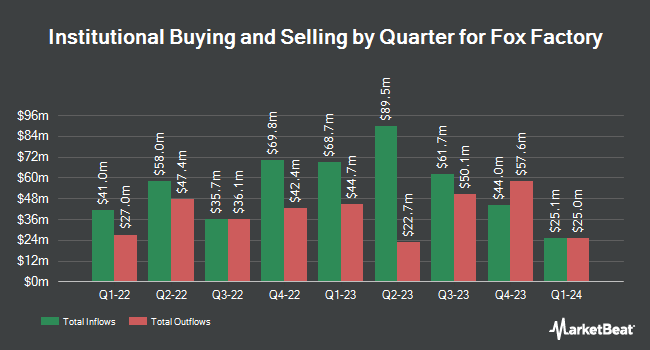

Northern Trust Corp reduced its stake in Fox Factory Holding Corp. (NASDAQ:FOXF - Free Report) by 3.7% during the 1st quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The firm owned 429,743 shares of the company's stock after selling 16,506 shares during the period. Northern Trust Corp owned approximately 1.03% of Fox Factory worth $10,030,000 at the end of the most recent quarter.

Other institutional investors and hedge funds have also recently bought and sold shares of the company. Bridges Investment Management Inc. raised its holdings in Fox Factory by 127.8% in the 1st quarter. Bridges Investment Management Inc. now owns 63,455 shares of the company's stock valued at $1,481,000 after buying an additional 35,599 shares during the period. Two Sigma Advisers LP purchased a new stake in Fox Factory in the 4th quarter valued at about $378,000. Geneva Capital Management LLC raised its holdings in Fox Factory by 4.0% in the 1st quarter. Geneva Capital Management LLC now owns 538,644 shares of the company's stock valued at $12,572,000 after buying an additional 20,692 shares during the period. GAMMA Investing LLC raised its holdings in Fox Factory by 254.1% in the 1st quarter. GAMMA Investing LLC now owns 1,696 shares of the company's stock valued at $40,000 after buying an additional 1,217 shares during the period. Finally, GSA Capital Partners LLP raised its holdings in Fox Factory by 50.2% in the 1st quarter. GSA Capital Partners LLP now owns 59,792 shares of the company's stock valued at $1,396,000 after buying an additional 19,985 shares during the period.

Analysts Set New Price Targets

Several research firms have recently commented on FOXF. B. Riley reissued a "neutral" rating and issued a $32.00 price objective (up previously from $26.00) on shares of Fox Factory in a research note on Friday, August 8th. Stifel Nicolaus lifted their price objective on shares of Fox Factory from $34.00 to $36.00 and gave the company a "buy" rating in a report on Friday, August 8th. Finally, Truist Financial lifted their price objective on shares of Fox Factory from $28.00 to $34.00 and gave the company a "buy" rating in a report on Wednesday, May 14th. Three equities research analysts have rated the stock with a Buy rating and four have assigned a Hold rating to the company's stock. According to MarketBeat, the company has a consensus rating of "Hold" and a consensus target price of $34.86.

Get Our Latest Stock Report on FOXF

Fox Factory Stock Up 2.9%

Shares of FOXF stock traded up $0.81 during trading on Thursday, reaching $28.81. The company's stock had a trading volume of 562,764 shares, compared to its average volume of 381,473. The company has a debt-to-equity ratio of 0.70, a current ratio of 3.03 and a quick ratio of 1.36. The company has a market capitalization of $1.20 billion, a price-to-earnings ratio of -4.76 and a beta of 1.48. The stock's 50-day moving average price is $28.80 and its 200 day moving average price is $25.70. Fox Factory Holding Corp. has a 1-year low of $17.95 and a 1-year high of $44.27.

Fox Factory (NASDAQ:FOXF - Get Free Report) last posted its quarterly earnings results on Thursday, August 7th. The company reported $0.40 EPS for the quarter, missing the consensus estimate of $0.43 by ($0.03). Fox Factory had a positive return on equity of 5.03% and a negative net margin of 17.50%.The firm had revenue of $374.86 million for the quarter, compared to analyst estimates of $349.01 million. During the same quarter last year, the firm earned $0.38 EPS. The company's revenue was up 7.6% on a year-over-year basis. Fox Factory has set its FY 2025 guidance at 1.600-2.000 EPS. Q3 2025 guidance at 0.450-0.650 EPS. On average, research analysts anticipate that Fox Factory Holding Corp. will post 1.31 EPS for the current year.

Fox Factory Company Profile

(

Free Report)

Fox Factory Holding Corp. designs, engineers, manufactures, and markets performance-defining products and system worldwide. The company offers powered vehicle products for side-by-side vehicles, on-road vehicles with and without off-road capabilities, off-road vehicles and trucks, all-terrain vehicles, snowmobiles, and specialty vehicles and applications, such as military, motorcycles, and commercial trucks; lift kits and components with shock products and aftermarket accessory packages for trucks; and mid-end and high-end front fork and rear suspension products.

Further Reading

Before you consider Fox Factory, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Fox Factory wasn't on the list.

While Fox Factory currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.