New York State Teachers Retirement System increased its holdings in shares of Nextracker Inc. (NASDAQ:NXT - Free Report) by 5.8% during the 2nd quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The firm owned 132,239 shares of the company's stock after buying an additional 7,234 shares during the quarter. New York State Teachers Retirement System owned about 0.09% of Nextracker worth $7,190,000 as of its most recent filing with the Securities and Exchange Commission.

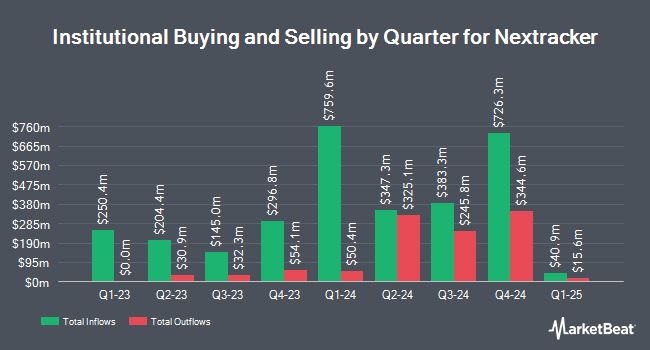

Several other large investors have also recently added to or reduced their stakes in the business. Wellington Management Group LLP lifted its position in Nextracker by 56.5% during the first quarter. Wellington Management Group LLP now owns 5,237,833 shares of the company's stock worth $220,722,000 after buying an additional 1,890,445 shares during the period. Encompass Capital Advisors LLC lifted its position in Nextracker by 72.5% during the first quarter. Encompass Capital Advisors LLC now owns 2,630,114 shares of the company's stock worth $110,833,000 after buying an additional 1,105,617 shares during the period. Earnest Partners LLC lifted its position in Nextracker by 4.4% during the first quarter. Earnest Partners LLC now owns 1,309,424 shares of the company's stock worth $55,179,000 after buying an additional 54,934 shares during the period. Westfield Capital Management Co. LP lifted its position in Nextracker by 2.8% during the first quarter. Westfield Capital Management Co. LP now owns 1,243,151 shares of the company's stock worth $52,386,000 after buying an additional 33,537 shares during the period. Finally, Wedge Capital Management L L P NC purchased a new position in Nextracker during the second quarter worth about $58,122,000. 67.41% of the stock is currently owned by hedge funds and other institutional investors.

Insider Buying and Selling

In other news, CFO Charles D. Boynton sold 4,500 shares of the stock in a transaction dated Monday, September 15th. The stock was sold at an average price of $67.21, for a total value of $302,445.00. Following the completion of the sale, the chief financial officer owned 295,059 shares in the company, valued at approximately $19,830,915.39. This trade represents a 1.50% decrease in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through this link. Also, President Howard Wenger sold 5,217 shares of the stock in a transaction dated Monday, September 29th. The shares were sold at an average price of $75.00, for a total value of $391,275.00. Following the completion of the sale, the president owned 409,039 shares of the company's stock, valued at approximately $30,677,925. This trade represents a 1.26% decrease in their position. The disclosure for this sale can be found here. Insiders have sold a total of 32,400 shares of company stock worth $2,053,385 in the last ninety days. 0.56% of the stock is owned by corporate insiders.

Nextracker Stock Performance

NXT stock opened at $87.06 on Monday. Nextracker Inc. has a 1 year low of $30.93 and a 1 year high of $93.90. The firm has a market cap of $12.88 billion, a P/E ratio of 23.72, a price-to-earnings-growth ratio of 2.16 and a beta of 2.27. The stock has a 50-day simple moving average of $71.18 and a 200-day simple moving average of $59.77.

Analysts Set New Price Targets

Several research firms recently weighed in on NXT. Zacks Research upgraded Nextracker to a "hold" rating in a research report on Tuesday, August 12th. Susquehanna raised their price objective on Nextracker from $76.00 to $100.00 and gave the stock a "positive" rating in a report on Monday, October 13th. Deutsche Bank Aktiengesellschaft assumed coverage on Nextracker in a report on Tuesday, September 30th. They issued a "buy" rating and a $88.00 price objective on the stock. TD Cowen raised their price objective on Nextracker from $55.00 to $65.00 and gave the stock a "hold" rating in a report on Wednesday, July 30th. Finally, Bank of America raised their price objective on Nextracker from $66.00 to $69.00 and gave the stock a "buy" rating in a report on Wednesday, July 30th. One equities research analyst has rated the stock with a Strong Buy rating, fifteen have given a Buy rating and ten have assigned a Hold rating to the company. According to MarketBeat.com, the stock presently has a consensus rating of "Moderate Buy" and an average target price of $71.10.

View Our Latest Analysis on NXT

About Nextracker

(

Free Report)

Nextracker Inc, an energy solutions company, provides solar tracker and software solutions for utility-scale and distributed generation solar projects in the United States and internationally. The company offers tracking solutions, which includes NX Horizon, a solar tracking solution; and NX Horizon-XTR, a terrain-following tracker designed to expand the addressable market for trackers on sites with sloped, uneven, and challenging terrain.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Nextracker, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Nextracker wasn't on the list.

While Nextracker currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.