Nomura Holdings Inc. grew its holdings in PulteGroup, Inc. (NYSE:PHM - Free Report) by 670.8% during the 1st quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The institutional investor owned 6,390 shares of the construction company's stock after acquiring an additional 5,561 shares during the period. Nomura Holdings Inc.'s holdings in PulteGroup were worth $657,000 as of its most recent filing with the Securities & Exchange Commission.

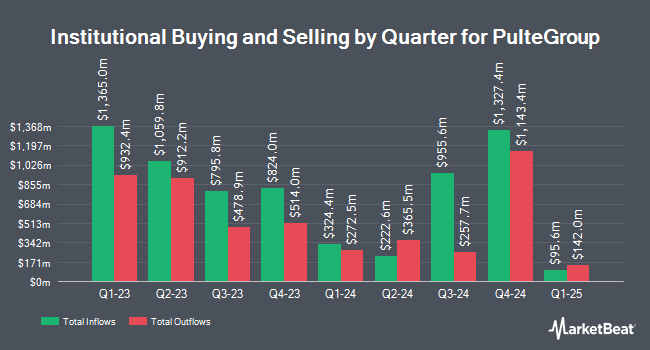

A number of other hedge funds have also recently made changes to their positions in the business. WPG Advisers LLC bought a new stake in PulteGroup during the 1st quarter valued at approximately $25,000. Ameriflex Group Inc. purchased a new stake in PulteGroup during the 4th quarter valued at approximately $37,000. American National Bank & Trust bought a new stake in shares of PulteGroup during the first quarter valued at approximately $39,000. Catalyst Capital Advisors LLC bought a new position in shares of PulteGroup during the first quarter worth $54,000. Finally, Sentry Investment Management LLC bought a new position in shares of PulteGroup during the first quarter worth $61,000. Institutional investors own 89.90% of the company's stock.

PulteGroup Trading Up 2.1%

Shares of NYSE:PHM traded up $2.92 during trading on Friday, reaching $140.53. The company's stock had a trading volume of 2,189,499 shares, compared to its average volume of 1,902,655. The stock has a market capitalization of $27.73 billion, a PE ratio of 10.50, a price-to-earnings-growth ratio of 0.41 and a beta of 1.27. PulteGroup, Inc. has a 12 month low of $88.07 and a 12 month high of $149.47. The company has a current ratio of 0.77, a quick ratio of 0.77 and a debt-to-equity ratio of 0.13. The firm's 50 day simple moving average is $120.49 and its two-hundred day simple moving average is $108.13.

PulteGroup (NYSE:PHM - Get Free Report) last issued its quarterly earnings data on Tuesday, July 22nd. The construction company reported $3.03 earnings per share for the quarter, topping the consensus estimate of $2.92 by $0.11. The company had revenue of $4.40 billion for the quarter, compared to analysts' expectations of $4.42 billion. PulteGroup had a return on equity of 21.01% and a net margin of 15.50%.The firm's revenue for the quarter was down 4.3% on a year-over-year basis. During the same period in the previous year, the firm posted $3.83 earnings per share. On average, research analysts predict that PulteGroup, Inc. will post 12.32 EPS for the current fiscal year.

PulteGroup Dividend Announcement

The business also recently declared a quarterly dividend, which will be paid on Thursday, October 2nd. Investors of record on Tuesday, September 16th will be issued a dividend of $0.22 per share. This represents a $0.88 annualized dividend and a yield of 0.6%. The ex-dividend date is Tuesday, September 16th. PulteGroup's dividend payout ratio is presently 6.58%.

Analyst Ratings Changes

A number of analysts have issued reports on the stock. JPMorgan Chase & Co. lifted their price target on shares of PulteGroup from $121.00 to $123.00 and gave the company an "overweight" rating in a report on Wednesday, July 23rd. Wells Fargo & Company lifted their target price on PulteGroup from $135.00 to $150.00 and gave the stock an "overweight" rating in a report on Tuesday, September 2nd. Seaport Res Ptn upgraded PulteGroup from a "hold" rating to a "strong-buy" rating in a research report on Tuesday, July 22nd. UBS Group raised their price target on PulteGroup from $141.00 to $150.00 and gave the company a "buy" rating in a report on Wednesday, July 23rd. Finally, Raymond James Financial reaffirmed an "outperform" rating and set a $140.00 price objective (up from $115.00) on shares of PulteGroup in a report on Wednesday, July 23rd. One investment analyst has rated the stock with a Strong Buy rating, nine have given a Buy rating and five have assigned a Hold rating to the company's stock. Based on data from MarketBeat.com, PulteGroup currently has an average rating of "Moderate Buy" and a consensus price target of $136.46.

Get Our Latest Stock Report on PHM

About PulteGroup

(

Free Report)

PulteGroup, Inc, through its subsidiaries, primarily engages in the homebuilding business in the United States. It acquires and develops land primarily for residential purposes; and constructs housing on such land. The company also offers various home designs, including single-family detached, townhomes, condominiums, and duplexes under the Centex, Pulte Homes, Del Webb, DiVosta Homes, John Wieland Homes and Neighborhoods, and American West brand names.

Featured Stories

Before you consider PulteGroup, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and PulteGroup wasn't on the list.

While PulteGroup currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.