Natixis Advisors LLC reduced its stake in shares of Skyworks Solutions, Inc. (NASDAQ:SWKS - Free Report) by 26.1% in the 1st quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The institutional investor owned 145,126 shares of the semiconductor manufacturer's stock after selling 51,171 shares during the quarter. Natixis Advisors LLC owned 0.09% of Skyworks Solutions worth $9,379,000 at the end of the most recent reporting period.

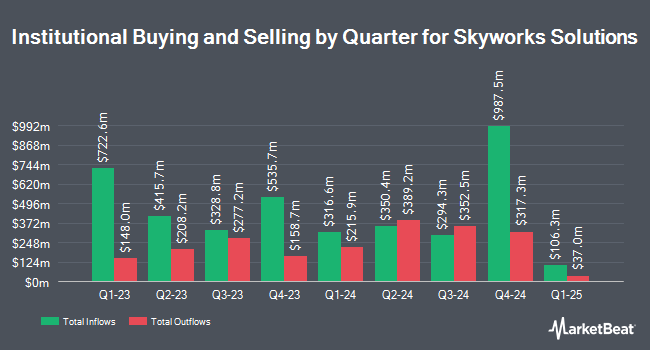

Other institutional investors also recently bought and sold shares of the company. Legacy Financial Advisors Inc. grew its stake in Skyworks Solutions by 2.5% during the 4th quarter. Legacy Financial Advisors Inc. now owns 6,383 shares of the semiconductor manufacturer's stock worth $566,000 after purchasing an additional 156 shares in the last quarter. Ridgewood Investments LLC increased its stake in Skyworks Solutions by 27.9% in the 1st quarter. Ridgewood Investments LLC now owns 861 shares of the semiconductor manufacturer's stock valued at $56,000 after purchasing an additional 188 shares in the last quarter. Inspire Advisors LLC increased its position in Skyworks Solutions by 1.3% during the first quarter. Inspire Advisors LLC now owns 14,732 shares of the semiconductor manufacturer's stock worth $952,000 after buying an additional 194 shares in the last quarter. Albert D Mason Inc. boosted its holdings in shares of Skyworks Solutions by 1.8% during the first quarter. Albert D Mason Inc. now owns 12,245 shares of the semiconductor manufacturer's stock worth $791,000 after purchasing an additional 215 shares during the last quarter. Finally, Quadrant Capital Group LLC boosted its holdings in Skyworks Solutions by 53.2% in the fourth quarter. Quadrant Capital Group LLC now owns 628 shares of the semiconductor manufacturer's stock valued at $56,000 after acquiring an additional 218 shares during the last quarter. 85.43% of the stock is owned by institutional investors and hedge funds.

Wall Street Analysts Forecast Growth

A number of analysts have recently weighed in on SWKS shares. Citigroup increased their price target on Skyworks Solutions from $63.00 to $66.00 and gave the stock a "sell" rating in a research report on Wednesday. Barclays increased their price target on shares of Skyworks Solutions from $45.00 to $52.00 and gave the stock an "underweight" rating in a research report on Thursday, May 8th. Susquehanna raised their price objective on shares of Skyworks Solutions from $60.00 to $75.00 and gave the company a "neutral" rating in a research note on Tuesday, July 22nd. Stifel Nicolaus lifted their price target on shares of Skyworks Solutions from $62.00 to $72.00 and gave the company a "hold" rating in a research note on Thursday, May 8th. Finally, UBS Group boosted their target price on shares of Skyworks Solutions from $65.00 to $75.00 and gave the company a "neutral" rating in a research report on Monday, July 21st. Four analysts have rated the stock with a sell rating, thirteen have issued a hold rating and one has assigned a buy rating to the stock. According to data from MarketBeat.com, the stock has an average rating of "Hold" and an average price target of $72.87.

View Our Latest Analysis on Skyworks Solutions

Skyworks Solutions Price Performance

SWKS traded up $2.44 during trading hours on Friday, hitting $70.99. The company's stock had a trading volume of 1,011,007 shares, compared to its average volume of 3,512,736. The business's 50-day moving average price is $72.66 and its 200-day moving average price is $69.79. Skyworks Solutions, Inc. has a 12 month low of $47.93 and a 12 month high of $110.76. The stock has a market cap of $10.66 billion, a price-to-earnings ratio of 28.40, a P/E/G ratio of 1.69 and a beta of 1.13. The company has a current ratio of 2.39, a quick ratio of 3.84 and a debt-to-equity ratio of 0.09.

Skyworks Solutions (NASDAQ:SWKS - Get Free Report) last posted its quarterly earnings results on Tuesday, August 5th. The semiconductor manufacturer reported $1.33 EPS for the quarter, topping analysts' consensus estimates of $1.24 by $0.09. Skyworks Solutions had a net margin of 9.88% and a return on equity of 11.77%. The firm had revenue of $965.00 million for the quarter, compared to analysts' expectations of $940.00 million. During the same period in the prior year, the business posted $1.21 earnings per share. The business's revenue for the quarter was up 6.6% on a year-over-year basis. Sell-side analysts expect that Skyworks Solutions, Inc. will post 3.7 earnings per share for the current fiscal year.

Skyworks Solutions Increases Dividend

The company also recently declared a quarterly dividend, which will be paid on Tuesday, September 16th. Shareholders of record on Tuesday, August 26th will be given a dividend of $0.71 per share. The ex-dividend date of this dividend is Tuesday, August 26th. This is a positive change from Skyworks Solutions's previous quarterly dividend of $0.70. This represents a $2.84 annualized dividend and a dividend yield of 4.0%. Skyworks Solutions's payout ratio is currently 113.60%.

About Skyworks Solutions

(

Free Report)

Skyworks Solutions, Inc, together with its subsidiaries, designs, develops, manufactures, and markets proprietary semiconductor products in the United States, China, South Korea, Taiwan, Europe, the Middle East, Africa, and the rest of Asia-Pacific. Its product portfolio includes amplifiers, antenna tuners, attenuators, automotive tuners and digital radios, DC/DC converters, demodulators, detectors, diodes, wireless analog system on chip products, directional couplers, diversity receive modules, filters, front-end modules, hybrids, light emitting diode drivers, low noise amplifiers, mixers, modulators, optocouplers/optoisolators, phase locked loops, phase shifters, power dividers/combiners, power over ethernet, power isolators, receivers, switches, synthesizers, timing devices, voltage controlled oscillators/synthesizers, and voltage regulators.

See Also

Before you consider Skyworks Solutions, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Skyworks Solutions wasn't on the list.

While Skyworks Solutions currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report