North Star Investment Management Corp. lowered its stake in shares of Comfort Systems USA, Inc. (NYSE:FIX - Free Report) by 17.2% during the 2nd quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The firm owned 2,400 shares of the construction company's stock after selling 500 shares during the quarter. North Star Investment Management Corp.'s holdings in Comfort Systems USA were worth $1,287,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

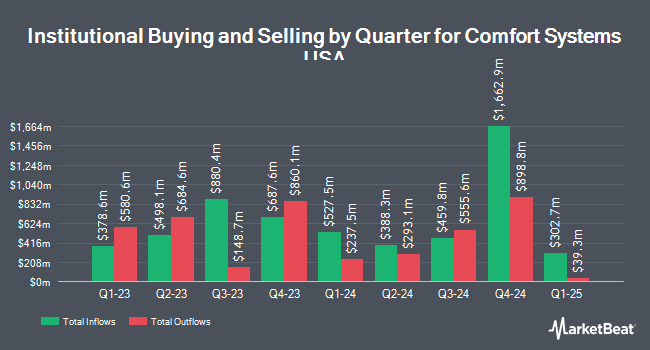

Several other hedge funds and other institutional investors also recently modified their holdings of the stock. Retireful LLC purchased a new position in shares of Comfort Systems USA during the second quarter valued at about $729,000. Public Employees Retirement System of Ohio increased its position in shares of Comfort Systems USA by 5.8% during the second quarter. Public Employees Retirement System of Ohio now owns 13,723 shares of the construction company's stock valued at $7,358,000 after buying an additional 747 shares during the period. Ballentine Partners LLC purchased a new position in shares of Comfort Systems USA during the second quarter valued at about $471,000. Maseco LLP purchased a new position in shares of Comfort Systems USA during the second quarter valued at about $64,000. Finally, Fifth Third Bancorp increased its position in shares of Comfort Systems USA by 2.0% during the second quarter. Fifth Third Bancorp now owns 1,739 shares of the construction company's stock valued at $932,000 after buying an additional 34 shares during the period. Hedge funds and other institutional investors own 96.51% of the company's stock.

Wall Street Analysts Forecast Growth

A number of equities research analysts have weighed in on FIX shares. Stifel Nicolaus upped their price objective on shares of Comfort Systems USA from $512.00 to $581.00 and gave the stock a "buy" rating in a report on Friday, July 11th. Zacks Research upgraded shares of Comfort Systems USA from a "hold" rating to a "strong-buy" rating in a report on Tuesday, August 19th. William Blair started coverage on shares of Comfort Systems USA in a report on Thursday, September 11th. They issued an "outperform" rating on the stock. DA Davidson upped their price objective on shares of Comfort Systems USA from $630.00 to $810.00 and gave the stock a "buy" rating in a report on Monday, July 28th. Finally, UBS Group upped their price objective on shares of Comfort Systems USA from $710.00 to $875.00 and gave the stock a "buy" rating in a report on Monday, September 15th. One research analyst has rated the stock with a Strong Buy rating, five have given a Buy rating and one has issued a Hold rating to the stock. According to data from MarketBeat.com, Comfort Systems USA currently has a consensus rating of "Buy" and a consensus price target of $668.60.

Get Our Latest Research Report on FIX

Insider Activity at Comfort Systems USA

In related news, CAO Julie Shaeff sold 1,369 shares of the stock in a transaction that occurred on Tuesday, August 12th. The shares were sold at an average price of $704.50, for a total transaction of $964,460.50. Following the transaction, the chief accounting officer owned 16,023 shares in the company, valued at $11,288,203.50. This represents a 7.87% decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available at the SEC website. Also, Director Pablo G. Mercado sold 1,078 shares of the stock in a transaction that occurred on Friday, August 22nd. The shares were sold at an average price of $695.88, for a total transaction of $750,158.64. Following the transaction, the director owned 6,500 shares in the company, valued at approximately $4,523,220. This trade represents a 14.23% decrease in their position. The disclosure for this sale can be found here. Insiders have sold 26,783 shares of company stock valued at $18,710,798 over the last quarter. 1.59% of the stock is owned by company insiders.

Comfort Systems USA Trading Down 1.3%

Shares of NYSE FIX opened at $780.89 on Friday. The firm's 50 day moving average price is $704.12 and its 200-day moving average price is $526.72. The company has a market cap of $27.55 billion, a PE ratio of 40.13 and a beta of 1.54. Comfort Systems USA, Inc. has a 52-week low of $276.44 and a 52-week high of $825.00. The company has a debt-to-equity ratio of 0.03, a quick ratio of 1.10 and a current ratio of 1.13.

Comfort Systems USA (NYSE:FIX - Get Free Report) last issued its earnings results on Thursday, July 24th. The construction company reported $6.53 earnings per share (EPS) for the quarter, topping the consensus estimate of $4.84 by $1.69. The firm had revenue of $2.17 billion for the quarter, compared to the consensus estimate of $1.97 billion. Comfort Systems USA had a net margin of 9.01% and a return on equity of 39.33%. The business's revenue was up 20.1% on a year-over-year basis. During the same quarter in the prior year, the firm posted $3.74 earnings per share. On average, equities research analysts expect that Comfort Systems USA, Inc. will post 16.85 EPS for the current fiscal year.

Comfort Systems USA Increases Dividend

The business also recently disclosed a quarterly dividend, which was paid on Monday, August 25th. Investors of record on Thursday, August 14th were given a dividend of $0.50 per share. This represents a $2.00 dividend on an annualized basis and a yield of 0.3%. This is a positive change from Comfort Systems USA's previous quarterly dividend of $0.45. The ex-dividend date was Thursday, August 14th. Comfort Systems USA's payout ratio is currently 10.28%.

Comfort Systems USA Profile

(

Free Report)

Comfort Systems USA, Inc, together with its subsidiaries, provides mechanical and electrical installation, renovation, maintenance, repair, and replacement services for the mechanical and electrical services industry in the United States. It operates through two segments, Mechanical and Electrical. The company offers heating, ventilation, and air conditioning systems, as well as plumbing, electrical, piping and controls, off-site construction, monitoring, and fire protection.

See Also

Want to see what other hedge funds are holding FIX? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Comfort Systems USA, Inc. (NYSE:FIX - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Comfort Systems USA, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Comfort Systems USA wasn't on the list.

While Comfort Systems USA currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for October 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report