Walleye Capital LLC cut its holdings in Nordic American Tankers Limited (NYSE:NAT - Free Report) by 95.7% during the 1st quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The fund owned 30,304 shares of the shipping company's stock after selling 675,427 shares during the quarter. Walleye Capital LLC's holdings in Nordic American Tankers were worth $75,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

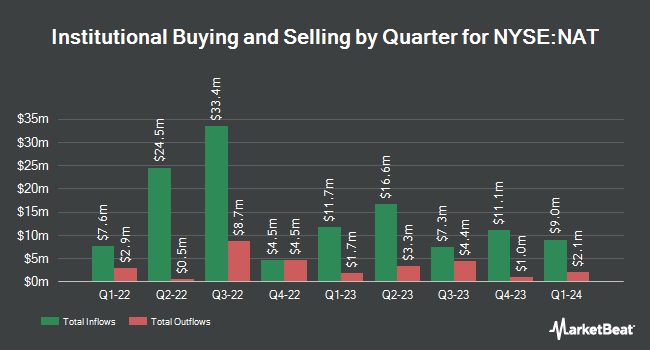

Several other large investors also recently modified their holdings of the business. Two Sigma Advisers LP grew its stake in shares of Nordic American Tankers by 0.4% in the fourth quarter. Two Sigma Advisers LP now owns 3,787,400 shares of the shipping company's stock worth $9,468,000 after purchasing an additional 13,300 shares during the last quarter. CenterBook Partners LP grew its stake in shares of Nordic American Tankers by 88.0% in the first quarter. CenterBook Partners LP now owns 3,135,619 shares of the shipping company's stock worth $7,714,000 after purchasing an additional 1,467,916 shares during the last quarter. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. grew its stake in shares of Nordic American Tankers by 10.1% in the fourth quarter. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. now owns 2,678,423 shares of the shipping company's stock worth $6,696,000 after purchasing an additional 246,365 shares during the last quarter. Northern Trust Corp grew its stake in shares of Nordic American Tankers by 3.3% in the fourth quarter. Northern Trust Corp now owns 1,376,932 shares of the shipping company's stock worth $3,442,000 after purchasing an additional 44,380 shares during the last quarter. Finally, Nuveen LLC bought a new stake in Nordic American Tankers during the 1st quarter valued at approximately $3,150,000. 44.29% of the stock is owned by institutional investors.

Analyst Ratings Changes

Several analysts have weighed in on NAT shares. Wall Street Zen cut Nordic American Tankers from a "hold" rating to a "sell" rating in a research report on Saturday, July 26th. Jefferies Financial Group reaffirmed a "hold" rating and set a $3.00 price objective on shares of Nordic American Tankers in a research report on Thursday, August 28th. One investment analyst has rated the stock with a Hold rating, Based on data from MarketBeat.com, the stock presently has an average rating of "Hold" and a consensus price target of $3.00.

Read Our Latest Analysis on Nordic American Tankers

Nordic American Tankers Stock Up 2.8%

Nordic American Tankers stock traded up $0.09 during trading hours on Thursday, hitting $3.28. 2,650,080 shares of the stock traded hands, compared to its average volume of 1,824,195. The company has a current ratio of 2.33, a quick ratio of 2.04 and a debt-to-equity ratio of 0.84. The firm's 50-day moving average price is $2.89 and its two-hundred day moving average price is $2.69. Nordic American Tankers Limited has a one year low of $2.13 and a one year high of $3.83. The company has a market cap of $694.54 million, a PE ratio of 46.86 and a beta of -0.22.

Nordic American Tankers (NYSE:NAT - Get Free Report) last issued its quarterly earnings results on Thursday, August 28th. The shipping company reported ($0.02) EPS for the quarter, missing analysts' consensus estimates of $0.03 by ($0.05). Nordic American Tankers had a return on equity of 2.67% and a net margin of 7.58%.The company had revenue of $40.15 million during the quarter, compared to the consensus estimate of $53.35 million. On average, research analysts forecast that Nordic American Tankers Limited will post 0.24 EPS for the current year.

Nordic American Tankers Increases Dividend

The business also recently declared a quarterly dividend, which will be paid on Monday, September 29th. Stockholders of record on Friday, September 12th will be given a $0.10 dividend. The ex-dividend date of this dividend is Friday, September 12th. This represents a $0.40 dividend on an annualized basis and a dividend yield of 12.2%. This is an increase from Nordic American Tankers's previous quarterly dividend of $0.07. Nordic American Tankers's payout ratio is presently 571.43%.

Nordic American Tankers Profile

(

Free Report)

Nordic American Tankers Limited, a tanker company, acquires and charters double-hull tankers in Bermuda and internationally. It operates a fleet of 20 Suezmax crude oil tankers. The company was incorporated in 1995 and is headquartered in Hamilton, Bermuda.

Further Reading

Before you consider Nordic American Tankers, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Nordic American Tankers wasn't on the list.

While Nordic American Tankers currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.