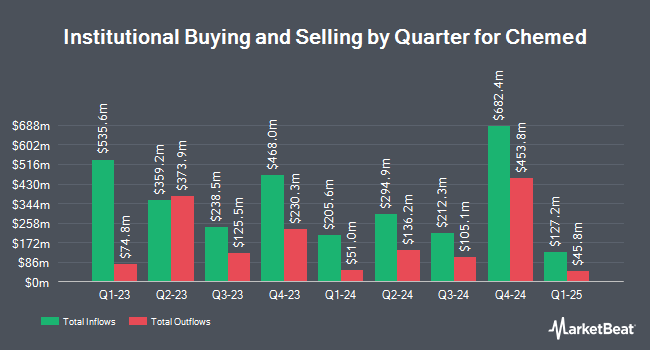

Northern Trust Corp boosted its holdings in Chemed Corporation (NYSE:CHE - Free Report) by 3.4% during the first quarter, according to its most recent 13F filing with the Securities & Exchange Commission. The fund owned 215,523 shares of the company's stock after acquiring an additional 6,988 shares during the quarter. Northern Trust Corp owned 1.47% of Chemed worth $132,616,000 at the end of the most recent reporting period.

Several other institutional investors have also recently modified their holdings of the company. Whipplewood Advisors LLC increased its position in shares of Chemed by 54.5% during the 1st quarter. Whipplewood Advisors LLC now owns 51 shares of the company's stock valued at $31,000 after purchasing an additional 18 shares during the last quarter. Renasant Bank increased its position in shares of Chemed by 2.3% during the 1st quarter. Renasant Bank now owns 815 shares of the company's stock valued at $501,000 after purchasing an additional 18 shares during the last quarter. Impact Capital Partners LLC increased its position in shares of Chemed by 2.7% during the 1st quarter. Impact Capital Partners LLC now owns 763 shares of the company's stock valued at $469,000 after purchasing an additional 20 shares during the last quarter. KFG Wealth Management LLC increased its position in shares of Chemed by 4.6% during the 1st quarter. KFG Wealth Management LLC now owns 525 shares of the company's stock valued at $323,000 after purchasing an additional 23 shares during the last quarter. Finally, First Horizon Advisors Inc. increased its position in shares of Chemed by 16.1% during the 1st quarter. First Horizon Advisors Inc. now owns 173 shares of the company's stock valued at $107,000 after purchasing an additional 24 shares during the last quarter. 95.85% of the stock is currently owned by institutional investors.

Insider Activity at Chemed

In other news, Director George J. Walsh III bought 200 shares of the firm's stock in a transaction dated Monday, August 4th. The stock was purchased at an average price of $417.10 per share, with a total value of $83,420.00. Following the transaction, the director owned 3,523 shares of the company's stock, valued at approximately $1,469,443.30. The trade was a 6.02% increase in their ownership of the stock. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through the SEC website. Also, EVP Nicholas Michael Westfall sold 10,012 shares of the stock in a transaction that occurred on Monday, August 4th. The stock was sold at an average price of $421.91, for a total value of $4,224,162.92. The disclosure for this sale can be found here. 3.29% of the stock is currently owned by corporate insiders.

Chemed Trading Up 2.2%

NYSE CHE traded up $9.66 on Wednesday, hitting $455.92. The company's stock had a trading volume of 84,447 shares, compared to its average volume of 138,376. Chemed Corporation has a 52-week low of $408.42 and a 52-week high of $623.60. The company's 50-day simple moving average is $468.68 and its 200 day simple moving average is $539.35. The firm has a market cap of $6.64 billion, a P/E ratio of 23.48, a PEG ratio of 2.51 and a beta of 0.46.

Chemed (NYSE:CHE - Get Free Report) last released its quarterly earnings data on Tuesday, July 29th. The company reported $4.27 earnings per share for the quarter, missing the consensus estimate of $6.02 by ($1.75). Chemed had a return on equity of 25.83% and a net margin of 11.56%.The business had revenue of $618.80 million during the quarter, compared to analysts' expectations of $650.60 million. During the same quarter last year, the business posted $5.47 EPS. The company's quarterly revenue was up 3.8% compared to the same quarter last year. Chemed has set its FY 2025 guidance at 22.000-22.300 EPS. On average, research analysts forecast that Chemed Corporation will post 21.43 EPS for the current fiscal year.

Chemed Increases Dividend

The company also recently announced a quarterly dividend, which will be paid on Friday, August 29th. Stockholders of record on Monday, August 11th will be given a $0.60 dividend. The ex-dividend date of this dividend is Monday, August 11th. This represents a $2.40 annualized dividend and a dividend yield of 0.5%. This is an increase from Chemed's previous quarterly dividend of $0.50. Chemed's dividend payout ratio is currently 12.34%.

Analyst Ratings Changes

Several brokerages have recently commented on CHE. Bank of America reduced their price objective on Chemed from $708.00 to $650.00 and set a "buy" rating on the stock in a research report on Monday, June 30th. Royal Bank Of Canada dropped their target price on Chemed from $640.00 to $589.00 and set an "outperform" rating for the company in a report on Thursday, July 31st. Oppenheimer dropped their target price on Chemed from $650.00 to $580.00 and set an "outperform" rating for the company in a report on Thursday, July 31st. Wall Street Zen cut Chemed from a "buy" rating to a "hold" rating in a report on Saturday, July 5th. Finally, Jefferies Financial Group began coverage on Chemed in a report on Friday, July 25th. They set a "hold" rating and a $500.00 target price for the company. Three analysts have rated the stock with a Buy rating and one has issued a Hold rating to the stock. According to MarketBeat, the stock currently has an average rating of "Moderate Buy" and a consensus target price of $579.75.

View Our Latest Report on Chemed

Chemed Profile

(

Free Report)

Chemed Corporation provides hospice and palliative care services to patients through a network of physicians, registered nurses, home health aides, social workers, clergy, and volunteers primarily in the United States. The company operates in VITAS and Roto-Rooter segments. It offers plumbing, drain cleaning, excavation, water restoration, and other related services to residential and commercial customers through company-owned branches, independent contractors, and franchisees.

Read More

Before you consider Chemed, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Chemed wasn't on the list.

While Chemed currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.