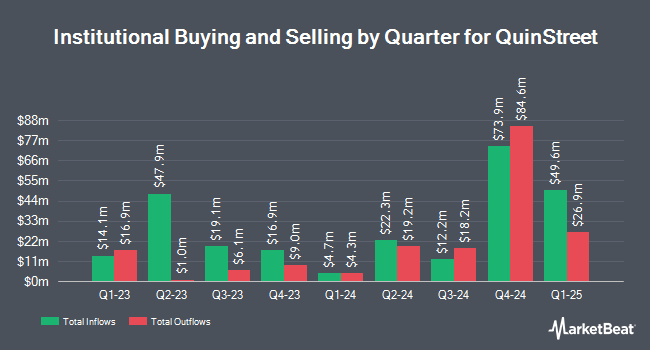

New York State Common Retirement Fund reduced its position in shares of QuinStreet, Inc. (NASDAQ:QNST - Free Report) by 74.0% in the 1st quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The fund owned 14,446 shares of the technology company's stock after selling 41,189 shares during the period. New York State Common Retirement Fund's holdings in QuinStreet were worth $258,000 at the end of the most recent quarter.

Other institutional investors have also recently made changes to their positions in the company. Principal Financial Group Inc. grew its position in shares of QuinStreet by 2.7% during the first quarter. Principal Financial Group Inc. now owns 281,756 shares of the technology company's stock worth $5,027,000 after buying an additional 7,511 shares in the last quarter. Teacher Retirement System of Texas boosted its position in shares of QuinStreet by 12.1% in the 1st quarter. Teacher Retirement System of Texas now owns 22,622 shares of the technology company's stock valued at $404,000 after purchasing an additional 2,449 shares during the period. Allspring Global Investments Holdings LLC grew its position in shares of QuinStreet by 51.2% during the first quarter. Allspring Global Investments Holdings LLC now owns 31,872 shares of the technology company's stock worth $574,000 after acquiring an additional 10,786 shares during the last quarter. Illinois Municipal Retirement Fund increased its stake in QuinStreet by 4.1% in the first quarter. Illinois Municipal Retirement Fund now owns 31,717 shares of the technology company's stock valued at $566,000 after purchasing an additional 1,247 shares during the period. Finally, SG Americas Securities LLC increased its position in QuinStreet by 26.2% in the 1st quarter. SG Americas Securities LLC now owns 32,889 shares of the technology company's stock valued at $587,000 after acquiring an additional 6,829 shares during the period. Hedge funds and other institutional investors own 97.83% of the company's stock.

Analyst Ratings Changes

Several research firms have recently commented on QNST. Stephens restated an "overweight" rating and issued a $31.00 target price on shares of QuinStreet in a research note on Thursday, May 8th. Barrington Research reissued an "outperform" rating and set a $29.00 price target on shares of QuinStreet in a research report on Wednesday, April 23rd. Lake Street Capital cut their price objective on shares of QuinStreet from $27.00 to $19.00 and set a "hold" rating for the company in a research report on Thursday, May 8th. Finally, Wall Street Zen raised QuinStreet from a "hold" rating to a "buy" rating in a research note on Saturday, June 21st. One equities research analyst has rated the stock with a hold rating and five have issued a buy rating to the company's stock. According to data from MarketBeat.com, the stock has a consensus rating of "Moderate Buy" and an average target price of $29.00.

Get Our Latest Report on QNST

QuinStreet Stock Performance

Shares of NASDAQ:QNST traded up $0.01 on Wednesday, hitting $16.21. The company's stock had a trading volume of 355,918 shares, compared to its average volume of 481,977. The stock's 50-day moving average is $15.70 and its two-hundred day moving average is $17.87. The company has a market capitalization of $915.38 million, a price-to-earnings ratio of -1,619.38 and a beta of 0.74. QuinStreet, Inc. has a 12 month low of $14.39 and a 12 month high of $26.27.

QuinStreet (NASDAQ:QNST - Get Free Report) last posted its quarterly earnings results on Wednesday, May 7th. The technology company reported $0.21 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.06 by $0.15. The firm had revenue of $269.84 million for the quarter, compared to analyst estimates of $270.36 million. QuinStreet had a negative net margin of 0.06% and a positive return on equity of 1.08%. The firm's quarterly revenue was up 60.1% compared to the same quarter last year. During the same quarter in the previous year, the business posted $0.06 earnings per share. Equities analysts expect that QuinStreet, Inc. will post 0.12 earnings per share for the current fiscal year.

About QuinStreet

(

Free Report)

QuinStreet, Inc, an online performance marketing company, provides customer acquisition services for its clients in the United States and internationally. The company offers online marketing services, such as qualified clicks, leads, calls, applications, and customers through its websites or third-party publishers.

Read More

Before you consider QuinStreet, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and QuinStreet wasn't on the list.

While QuinStreet currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.