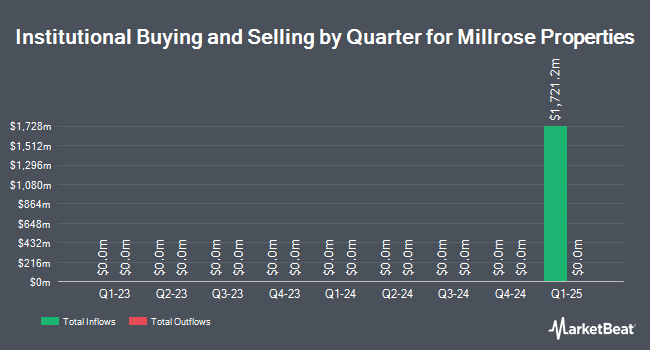

North Ground Capital bought a new stake in Millrose Properties, Inc. (NYSE:MRP - Free Report) in the first quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The fund bought 324,133 shares of the company's stock, valued at approximately $8,045,000. Millrose Properties accounts for about 7.8% of North Ground Capital's portfolio, making the stock its 4th largest position. North Ground Capital owned about 0.20% of Millrose Properties as of its most recent filing with the Securities and Exchange Commission (SEC).

A number of other institutional investors and hedge funds have also recently added to or reduced their stakes in the business. Keeley Teton Advisors LLC acquired a new position in Millrose Properties in the first quarter valued at about $6,633,000. Corebridge Financial Inc. acquired a new position in Millrose Properties in the first quarter valued at about $125,000. MetLife Investment Management LLC acquired a new position in Millrose Properties in the first quarter valued at about $150,000. Walleye Capital LLC acquired a new position in Millrose Properties in the first quarter valued at about $1,576,000. Finally, Jump Financial LLC acquired a new position in Millrose Properties in the first quarter valued at about $518,000.

Millrose Properties Stock Performance

NYSE MRP traded down $0.15 during trading hours on Friday, hitting $35.35. 1,414,198 shares of the company traded hands, compared to its average volume of 1,022,238. The stock has a 50-day simple moving average of $30.87. Millrose Properties, Inc. has a twelve month low of $19.00 and a twelve month high of $36.00. The company has a debt-to-equity ratio of 0.17, a quick ratio of 0.06 and a current ratio of 0.06.

Millrose Properties (NYSE:MRP - Get Free Report) last issued its quarterly earnings results on Thursday, July 31st. The company reported $0.68 EPS for the quarter. The company had revenue of $149.00 million for the quarter.

Millrose Properties Announces Dividend

The business also recently declared a quarterly dividend, which was paid on Tuesday, July 15th. Investors of record on Thursday, July 3rd were given a dividend of $0.69 per share. This represents a $2.76 annualized dividend and a yield of 7.8%.

Analysts Set New Price Targets

Separately, The Goldman Sachs Group boosted their target price on Millrose Properties from $28.00 to $31.50 and gave the company a "buy" rating in a research note on Thursday, May 15th. Two analysts have rated the stock with a Buy rating, According to data from MarketBeat.com, the stock presently has a consensus rating of "Buy" and an average target price of $30.75.

Get Our Latest Analysis on Millrose Properties

Millrose Properties Profile

(

Free Report)

Millrose Properties, Inc is a real estate investment and management company that focuses on acquiring, developing, and managing high-quality commercial properties. They are headquartered in Purchase, New York.

Featured Articles

Before you consider Millrose Properties, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Millrose Properties wasn't on the list.

While Millrose Properties currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.