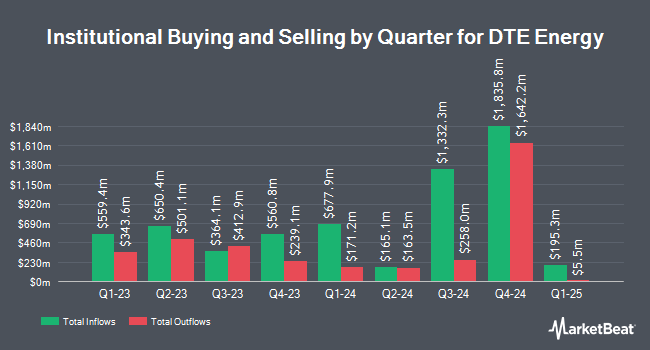

Other institutional investors and hedge funds also recently added to or reduced their stakes in the company. Capital World Investors boosted its position in shares of DTE Energy by 123.2% during the 4th quarter. Capital World Investors now owns 6,823,231 shares of the utilities provider's stock worth $823,905,000 after acquiring an additional 3,766,221 shares in the last quarter. Janus Henderson Group PLC boosted its holdings in DTE Energy by 0.5% in the fourth quarter. Janus Henderson Group PLC now owns 2,732,819 shares of the utilities provider's stock valued at $329,988,000 after acquiring an additional 12,554 shares during the last quarter. Invesco Ltd. increased its position in shares of DTE Energy by 50.2% during the fourth quarter. Invesco Ltd. now owns 2,462,592 shares of the utilities provider's stock worth $297,358,000 after acquiring an additional 822,854 shares during the last quarter. Northern Trust Corp increased its holdings in DTE Energy by 4.7% in the fourth quarter. Northern Trust Corp now owns 1,827,168 shares of the utilities provider's stock valued at $220,631,000 after buying an additional 81,935 shares during the last quarter. Finally, GAMMA Investing LLC grew its holdings in shares of DTE Energy by 14,878.4% during the first quarter. GAMMA Investing LLC now owns 1,183,591 shares of the utilities provider's stock valued at $163,655,000 after purchasing an additional 1,175,689 shares during the last quarter. Hedge funds and other institutional investors own 76.06% of the company's stock.

Wall Street Analyst Weigh In

Several equities analysts have recently issued reports on DTE shares. BMO Capital Markets boosted their price objective on DTE Energy from $135.00 to $142.00 and gave the stock a "market perform" rating in a research report on Monday, April 21st. JPMorgan Chase & Co. upped their price target on shares of DTE Energy from $145.00 to $147.00 and gave the stock a "neutral" rating in a research note on Tuesday, July 15th. Evercore ISI upped their price objective on shares of DTE Energy from $136.00 to $145.00 and gave the stock an "outperform" rating in a report on Friday, May 2nd. Wall Street Zen cut shares of DTE Energy from a "hold" rating to a "sell" rating in a report on Friday, May 16th. Finally, Citigroup reiterated a "buy" rating and issued a $151.00 target price (up previously from $142.00) on shares of DTE Energy in a research note on Friday, May 23rd. One research analyst has rated the stock with a sell rating, five have given a hold rating and ten have assigned a buy rating to the stock. Based on data from MarketBeat.com, DTE Energy currently has a consensus rating of "Moderate Buy" and an average price target of $141.53.

Check Out Our Latest Analysis on DTE

DTE Energy Stock Up 0.7%

Shares of DTE stock traded up $1.01 during trading hours on Thursday, hitting $140.13. 525,418 shares of the company's stock traded hands, compared to its average volume of 1,407,261. The stock's fifty day simple moving average is $134.66 and its two-hundred day simple moving average is $132.66. DTE Energy Company has a 12-month low of $115.59 and a 12-month high of $141.54. The company has a quick ratio of 0.57, a current ratio of 0.94 and a debt-to-equity ratio of 1.96. The stock has a market cap of $29.09 billion, a price-to-earnings ratio of 20.16, a PEG ratio of 2.77 and a beta of 0.42.

DTE Energy (NYSE:DTE - Get Free Report) last issued its quarterly earnings data on Tuesday, July 29th. The utilities provider reported $1.36 EPS for the quarter, missing analysts' consensus estimates of $1.37 by ($0.01). The business had revenue of $2.91 billion during the quarter, compared to analysts' expectations of $2.67 billion. DTE Energy had a return on equity of 12.72% and a net margin of 10.16%. On average, analysts expect that DTE Energy Company will post 7.18 EPS for the current year.

DTE Energy Dividend Announcement

The business also recently announced a quarterly dividend, which will be paid on Wednesday, October 15th. Stockholders of record on Monday, September 15th will be given a $1.09 dividend. The ex-dividend date is Monday, September 15th. This represents a $4.36 annualized dividend and a dividend yield of 3.1%. DTE Energy's dividend payout ratio (DPR) is 62.73%.

DTE Energy Company Profile

(

Free Report)

DTE Energy Company engages in the utility operations. The company's Electric segment generates, purchases, distributes, and sells electricity to various residential, commercial, and industrial customers in southeastern Michigan. It generates electricity through coal-fired plants, hydroelectric pumped storage, and nuclear plants, as well as wind and solar assets.

Read More

Before you consider DTE Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and DTE Energy wasn't on the list.

While DTE Energy currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.