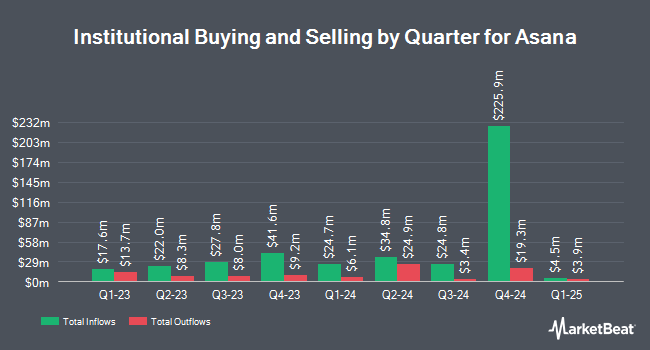

Neo Ivy Capital Management lowered its stake in shares of Asana, Inc. (NYSE:ASAN - Free Report) by 73.9% during the 1st quarter, according to its most recent filing with the SEC. The firm owned 23,002 shares of the company's stock after selling 65,189 shares during the period. Neo Ivy Capital Management's holdings in Asana were worth $335,000 as of its most recent SEC filing.

Several other hedge funds and other institutional investors have also bought and sold shares of the stock. Readystate Asset Management LP bought a new position in shares of Asana in the 1st quarter worth approximately $209,000. Universal Beteiligungs und Servicegesellschaft mbH purchased a new stake in Asana during the 1st quarter valued at approximately $285,000. Y Intercept Hong Kong Ltd purchased a new position in shares of Asana in the first quarter valued at $796,000. Allianz Asset Management GmbH grew its holdings in shares of Asana by 187.6% in the first quarter. Allianz Asset Management GmbH now owns 43,290 shares of the company's stock valued at $638,000 after purchasing an additional 28,239 shares in the last quarter. Finally, CWM LLC grew its holdings in shares of Asana by 436.0% in the first quarter. CWM LLC now owns 20,190 shares of the company's stock valued at $294,000 after purchasing an additional 16,423 shares in the last quarter. Institutional investors own 26.21% of the company's stock.

Insider Activity

In other news, Director Justin Rosenstein sold 223,894 shares of the company's stock in a transaction dated Friday, July 25th. The stock was sold at an average price of $14.98, for a total value of $3,353,932.12. Following the completion of the sale, the director owned 3,728,033 shares of the company's stock, valued at $55,845,934.34. This represents a 5.67% decrease in their ownership of the stock. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available at this hyperlink. Also, Director Dustin A. Moskovitz bought 225,000 shares of the firm's stock in a transaction dated Wednesday, July 23rd. The stock was bought at an average cost of $15.04 per share, with a total value of $3,384,000.00. Following the transaction, the director directly owned 54,405,999 shares of the company's stock, valued at approximately $818,266,224.96. This trade represents a 0.42% increase in their ownership of the stock. The disclosure for this purchase can be found here. Over the last 90 days, insiders have acquired 2,332,563 shares of company stock valued at $33,400,904 and have sold 2,515,495 shares valued at $37,766,987. Corporate insiders own 61.28% of the company's stock.

Asana Trading Up 0.6%

Asana stock traded up $0.09 during trading on Wednesday, hitting $15.30. The company's stock had a trading volume of 844,642 shares, compared to its average volume of 3,410,008. The stock has a market capitalization of $3.60 billion, a price-to-earnings ratio of -15.28 and a beta of 1.13. The stock's fifty day moving average is $14.87 and its 200 day moving average is $16.74. Asana, Inc. has a 1-year low of $11.05 and a 1-year high of $27.77. The company has a debt-to-equity ratio of 0.16, a quick ratio of 1.47 and a current ratio of 1.47.

Asana (NYSE:ASAN - Get Free Report) last released its earnings results on Tuesday, June 3rd. The company reported $0.05 EPS for the quarter, beating the consensus estimate of $0.02 by $0.03. The firm had revenue of $187.63 million during the quarter, compared to analyst estimates of $185.40 million. Asana had a negative return on equity of 87.78% and a negative net margin of 31.38%. The business's quarterly revenue was up 8.6% compared to the same quarter last year. During the same period in the prior year, the firm posted ($0.06) earnings per share. As a group, equities research analysts predict that Asana, Inc. will post -1.09 EPS for the current year.

Analyst Upgrades and Downgrades

Several research firms recently weighed in on ASAN. Wall Street Zen upgraded Asana from a "hold" rating to a "buy" rating in a report on Friday, June 6th. Jefferies Financial Group upped their price objective on shares of Asana from $15.00 to $17.00 and gave the company a "hold" rating in a report on Wednesday, June 4th. Piper Sandler upped their price objective on shares of Asana from $17.00 to $19.00 and gave the company an "overweight" rating in a report on Wednesday, June 4th. FBN Securities upgraded shares of Asana to a "strong-buy" rating in a report on Wednesday, June 4th. Finally, UBS Group upped their price objective on shares of Asana from $14.00 to $18.00 and gave the company a "neutral" rating in a report on Wednesday, June 4th. Four research analysts have rated the stock with a sell rating, seven have given a hold rating, five have assigned a buy rating and one has assigned a strong buy rating to the stock. According to data from MarketBeat, the company has a consensus rating of "Hold" and a consensus target price of $15.97.

Check Out Our Latest Stock Report on Asana

Asana Company Profile

(

Free Report)

Asana, Inc, together with its subsidiaries, operates a work management platform for individuals, team leads, and executives in the United States and internationally. Its platform helps organizations to orchestrate work from daily tasks to cross-functional strategic initiatives; manage work across a portfolio of projects or workflows, see progress against goals, identify bottlenecks, resource constraints, and milestones; and communicate company-wide goals, monitor status, and oversee work across projects and portfolios to gain real-time insights.

Recommended Stories

Before you consider Asana, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Asana wasn't on the list.

While Asana currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Fall 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.