Neo Ivy Capital Management trimmed its position in shares of Lear Corporation (NYSE:LEA - Free Report) by 98.1% in the first quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The firm owned 770 shares of the auto parts company's stock after selling 38,758 shares during the period. Neo Ivy Capital Management's holdings in Lear were worth $68,000 as of its most recent SEC filing.

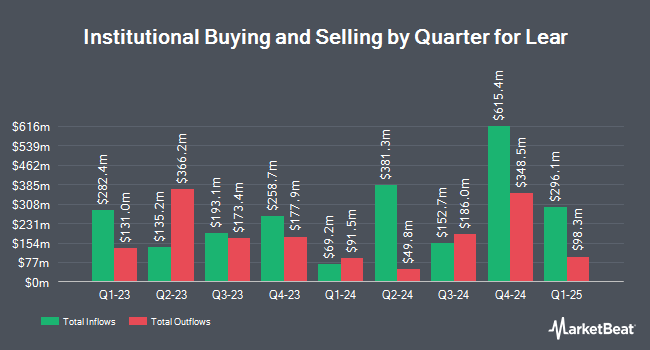

A number of other hedge funds also recently bought and sold shares of the company. Vanguard Group Inc. boosted its holdings in Lear by 7.4% during the fourth quarter. Vanguard Group Inc. now owns 6,491,895 shares of the auto parts company's stock valued at $614,782,000 after acquiring an additional 447,835 shares during the period. Dimensional Fund Advisors LP boosted its holdings in Lear by 12.2% during the fourth quarter. Dimensional Fund Advisors LP now owns 2,614,227 shares of the auto parts company's stock valued at $247,566,000 after acquiring an additional 283,838 shares during the period. Massachusetts Financial Services Co. MA boosted its holdings in Lear by 6.6% during the first quarter. Massachusetts Financial Services Co. MA now owns 2,358,330 shares of the auto parts company's stock valued at $208,052,000 after acquiring an additional 145,751 shares during the period. First Trust Advisors LP raised its position in shares of Lear by 45.9% during the fourth quarter. First Trust Advisors LP now owns 1,133,186 shares of the auto parts company's stock valued at $107,313,000 after buying an additional 356,760 shares during the last quarter. Finally, Lyrical Asset Management LP raised its position in shares of Lear by 2.9% during the fourth quarter. Lyrical Asset Management LP now owns 1,056,694 shares of the auto parts company's stock valued at $100,069,000 after buying an additional 29,370 shares during the last quarter. 97.04% of the stock is currently owned by institutional investors.

Insiders Place Their Bets

In other Lear news, Director Conrad L. Mallett, Jr. sold 1,187 shares of the company's stock in a transaction dated Monday, June 16th. The shares were sold at an average price of $92.86, for a total transaction of $110,224.82. Following the sale, the director directly owned 84 shares of the company's stock, valued at approximately $7,800.24. This represents a 93.39% decrease in their ownership of the stock. The sale was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through this link. Corporate insiders own 0.91% of the company's stock.

Lear Price Performance

NYSE:LEA traded down $0.51 during mid-day trading on Monday, hitting $98.88. The company's stock had a trading volume of 1,082,989 shares, compared to its average volume of 726,399. The company has a current ratio of 1.34, a quick ratio of 1.07 and a debt-to-equity ratio of 0.53. The company has a market capitalization of $5.29 billion, a price-to-earnings ratio of 11.54, a P/E/G ratio of 0.52 and a beta of 1.29. Lear Corporation has a fifty-two week low of $73.85 and a fifty-two week high of $125.09. The stock has a fifty day moving average of $96.63 and a 200-day moving average of $92.90.

Lear (NYSE:LEA - Get Free Report) last issued its quarterly earnings data on Friday, July 25th. The auto parts company reported $3.47 earnings per share for the quarter, topping the consensus estimate of $3.23 by $0.24. The firm had revenue of $6.03 billion for the quarter, compared to analysts' expectations of $5.89 billion. Lear had a net margin of 2.05% and a return on equity of 13.94%. The company's quarterly revenue was up .3% compared to the same quarter last year. During the same period in the prior year, the firm earned $3.60 earnings per share. As a group, equities analysts forecast that Lear Corporation will post 12.89 EPS for the current fiscal year.

Lear Announces Dividend

The company also recently disclosed a quarterly dividend, which was paid on Wednesday, June 25th. Shareholders of record on Thursday, June 5th were paid a dividend of $0.77 per share. The ex-dividend date of this dividend was Thursday, June 5th. This represents a $3.08 annualized dividend and a yield of 3.11%. Lear's dividend payout ratio is 36.11%.

Analyst Upgrades and Downgrades

A number of research analysts have recently commented on the stock. Barclays upped their price objective on shares of Lear from $100.00 to $120.00 and gave the company an "equal weight" rating in a research report on Wednesday, July 16th. The Goldman Sachs Group set a $88.00 price objective on shares of Lear and gave the company a "neutral" rating in a research report on Tuesday, May 6th. Bank of America upped their price objective on shares of Lear from $110.00 to $115.00 and gave the company a "buy" rating in a research report on Monday, June 16th. Morgan Stanley cut their price objective on shares of Lear from $125.00 to $115.00 and set an "overweight" rating for the company in a research report on Monday, May 19th. Finally, Citigroup upped their price objective on shares of Lear from $123.00 to $136.00 and gave the company a "buy" rating in a research report on Monday, June 30th. Nine investment analysts have rated the stock with a hold rating, four have issued a buy rating and one has assigned a strong buy rating to the company. According to MarketBeat, Lear has an average rating of "Hold" and an average price target of $113.00.

Get Our Latest Stock Analysis on Lear

Lear Profile

(

Free Report)

Lear Corporation designs, develops, engineers, manufactures, assembles, and supplies automotive seating, and electrical distribution systems and related components for automotive original equipment manufacturers in North America, Europe, Africa, Asia, and South America. Its Seating segment offers seat systems, seat subsystems, keyseat components, seat trim covers, seat mechanisms, seat foams, and headrests, as well as surface materials, such as leather and fabric for automobiles and light trucks, compact cars, pick-up trucks, and sport utility vehicles.

Read More

Before you consider Lear, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Lear wasn't on the list.

While Lear currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report