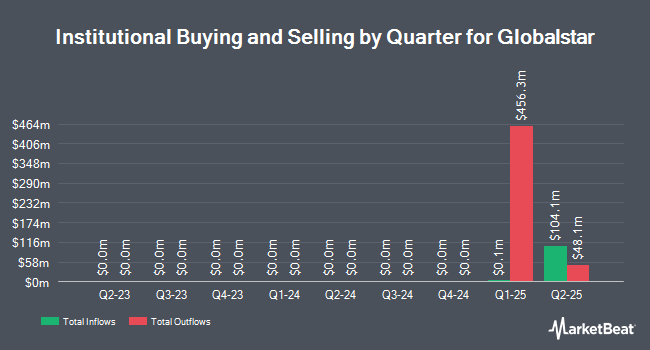

Nordea Investment Management AB bought a new stake in Globalstar, Inc. (NASDAQ:GSAT - Free Report) in the 2nd quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission. The fund bought 129,282 shares of the company's stock, valued at approximately $3,037,000. Nordea Investment Management AB owned about 0.10% of Globalstar at the end of the most recent quarter.

Separately, Acadian Asset Management LLC acquired a new position in Globalstar in the 1st quarter valued at about $99,000. Institutional investors own 18.89% of the company's stock.

Analyst Ratings Changes

A number of research analysts have recently commented on GSAT shares. Weiss Ratings reaffirmed a "sell (d-)" rating on shares of Globalstar in a research note on Wednesday, October 8th. Zacks Research downgraded shares of Globalstar from a "strong-buy" rating to a "hold" rating in a research note on Tuesday, October 7th. One investment analyst has rated the stock with a Hold rating and one has given a Sell rating to the company's stock. Based on data from MarketBeat, Globalstar has an average rating of "Reduce".

Read Our Latest Stock Report on GSAT

Insider Transactions at Globalstar

In other news, CFO Rebecca Clary sold 4,333 shares of the business's stock in a transaction dated Thursday, October 16th. The stock was sold at an average price of $44.43, for a total transaction of $192,515.19. Following the completion of the sale, the chief financial officer owned 110,852 shares in the company, valued at approximately $4,925,154.36. The trade was a 3.76% decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through this link. Also, CEO Paul E. Jacobs sold 53,479 shares of the business's stock in a transaction dated Thursday, September 25th. The stock was sold at an average price of $34.95, for a total value of $1,869,091.05. Following the sale, the chief executive officer owned 58,895 shares of the company's stock, valued at $2,058,380.25. The trade was a 47.59% decrease in their position. The disclosure for this sale can be found here. In the last quarter, insiders sold 117,938 shares of company stock worth $3,950,670. 60.76% of the stock is currently owned by company insiders.

Globalstar Stock Performance

Shares of NASDAQ:GSAT opened at $44.96 on Wednesday. The company has a quick ratio of 2.72, a current ratio of 2.81 and a debt-to-equity ratio of 1.30. Globalstar, Inc. has a 1 year low of $15.00 and a 1 year high of $47.44. The stock has a market cap of $5.70 billion, a PE ratio of -99.91 and a beta of 0.99. The business's 50-day moving average price is $34.84.

Globalstar (NASDAQ:GSAT - Get Free Report) last issued its earnings results on Thursday, August 7th. The company reported $0.13 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of ($0.09) by $0.22. Globalstar had a negative return on equity of 1.17% and a negative net margin of 17.80%.The business had revenue of $67.15 million during the quarter. Globalstar has set its FY 2025 guidance at EPS.

Globalstar Company Profile

(

Free Report)

Globalstar, Inc provides mobile satellite services worldwide. The company offers duplex two-way voice and data products, including mobile voice and data satellite communications services and equipment for remote business continuity, recreational usage, safety, emergency preparedness and response, and other applications; fixed voice and data satellite communications services and equipment at industrial, commercial, and residential sites, as well as rural villages and ships; and data modem services and equipment.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Globalstar, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Globalstar wasn't on the list.

While Globalstar currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.