Cwm LLC lessened its position in shares of Nexstar Media Group, Inc. (NASDAQ:NXST - Free Report) by 55.5% in the 1st quarter, according to its most recent filing with the Securities & Exchange Commission. The institutional investor owned 1,308 shares of the company's stock after selling 1,632 shares during the period. Cwm LLC's holdings in Nexstar Media Group were worth $234,000 as of its most recent SEC filing.

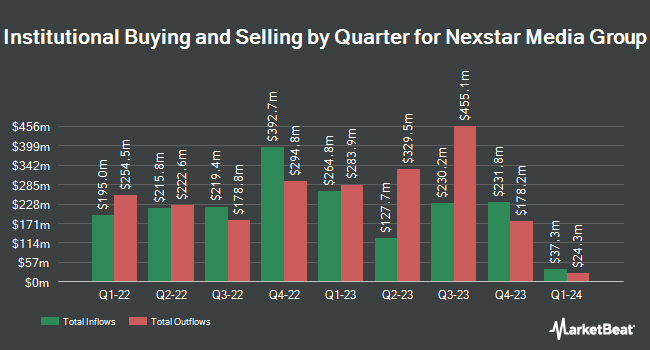

Several other institutional investors have also modified their holdings of the stock. Dimensional Fund Advisors LP lifted its position in shares of Nexstar Media Group by 0.4% during the 4th quarter. Dimensional Fund Advisors LP now owns 1,331,355 shares of the company's stock worth $210,314,000 after buying an additional 4,704 shares during the last quarter. Demars Financial Group LLC raised its position in Nexstar Media Group by 13.6% in the 1st quarter. Demars Financial Group LLC now owns 879,253 shares of the company's stock valued at $157,580,000 after purchasing an additional 105,516 shares during the last quarter. Northern Trust Corp raised its position in Nexstar Media Group by 22.3% in the 4th quarter. Northern Trust Corp now owns 463,139 shares of the company's stock valued at $73,162,000 after purchasing an additional 84,367 shares during the last quarter. AQR Capital Management LLC raised its position in Nexstar Media Group by 15.5% in the 4th quarter. AQR Capital Management LLC now owns 423,808 shares of the company's stock valued at $66,949,000 after purchasing an additional 56,935 shares during the last quarter. Finally, Brown Advisory Inc. raised its position in Nexstar Media Group by 58.3% in the 1st quarter. Brown Advisory Inc. now owns 352,165 shares of the company's stock valued at $63,115,000 after purchasing an additional 129,647 shares during the last quarter. Hedge funds and other institutional investors own 95.30% of the company's stock.

Nexstar Media Group Stock Performance

Shares of NXST opened at $189.60 on Friday. The company has a 50-day simple moving average of $175.32 and a 200-day simple moving average of $165.26. The company has a quick ratio of 1.74, a current ratio of 1.74 and a debt-to-equity ratio of 2.86. The company has a market capitalization of $5.78 billion, a PE ratio of 9.60, a P/E/G ratio of 1.39 and a beta of 1.04. Nexstar Media Group, Inc. has a 52-week low of $141.66 and a 52-week high of $192.21.

Nexstar Media Group (NASDAQ:NXST - Get Free Report) last posted its earnings results on Thursday, May 8th. The company reported $3.37 earnings per share for the quarter, beating the consensus estimate of $3.26 by $0.11. Nexstar Media Group had a net margin of 12.21% and a return on equity of 29.21%. The firm had revenue of $1.23 billion during the quarter, compared to the consensus estimate of $1.23 billion. During the same period last year, the firm posted $5.16 EPS. The firm's revenue for the quarter was down 3.9% on a year-over-year basis. Equities research analysts predict that Nexstar Media Group, Inc. will post 21.62 earnings per share for the current fiscal year.

Nexstar Media Group Announces Dividend

The company also recently declared a quarterly dividend, which was paid on Monday, June 2nd. Shareholders of record on Monday, May 19th were paid a dividend of $1.86 per share. The ex-dividend date of this dividend was Monday, May 19th. This represents a $7.44 annualized dividend and a dividend yield of 3.92%. Nexstar Media Group's dividend payout ratio is currently 37.69%.

Insider Activity at Nexstar Media Group

In other Nexstar Media Group news, insider Dana Zimmer sold 889 shares of the firm's stock in a transaction dated Tuesday, June 17th. The shares were sold at an average price of $165.25, for a total transaction of $146,907.25. Following the sale, the insider directly owned 6,201 shares of the company's stock, valued at $1,024,715.25. This trade represents a 12.54% decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through this link. Also, insider Gary Weitman sold 510 shares of the firm's stock in a transaction dated Tuesday, June 17th. The stock was sold at an average price of $165.25, for a total transaction of $84,277.50. Following the sale, the insider directly owned 8,229 shares in the company, valued at $1,359,842.25. This represents a 5.84% decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold 21,474 shares of company stock worth $3,666,988 over the last three months. Company insiders own 6.70% of the company's stock.

Analyst Upgrades and Downgrades

Several research firms recently commented on NXST. Wells Fargo & Company reduced their price target on shares of Nexstar Media Group from $216.00 to $200.00 and set an "overweight" rating for the company in a research report on Thursday, May 1st. Barrington Research restated an "outperform" rating and set a $200.00 price objective on shares of Nexstar Media Group in a research report on Tuesday, May 13th. Finally, Benchmark cut their price objective on shares of Nexstar Media Group from $225.00 to $215.00 and set a "buy" rating for the company in a research report on Tuesday, May 6th. One analyst has rated the stock with a hold rating and seven have issued a buy rating to the company. According to data from MarketBeat.com, the stock presently has an average rating of "Moderate Buy" and a consensus price target of $205.71.

Check Out Our Latest Analysis on NXST

Nexstar Media Group Company Profile

(

Free Report)

Nexstar Media Group, Inc operates as a diversified media company that produces and distributes engaging local and national news, sports and entertainment content across the television and digital platforms in the United States. It owns, operates, programs, or provides sales and other services to various markets; and offers television programming services.

Further Reading

Want to see what other hedge funds are holding NXST? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Nexstar Media Group, Inc. (NASDAQ:NXST - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Nexstar Media Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Nexstar Media Group wasn't on the list.

While Nexstar Media Group currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report