New Age Alpha Advisors LLC acquired a new stake in DoubleVerify Holdings, Inc. (NYSE:DV - Free Report) in the 1st quarter, according to the company in its most recent filing with the SEC. The firm acquired 134,216 shares of the company's stock, valued at approximately $1,794,000. New Age Alpha Advisors LLC owned about 0.08% of DoubleVerify as of its most recent filing with the SEC.

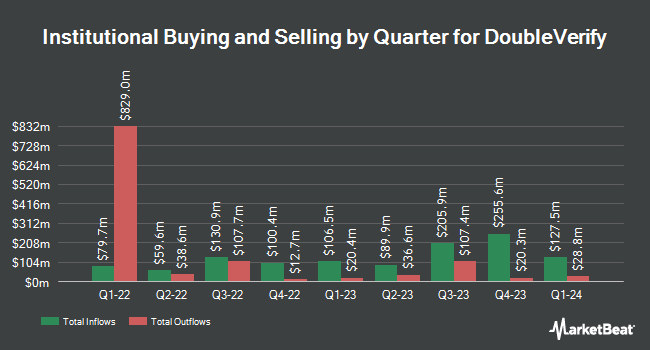

Several other institutional investors and hedge funds have also recently added to or reduced their stakes in DV. LPL Financial LLC boosted its holdings in shares of DoubleVerify by 15.3% during the fourth quarter. LPL Financial LLC now owns 31,123 shares of the company's stock worth $598,000 after purchasing an additional 4,123 shares during the period. JPMorgan Chase & Co. lifted its holdings in DoubleVerify by 9.8% in the fourth quarter. JPMorgan Chase & Co. now owns 708,429 shares of the company's stock worth $13,609,000 after buying an additional 63,196 shares during the period. Wellington Management Group LLP lifted its holdings in DoubleVerify by 13.4% in the fourth quarter. Wellington Management Group LLP now owns 415,337 shares of the company's stock worth $7,979,000 after buying an additional 49,078 shares during the period. Alliancebernstein L.P. lifted its holdings in DoubleVerify by 25.1% in the fourth quarter. Alliancebernstein L.P. now owns 154,160 shares of the company's stock worth $2,961,000 after buying an additional 30,948 shares during the period. Finally, Envestnet Asset Management Inc. raised its position in shares of DoubleVerify by 6.5% in the 4th quarter. Envestnet Asset Management Inc. now owns 675,275 shares of the company's stock worth $12,972,000 after acquiring an additional 41,022 shares in the last quarter. Hedge funds and other institutional investors own 97.29% of the company's stock.

Analyst Ratings Changes

DV has been the subject of several research reports. Needham & Company LLC reissued a "buy" rating and issued a $18.00 target price on shares of DoubleVerify in a research report on Thursday, June 12th. BMO Capital Markets reissued an "outperform" rating and issued a $27.00 target price (up previously from $26.00) on shares of DoubleVerify in a research report on Wednesday, August 6th. JMP Securities reiterated a "market outperform" rating and set a $20.00 target price on shares of DoubleVerify in a report on Thursday, June 12th. Craig Hallum reiterated a "buy" rating and set a $20.00 target price on shares of DoubleVerify in a report on Monday, July 7th. Finally, Raymond James Financial lowered their target price on shares of DoubleVerify from $22.00 to $16.00 and set an "outperform" rating for the company in a report on Monday, May 5th. One investment analyst has rated the stock with a sell rating, seven have assigned a hold rating and fourteen have issued a buy rating to the stock. Based on data from MarketBeat.com, the stock has an average rating of "Moderate Buy" and a consensus target price of $19.13.

Read Our Latest Stock Analysis on DV

DoubleVerify Price Performance

Shares of NYSE DV traded up $0.15 during mid-day trading on Tuesday, hitting $14.97. 767,521 shares of the company's stock traded hands, compared to its average volume of 2,465,207. The company's 50-day moving average is $15.07 and its two-hundred day moving average is $15.50. The company has a debt-to-equity ratio of 0.01, a current ratio of 4.41 and a quick ratio of 4.41. The company has a market capitalization of $2.45 billion, a P/E ratio of 51.57, a PEG ratio of 2.22 and a beta of 1.05. DoubleVerify Holdings, Inc. has a 1 year low of $11.52 and a 1 year high of $23.11.

DoubleVerify (NYSE:DV - Get Free Report) last released its quarterly earnings data on Tuesday, August 5th. The company reported $0.05 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $0.06 by ($0.01). The business had revenue of $189.02 million for the quarter, compared to the consensus estimate of $171.14 million. DoubleVerify had a net margin of 7.38% and a return on equity of 4.86%. DoubleVerify's revenue for the quarter was up 21.3% on a year-over-year basis. During the same quarter in the prior year, the business posted $0.04 earnings per share. On average, equities analysts anticipate that DoubleVerify Holdings, Inc. will post 0.36 EPS for the current fiscal year.

About DoubleVerify

(

Free Report)

DoubleVerify Holdings, Inc provides a software platform for digital media measurement, and data analytics in the United States and internationally. The company provides solutions to advertisers that enable advertisers to increase the effectiveness and quality and return on their digital advertising investments.

Featured Stories

Before you consider DoubleVerify, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and DoubleVerify wasn't on the list.

While DoubleVerify currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.