Norden Group LLC lessened its stake in shares of Medpace Holdings, Inc. (NASDAQ:MEDP - Free Report) by 49.4% during the first quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The fund owned 1,563 shares of the company's stock after selling 1,527 shares during the quarter. Norden Group LLC's holdings in Medpace were worth $476,000 as of its most recent SEC filing.

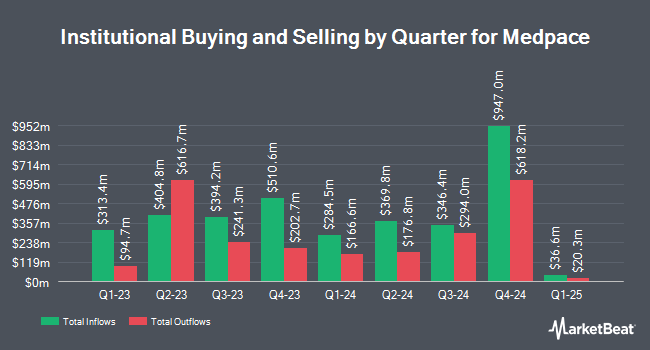

Several other hedge funds and other institutional investors have also recently made changes to their positions in MEDP. Whittier Trust Co. lifted its holdings in Medpace by 47.3% during the first quarter. Whittier Trust Co. now owns 109 shares of the company's stock valued at $33,000 after purchasing an additional 35 shares in the last quarter. Colonial Trust Co SC grew its position in shares of Medpace by 150.0% during the fourth quarter. Colonial Trust Co SC now owns 175 shares of the company's stock worth $58,000 after purchasing an additional 105 shares in the last quarter. Bank Julius Baer & Co. Ltd Zurich purchased a new stake in shares of Medpace during the first quarter worth about $60,000. Assetmark Inc. grew its position in shares of Medpace by 24.9% during the first quarter. Assetmark Inc. now owns 216 shares of the company's stock worth $66,000 after purchasing an additional 43 shares in the last quarter. Finally, Nemes Rush Group LLC purchased a new stake in shares of Medpace during the fourth quarter worth about $86,000. Hedge funds and other institutional investors own 77.98% of the company's stock.

Medpace Price Performance

MEDP stock traded down $4.11 during mid-day trading on Friday, reaching $423.09. 517,813 shares of the company's stock were exchanged, compared to its average volume of 739,468. The company has a market cap of $11.88 billion, a price-to-earnings ratio of 31.46, a price-to-earnings-growth ratio of 2.66 and a beta of 1.42. The stock's 50 day moving average is $333.51 and its 200 day moving average is $324.05. Medpace Holdings, Inc. has a 12-month low of $250.05 and a 12-month high of $501.30.

Medpace (NASDAQ:MEDP - Get Free Report) last posted its quarterly earnings data on Monday, July 21st. The company reported $3.10 EPS for the quarter, topping the consensus estimate of $3.00 by $0.10. The company had revenue of $603.31 million during the quarter, compared to analyst estimates of $537.70 million. Medpace had a return on equity of 67.66% and a net margin of 18.74%. Medpace's quarterly revenue was up 14.2% on a year-over-year basis. During the same period in the previous year, the business earned $2.75 EPS. On average, research analysts forecast that Medpace Holdings, Inc. will post 12.29 earnings per share for the current fiscal year.

Insider Transactions at Medpace

In related news, VP Susan E. Burwig sold 7,500 shares of Medpace stock in a transaction that occurred on Monday, July 28th. The shares were sold at an average price of $450.14, for a total value of $3,376,050.00. Following the completion of the sale, the vice president owned 57,500 shares in the company, valued at approximately $25,883,050. This trade represents a 11.54% decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through this link. Also, CEO August J. Troendle sold 48,487 shares of Medpace stock in a transaction that occurred on Monday, July 28th. The shares were sold at an average price of $451.69, for a total transaction of $21,901,093.03. Following the completion of the sale, the chief executive officer owned 962,615 shares of the company's stock, valued at $434,803,569.35. This trade represents a 4.80% decrease in their position. The disclosure for this sale can be found here. Insiders sold a total of 112,788 shares of company stock valued at $51,018,354 in the last ninety days. 20.30% of the stock is currently owned by corporate insiders.

Analyst Upgrades and Downgrades

A number of equities research analysts recently commented on the company. TD Cowen reiterated a "sell" rating and issued a $366.00 target price (up from $283.00) on shares of Medpace in a research report on Wednesday, July 23rd. William Blair reissued a "market perform" rating on shares of Medpace in a research report on Wednesday, July 23rd. Deutsche Bank Aktiengesellschaft lifted their price objective on shares of Medpace from $270.00 to $430.00 and gave the stock a "hold" rating in a research report on Wednesday, July 23rd. UBS Group lowered shares of Medpace from a "neutral" rating to a "sell" rating and increased their price objective for the company from $300.00 to $305.00 in a research report on Tuesday, July 29th. Finally, Barclays increased their price target on shares of Medpace from $300.00 to $450.00 and gave the stock an "equal weight" rating in a report on Wednesday, July 23rd. Three research analysts have rated the stock with a sell rating, ten have issued a hold rating and two have assigned a buy rating to the stock. According to MarketBeat, the company presently has a consensus rating of "Hold" and a consensus target price of $406.60.

Check Out Our Latest Stock Analysis on Medpace

Medpace Profile

(

Free Report)

Medpace Holdings, Inc engages in the provision of outsourced clinical development services to the biotechnology, pharmaceutical and medical device industries. Its services include medical department, clinical trial management, data-driven feasibility, study-start-up, clinical monitoring, regulatory affairs, patient recruitment and retention, medical writing, biometrics and data sciences, pharmacovigilance, core laboratory, laboratories, clinics, and quality assurance.

Featured Stories

Before you consider Medpace, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Medpace wasn't on the list.

While Medpace currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.