New York State Common Retirement Fund lifted its position in Vail Resorts, Inc. (NYSE:MTN - Free Report) by 10.1% during the 1st quarter, according to the company in its most recent filing with the SEC. The fund owned 25,121 shares of the company's stock after purchasing an additional 2,300 shares during the quarter. New York State Common Retirement Fund owned 0.07% of Vail Resorts worth $4,020,000 at the end of the most recent reporting period.

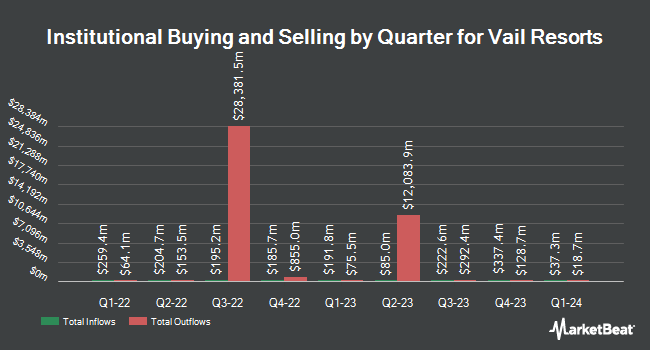

A number of other hedge funds have also recently added to or reduced their stakes in MTN. Commonwealth Equity Services LLC grew its holdings in Vail Resorts by 11.3% during the 4th quarter. Commonwealth Equity Services LLC now owns 14,654 shares of the company's stock worth $2,747,000 after acquiring an additional 1,488 shares during the last quarter. Envestnet Portfolio Solutions Inc. grew its holdings in Vail Resorts by 16.1% during the 4th quarter. Envestnet Portfolio Solutions Inc. now owns 2,892 shares of the company's stock worth $542,000 after acquiring an additional 401 shares during the last quarter. Corient Private Wealth LLC grew its holdings in Vail Resorts by 56.2% during the 4th quarter. Corient Private Wealth LLC now owns 6,057 shares of the company's stock worth $1,135,000 after acquiring an additional 2,179 shares during the last quarter. Harvest Fund Management Co. Ltd bought a new stake in Vail Resorts during the 4th quarter worth about $92,000. Finally, KLP Kapitalforvaltning AS acquired a new position in Vail Resorts during the 4th quarter valued at about $1,496,000. Institutional investors own 94.94% of the company's stock.

Vail Resorts Stock Performance

Shares of Vail Resorts stock traded up $2.92 during trading hours on Friday, hitting $160.51. 468,460 shares of the company's stock traded hands, compared to its average volume of 610,139. Vail Resorts, Inc. has a 12-month low of $129.85 and a 12-month high of $199.45. The stock has a market capitalization of $5.96 billion, a price-to-earnings ratio of 20.53, a PEG ratio of 1.94 and a beta of 0.91. The company has a fifty day simple moving average of $157.63 and a 200-day simple moving average of $157.25. The company has a debt-to-equity ratio of 1.70, a current ratio of 0.61 and a quick ratio of 0.54.

Vail Resorts (NYSE:MTN - Get Free Report) last announced its quarterly earnings data on Thursday, June 5th. The company reported $10.54 earnings per share for the quarter, topping the consensus estimate of $10.00 by $0.54. Vail Resorts had a return on equity of 30.25% and a net margin of 9.81%. The company had revenue of $1.30 billion during the quarter, compared to analyst estimates of $1.31 billion. During the same quarter last year, the firm posted $9.54 EPS. The firm's revenue for the quarter was up 1.0% on a year-over-year basis. Equities research analysts anticipate that Vail Resorts, Inc. will post 7.62 EPS for the current fiscal year.

Vail Resorts Dividend Announcement

The firm also recently declared a quarterly dividend, which was paid on Wednesday, July 9th. Stockholders of record on Tuesday, June 24th were given a dividend of $2.22 per share. The ex-dividend date was Tuesday, June 24th. This represents a $8.88 dividend on an annualized basis and a dividend yield of 5.53%. Vail Resorts's dividend payout ratio (DPR) is presently 113.55%.

Analyst Upgrades and Downgrades

A number of brokerages recently weighed in on MTN. Mizuho increased their price target on shares of Vail Resorts from $215.00 to $216.00 and gave the company an "outperform" rating in a research report on Friday, June 6th. Bank of America increased their price target on shares of Vail Resorts from $160.00 to $175.00 and gave the company a "neutral" rating in a research report on Wednesday, May 28th. UBS Group cut their price target on shares of Vail Resorts from $185.00 to $169.00 and set a "neutral" rating on the stock in a research report on Wednesday, June 11th. Truist Financial cut their price target on shares of Vail Resorts from $247.00 to $244.00 and set a "buy" rating on the stock in a research report on Friday, June 6th. Finally, Deutsche Bank Aktiengesellschaft dropped their target price on shares of Vail Resorts from $183.00 to $171.00 and set a "hold" rating on the stock in a report on Thursday, May 29th. One research analyst has rated the stock with a sell rating, seven have assigned a hold rating and three have issued a buy rating to the company's stock. According to data from MarketBeat, the stock has a consensus rating of "Hold" and an average target price of $187.20.

View Our Latest Analysis on MTN

Insider Activity

In other Vail Resorts news, CFO Angela A. Korch purchased 200 shares of the company's stock in a transaction dated Friday, June 20th. The stock was purchased at an average price of $157.00 per share, for a total transaction of $31,400.00. Following the transaction, the chief financial officer owned 3,156 shares in the company, valued at $495,492. The trade was a 6.77% increase in their position. The transaction was disclosed in a document filed with the SEC, which is available through the SEC website. Company insiders own 1.20% of the company's stock.

About Vail Resorts

(

Free Report)

Vail Resorts, Inc, through its subsidiaries, operates mountain resorts and regional ski areas in the United States. It operates through three segments: Mountain, Lodging, and Real Estate. The Mountain segment operates 41 destination mountain resorts and regional ski areas. This segment is also involved in the ancillary activities, including ski school, dining, and retail/rental operations, as well as real estate brokerage activities.

Recommended Stories

Before you consider Vail Resorts, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Vail Resorts wasn't on the list.

While Vail Resorts currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for August 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.