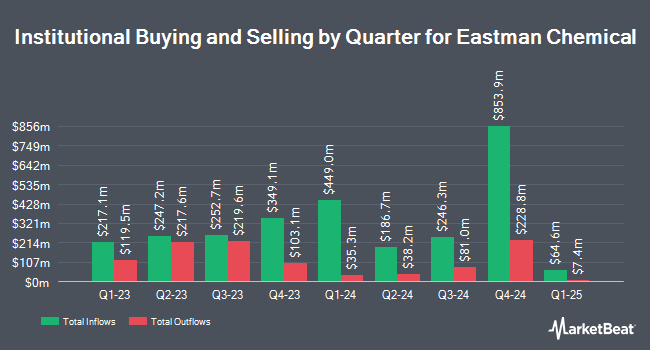

New York State Teachers Retirement System trimmed its position in shares of Eastman Chemical Company (NYSE:EMN - Free Report) by 6.5% in the 1st quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The institutional investor owned 121,226 shares of the basic materials company's stock after selling 8,477 shares during the quarter. New York State Teachers Retirement System owned approximately 0.11% of Eastman Chemical worth $10,681,000 as of its most recent SEC filing.

Other institutional investors have also recently made changes to their positions in the company. Picton Mahoney Asset Management increased its holdings in shares of Eastman Chemical by 62.3% during the 4th quarter. Picton Mahoney Asset Management now owns 323 shares of the basic materials company's stock valued at $29,000 after purchasing an additional 124 shares in the last quarter. Assetmark Inc. increased its holdings in shares of Eastman Chemical by 384.4% during the 4th quarter. Assetmark Inc. now owns 373 shares of the basic materials company's stock valued at $34,000 after purchasing an additional 296 shares in the last quarter. Headlands Technologies LLC purchased a new position in shares of Eastman Chemical during the 4th quarter valued at approximately $43,000. Orion Capital Management LLC purchased a new position in shares of Eastman Chemical during the 4th quarter valued at approximately $47,000. Finally, Brown Brothers Harriman & Co. increased its holdings in shares of Eastman Chemical by 135.7% during the 4th quarter. Brown Brothers Harriman & Co. now owns 528 shares of the basic materials company's stock valued at $48,000 after purchasing an additional 304 shares in the last quarter. 83.65% of the stock is owned by hedge funds and other institutional investors.

Analyst Ratings Changes

A number of research firms have weighed in on EMN. KeyCorp reduced their price objective on shares of Eastman Chemical from $120.00 to $106.00 and set an "overweight" rating for the company in a research report on Monday, April 28th. Piper Sandler reduced their price objective on shares of Eastman Chemical from $105.00 to $99.00 and set a "neutral" rating for the company in a research report on Monday, April 7th. Mizuho upgraded shares of Eastman Chemical from a "neutral" rating to an "outperform" rating and set a $105.00 price objective for the company in a research report on Thursday, April 3rd. The Goldman Sachs Group reduced their price objective on shares of Eastman Chemical from $112.00 to $87.00 and set a "neutral" rating for the company in a research report on Monday, April 28th. Finally, Wall Street Zen cut shares of Eastman Chemical from a "buy" rating to a "hold" rating in a research report on Monday, April 28th. Six investment analysts have rated the stock with a hold rating and eight have issued a buy rating to the company. According to MarketBeat.com, the company presently has a consensus rating of "Moderate Buy" and an average target price of $98.54.

Get Our Latest Analysis on Eastman Chemical

Eastman Chemical Trading Down 1.7%

NYSE EMN traded down $1.39 during trading hours on Monday, reaching $78.18. The company had a trading volume of 1,378,263 shares, compared to its average volume of 1,236,757. The stock has a 50-day moving average of $78.63 and a 200 day moving average of $86.24. Eastman Chemical Company has a 1-year low of $70.90 and a 1-year high of $114.50. The company has a current ratio of 1.72, a quick ratio of 0.79 and a debt-to-equity ratio of 0.80. The stock has a market capitalization of $9.03 billion, a P/E ratio of 9.95, a price-to-earnings-growth ratio of 1.91 and a beta of 1.22.

Eastman Chemical (NYSE:EMN - Get Free Report) last posted its earnings results on Thursday, April 24th. The basic materials company reported $1.91 EPS for the quarter, beating analysts' consensus estimates of $1.89 by $0.02. Eastman Chemical had a net margin of 9.85% and a return on equity of 16.59%. The company had revenue of $2.29 billion for the quarter, compared to analysts' expectations of $2.35 billion. During the same quarter in the prior year, the company posted $1.61 earnings per share. Eastman Chemical's revenue for the quarter was down .9% compared to the same quarter last year. As a group, research analysts anticipate that Eastman Chemical Company will post 8.55 earnings per share for the current fiscal year.

Eastman Chemical Dividend Announcement

The firm also recently declared a quarterly dividend, which will be paid on Tuesday, July 8th. Stockholders of record on Friday, June 13th will be given a dividend of $0.83 per share. The ex-dividend date is Friday, June 13th. This represents a $3.32 annualized dividend and a dividend yield of 4.25%. Eastman Chemical's dividend payout ratio is presently 42.24%.

Eastman Chemical Profile

(

Free Report)

Eastman Chemical Company operates as a specialty materials company in the United States, China, and internationally. The company's Additives & Functional Products segment offers amine derivative-based building blocks, intermediates for surfactants, metam-based soil fumigants, and organic acid-based solutions; specialty coalescent and solvents, paint additives, and specialty polymers; and heat transfer and aviation fluids.

Recommended Stories

Before you consider Eastman Chemical, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Eastman Chemical wasn't on the list.

While Eastman Chemical currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.