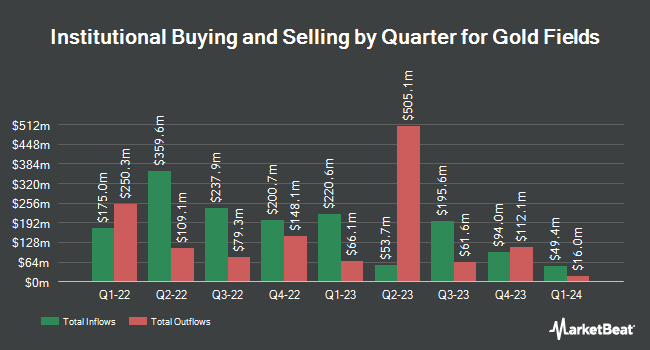

Naviter Wealth LLC purchased a new position in Gold Fields Limited (NYSE:GFI - Free Report) in the 2nd quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The fund purchased 12,384 shares of the company's stock, valued at approximately $293,000.

Several other hedge funds have also added to or reduced their stakes in the business. Sequoia Financial Advisors LLC lifted its stake in Gold Fields by 34.1% in the second quarter. Sequoia Financial Advisors LLC now owns 21,123 shares of the company's stock worth $500,000 after purchasing an additional 5,367 shares during the last quarter. Yousif Capital Management LLC lifted its stake in Gold Fields by 8.5% in the second quarter. Yousif Capital Management LLC now owns 14,917 shares of the company's stock worth $353,000 after purchasing an additional 1,165 shares during the last quarter. Vanguard Personalized Indexing Management LLC lifted its stake in Gold Fields by 19.6% in the second quarter. Vanguard Personalized Indexing Management LLC now owns 26,555 shares of the company's stock worth $629,000 after purchasing an additional 4,360 shares during the last quarter. Lester Murray Antman dba SimplyRich lifted its stake in Gold Fields by 6.7% in the second quarter. Lester Murray Antman dba SimplyRich now owns 17,056 shares of the company's stock worth $403,000 after purchasing an additional 1,064 shares during the last quarter. Finally, U S Global Investors Inc. lifted its stake in Gold Fields by 53.8% in the second quarter. U S Global Investors Inc. now owns 100,000 shares of the company's stock worth $2,367,000 after purchasing an additional 35,000 shares during the last quarter. 24.81% of the stock is owned by institutional investors.

Analysts Set New Price Targets

Several brokerages have recently commented on GFI. Canaccord Genuity Group downgraded shares of Gold Fields from a "buy" rating to a "hold" rating and set a $39.00 price objective for the company. in a research note on Monday. Investec downgraded shares of Gold Fields from a "buy" rating to a "hold" rating in a research note on Friday. BMO Capital Markets upped their price objective on shares of Gold Fields from $24.00 to $32.00 and gave the company a "market perform" rating in a research note on Monday, August 25th. Wall Street Zen raised shares of Gold Fields from a "buy" rating to a "strong-buy" rating in a research note on Friday, September 26th. Finally, HSBC reaffirmed a "hold" rating on shares of Gold Fields in a research note on Thursday, October 9th. One research analyst has rated the stock with a Buy rating and eight have issued a Hold rating to the company's stock. Based on data from MarketBeat.com, the company has a consensus rating of "Hold" and a consensus target price of $27.63.

Check Out Our Latest Stock Report on Gold Fields

Gold Fields Price Performance

GFI stock opened at $42.08 on Wednesday. Gold Fields Limited has a 1 year low of $12.98 and a 1 year high of $43.69. The company has a market cap of $37.66 billion, a P/E ratio of 17.91, a PEG ratio of 0.44 and a beta of 0.49. The firm has a 50-day moving average of $36.38 and a 200 day moving average of $27.95.

Gold Fields Increases Dividend

The firm also recently disclosed a semi-annual dividend, which was paid on Thursday, September 25th. Shareholders of record on Friday, September 12th were issued a $0.3993 dividend. This represents a yield of 130.0%. This is a boost from Gold Fields's previous semi-annual dividend of $0.38. The ex-dividend date was Friday, September 12th. Gold Fields's dividend payout ratio is currently 27.23%.

Gold Fields Profile

(

Free Report)

Gold Fields Limited operates as a gold producer with reserves and resources in Chile, South Africa, Ghana, Canada, Australia, and Peru. It also explores for copper and silver deposits. The company was founded in 1887 and is based in Sandton, South Africa.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Gold Fields, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Gold Fields wasn't on the list.

While Gold Fields currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.