Naviter Wealth LLC purchased a new stake in shares of Woodside Energy Group Ltd (NYSE:WDS - Free Report) in the second quarter, according to its most recent disclosure with the SEC. The firm purchased 23,706 shares of the company's stock, valued at approximately $366,000.

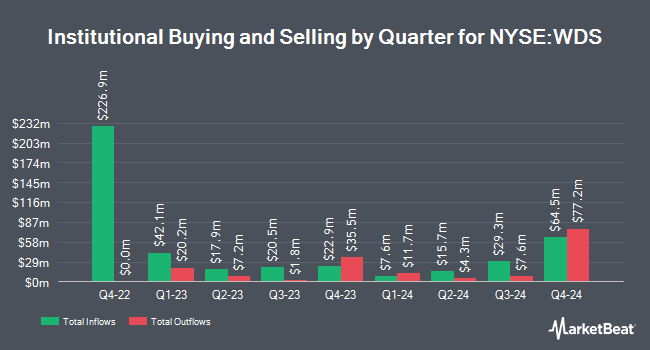

Other institutional investors and hedge funds have also recently added to or reduced their stakes in the company. Sequoia Financial Advisors LLC boosted its stake in shares of Woodside Energy Group by 295.7% during the 2nd quarter. Sequoia Financial Advisors LLC now owns 50,963 shares of the company's stock worth $786,000 after acquiring an additional 38,083 shares in the last quarter. Yousif Capital Management LLC boosted its stake in shares of Woodside Energy Group by 8.8% during the 2nd quarter. Yousif Capital Management LLC now owns 32,264 shares of the company's stock worth $498,000 after acquiring an additional 2,615 shares in the last quarter. Vanguard Personalized Indexing Management LLC boosted its stake in shares of Woodside Energy Group by 16.5% during the 2nd quarter. Vanguard Personalized Indexing Management LLC now owns 116,991 shares of the company's stock worth $1,805,000 after acquiring an additional 16,573 shares in the last quarter. U S Global Investors Inc. bought a new stake in shares of Woodside Energy Group during the 2nd quarter worth $231,000. Finally, PDS Planning Inc bought a new stake in shares of Woodside Energy Group during the 2nd quarter worth $169,000. 3.17% of the stock is owned by institutional investors.

Woodside Energy Group Stock Down 0.1%

Shares of Woodside Energy Group stock opened at $14.47 on Wednesday. The stock has a 50-day moving average price of $16.27 and a 200 day moving average price of $15.19. The company has a market cap of $27.51 billion, a P/E ratio of 17.65 and a beta of 0.63. The company has a current ratio of 1.90, a quick ratio of 1.74 and a debt-to-equity ratio of 0.31. Woodside Energy Group Ltd has a 1 year low of $11.26 and a 1 year high of $17.70.

Woodside Energy Group Increases Dividend

The firm also recently disclosed a semi-annual dividend, which was paid on Wednesday, September 24th. Investors of record on Friday, August 29th were paid a $0.53 dividend. The ex-dividend date of this dividend was Friday, August 29th. This represents a yield of 616.0%. This is an increase from Woodside Energy Group's previous semi-annual dividend of $0.51. Woodside Energy Group's dividend payout ratio (DPR) is currently 124.39%.

Analyst Ratings Changes

WDS has been the subject of several research reports. Wall Street Zen lowered Woodside Energy Group from a "hold" rating to a "sell" rating in a research note on Saturday. CLSA raised Woodside Energy Group to a "strong-buy" rating in a research note on Tuesday, June 24th. Finally, Weiss Ratings reaffirmed a "hold (c)" rating on shares of Woodside Energy Group in a research report on Wednesday, October 8th. One investment analyst has rated the stock with a Strong Buy rating, one has issued a Buy rating and three have assigned a Hold rating to the stock. Based on data from MarketBeat.com, Woodside Energy Group presently has a consensus rating of "Moderate Buy".

View Our Latest Stock Analysis on Woodside Energy Group

Woodside Energy Group Profile

(

Free Report)

Woodside Energy Group Ltd engages in the exploration, evaluation, development, production, and marketing of hydrocarbons in the Asia Pacific, Africa, the Americas, and the Europe. The company produces liquefied natural gas, pipeline gas, crude oil and condensate, and natural gas liquids. It holds interests in the Pluto LNG, North West Shelf, Wheatstone and Julimar-Brunello, Bass Strait, Ngujima-Yin FPSO, Okha FPSO, Pyrenees FPSO, Macedon, Shenzi, Mad dog, Greater Angostura, as well as Scarborough, Sangomar, Trion, Calypso, Browse, Liard, Atlantis, Woodside Solar opportunity, and Sunrise and Troubadour.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Woodside Energy Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Woodside Energy Group wasn't on the list.

While Woodside Energy Group currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.