Rye Brook Capital LLC lifted its position in shares of NexGen Energy (NYSE:NXE - Free Report) by 6.3% in the 2nd quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The firm owned 767,900 shares of the company's stock after buying an additional 45,300 shares during the quarter. NexGen Energy comprises about 5.6% of Rye Brook Capital LLC's holdings, making the stock its 5th largest position. Rye Brook Capital LLC owned 0.13% of NexGen Energy worth $5,329,000 at the end of the most recent reporting period.

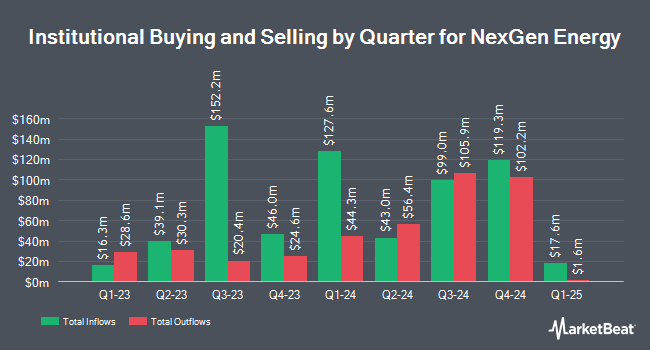

Several other large investors also recently modified their holdings of NXE. Accordant Advisory Group Inc increased its position in shares of NexGen Energy by 54.4% during the first quarter. Accordant Advisory Group Inc now owns 139,209 shares of the company's stock worth $625,000 after buying an additional 49,074 shares during the period. Packer & Co Ltd bought a new stake in shares of NexGen Energy in the 1st quarter valued at $13,581,000. Cambridge Investment Research Advisors Inc. increased its stake in shares of NexGen Energy by 11.4% in the 1st quarter. Cambridge Investment Research Advisors Inc. now owns 39,726 shares of the company's stock valued at $178,000 after acquiring an additional 4,075 shares in the last quarter. Goehring & Rozencwajg Associates LLC increased its stake in shares of NexGen Energy by 2.2% in the 1st quarter. Goehring & Rozencwajg Associates LLC now owns 1,472,899 shares of the company's stock valued at $6,613,000 after acquiring an additional 32,025 shares in the last quarter. Finally, Bank of New York Mellon Corp increased its stake in shares of NexGen Energy by 7.7% in the 1st quarter. Bank of New York Mellon Corp now owns 2,021,300 shares of the company's stock valued at $9,076,000 after acquiring an additional 144,742 shares in the last quarter. 42.43% of the stock is currently owned by institutional investors and hedge funds.

NexGen Energy Trading Down 1.4%

NYSE NXE opened at $8.76 on Thursday. The company has a fifty day simple moving average of $7.78 and a 200 day simple moving average of $6.52. NexGen Energy has a 12-month low of $3.91 and a 12-month high of $9.43. The company has a market cap of $5.04 billion, a P/E ratio of -35.04 and a beta of 1.44.

NexGen Energy (NYSE:NXE - Get Free Report) last posted its quarterly earnings results on Tuesday, August 5th. The company reported ($0.10) earnings per share (EPS) for the quarter, missing the consensus estimate of ($0.02) by ($0.08). Sell-side analysts predict that NexGen Energy will post -0.05 EPS for the current year.

Wall Street Analyst Weigh In

Several analysts have recently weighed in on the stock. TD Securities reiterated a "buy" rating on shares of NexGen Energy in a research note on Friday, August 8th. Weiss Ratings reiterated a "sell (d)" rating on shares of NexGen Energy in a research note on Wednesday. One research analyst has rated the stock with a Strong Buy rating, five have given a Buy rating and one has issued a Sell rating to the stock. According to data from MarketBeat.com, the company has a consensus rating of "Moderate Buy".

Read Our Latest Stock Analysis on NexGen Energy

NexGen Energy Profile

(

Free Report)

NexGen Energy Ltd., an exploration and development stage company, engages in the acquisition, exploration, and evaluation and development of uranium properties in Canada. It holds a 100% interest in the Rook I project that consists of 32 contiguous mineral claims totaling an area of 35,065 hectares located in the southwestern Athabasca Basin of Saskatchewan.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider NexGen Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and NexGen Energy wasn't on the list.

While NexGen Energy currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.