Invesco Ltd. decreased its holdings in NetScout Systems, Inc. (NASDAQ:NTCT - Free Report) by 10.8% in the first quarter, according to its most recent 13F filing with the SEC. The institutional investor owned 366,486 shares of the technology company's stock after selling 44,259 shares during the period. Invesco Ltd. owned approximately 0.51% of NetScout Systems worth $7,700,000 as of its most recent SEC filing.

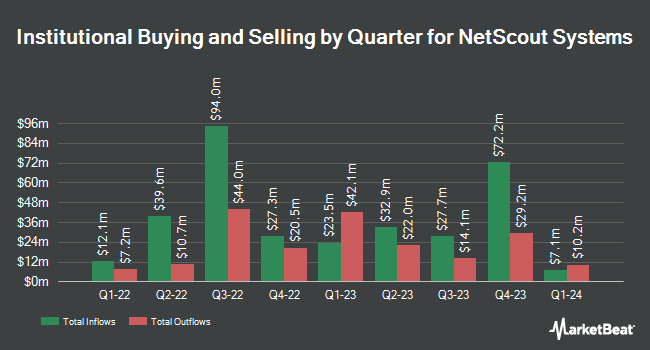

A number of other institutional investors also recently made changes to their positions in NTCT. Russell Investments Group Ltd. boosted its stake in shares of NetScout Systems by 1,214.4% in the 4th quarter. Russell Investments Group Ltd. now owns 1,367 shares of the technology company's stock valued at $30,000 after purchasing an additional 1,263 shares in the last quarter. Point72 Asia Singapore Pte. Ltd. purchased a new stake in shares of NetScout Systems in the 4th quarter valued at $71,000. PNC Financial Services Group Inc. boosted its stake in shares of NetScout Systems by 15.8% in the 1st quarter. PNC Financial Services Group Inc. now owns 4,048 shares of the technology company's stock valued at $85,000 after purchasing an additional 553 shares in the last quarter. Wealth Enhancement Advisory Services LLC purchased a new stake in shares of NetScout Systems in the 1st quarter valued at $216,000. Finally, Lazard Asset Management LLC purchased a new stake in shares of NetScout Systems in the 4th quarter valued at $229,000. Hedge funds and other institutional investors own 91.64% of the company's stock.

NetScout Systems Trading Down 0.8%

NASDAQ NTCT traded down $0.19 during trading on Friday, hitting $24.89. The company had a trading volume of 474,561 shares, compared to its average volume of 616,611. NetScout Systems, Inc. has a one year low of $18.12 and a one year high of $27.89. The company has a market cap of $1.79 billion, a price-to-earnings ratio of 24.89 and a beta of 0.72. The company's fifty day moving average is $23.05 and its 200-day moving average is $22.35.

NetScout Systems (NASDAQ:NTCT - Get Free Report) last issued its quarterly earnings data on Thursday, August 7th. The technology company reported $0.34 EPS for the quarter, topping the consensus estimate of $0.29 by $0.05. NetScout Systems had a net margin of 8.72% and a return on equity of 7.47%. The business had revenue of $186.75 million during the quarter, compared to analyst estimates of $181.50 million. During the same period in the prior year, the business earned $0.28 EPS. The company's revenue for the quarter was up 6.9% on a year-over-year basis. NetScout Systems has set its FY 2026 guidance at 2.250-2.40 EPS. As a group, equities analysts anticipate that NetScout Systems, Inc. will post 1.5 EPS for the current year.

Analyst Upgrades and Downgrades

Separately, B. Riley started coverage on shares of NetScout Systems in a research report on Tuesday, August 26th. They set a "buy" rating and a $33.00 price target for the company. One equities research analyst has rated the stock with a Strong Buy rating and one has given a Hold rating to the company's stock. According to data from MarketBeat.com, NetScout Systems has an average rating of "Buy" and an average target price of $29.00.

Get Our Latest Stock Report on NetScout Systems

Insiders Place Their Bets

In other NetScout Systems news, Director Alfred Grasso sold 5,644 shares of the company's stock in a transaction on Wednesday, August 27th. The shares were sold at an average price of $24.44, for a total value of $137,939.36. Following the completion of the transaction, the director directly owned 33,000 shares in the company, valued at approximately $806,520. This represents a 14.61% decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through the SEC website. Also, Director Michael Szabados sold 4,000 shares of the company's stock in a transaction on Friday, August 22nd. The stock was sold at an average price of $22.91, for a total transaction of $91,640.00. Following the completion of the transaction, the director owned 38,939 shares of the company's stock, valued at $892,092.49. This trade represents a 9.32% decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last ninety days, insiders sold 18,500 shares of company stock worth $442,348. 3.82% of the stock is currently owned by corporate insiders.

About NetScout Systems

(

Free Report)

NetScout Systems, Inc provides service assurance and cybersecurity solutions for protect digital business services against disruptions in the United States, Europe, Asia, and internationally. The company offers nGeniusONE management software that enables customers to predict, preempt, and resolve network and service delivery problems, as well as facilitate the optimization and capacity planning of their network infrastructures; and specialized platforms and analytic modules that enable its customers to analyze and troubleshoot traffic in radio access and Wi-Fi networks.

Featured Articles

Before you consider NetScout Systems, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and NetScout Systems wasn't on the list.

While NetScout Systems currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.