Northern Trust Corp grew its stake in shares of Live Nation Entertainment, Inc. (NYSE:LYV - Free Report) by 0.6% in the 1st quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The fund owned 1,454,064 shares of the company's stock after acquiring an additional 8,562 shares during the period. Northern Trust Corp owned 0.63% of Live Nation Entertainment worth $189,872,000 at the end of the most recent quarter.

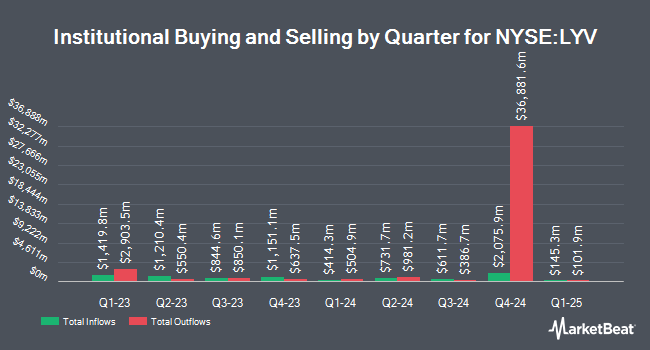

Several other hedge funds also recently made changes to their positions in LYV. Measured Risk Portfolios Inc. bought a new position in shares of Live Nation Entertainment during the fourth quarter worth approximately $29,000. Wayfinding Financial LLC bought a new position in Live Nation Entertainment in the first quarter valued at approximately $30,000. Chilton Capital Management LLC bought a new position in Live Nation Entertainment in the first quarter valued at approximately $33,000. GW&K Investment Management LLC increased its stake in Live Nation Entertainment by 690.2% in the first quarter. GW&K Investment Management LLC now owns 324 shares of the company's stock valued at $42,000 after acquiring an additional 283 shares during the last quarter. Finally, N.E.W. Advisory Services LLC bought a new position in Live Nation Entertainment in the first quarter valued at approximately $42,000. 74.52% of the stock is owned by institutional investors.

Live Nation Entertainment Stock Up 0.2%

Shares of LYV traded up $0.3720 on Monday, reaching $166.0920. The company's stock had a trading volume of 1,403,865 shares, compared to its average volume of 2,484,225. The company has a current ratio of 0.88, a quick ratio of 0.88 and a debt-to-equity ratio of 5.38. Live Nation Entertainment, Inc. has a twelve month low of $92.57 and a twelve month high of $166.57. The stock has a market capitalization of $38.94 billion, a PE ratio of 71.90, a PEG ratio of 10.00 and a beta of 1.46. The firm has a fifty day moving average of $151.31 and a 200-day moving average of $141.16.

Live Nation Entertainment (NYSE:LYV - Get Free Report) last posted its quarterly earnings data on Thursday, August 7th. The company reported $0.41 EPS for the quarter, missing the consensus estimate of $1.08 by ($0.67). The firm had revenue of $7.01 billion during the quarter, compared to analysts' expectations of $6.93 billion. Live Nation Entertainment had a net margin of 3.88% and a return on equity of 105.85%. The company's quarterly revenue was up 16.3% on a year-over-year basis. During the same quarter last year, the business posted $1.03 EPS. Equities analysts predict that Live Nation Entertainment, Inc. will post 2.38 EPS for the current year.

Analysts Set New Price Targets

LYV has been the topic of a number of recent analyst reports. Benchmark lifted their price objective on shares of Live Nation Entertainment from $178.00 to $180.00 and gave the company a "buy" rating in a research note on Friday, August 8th. Moffett Nathanson began coverage on shares of Live Nation Entertainment in a research note on Monday, August 18th. They issued a "buy" rating and a $195.00 price objective on the stock. Guggenheim reaffirmed a "buy" rating and set a $170.00 price target on shares of Live Nation Entertainment in a research report on Wednesday, June 18th. Wolfe Research upped their price target on shares of Live Nation Entertainment from $160.00 to $168.00 and gave the company an "outperform" rating in a research report on Tuesday, June 10th. Finally, Oppenheimer upped their price target on shares of Live Nation Entertainment from $165.00 to $180.00 and gave the company an "outperform" rating in a research report on Tuesday, August 12th. Eighteen investment analysts have rated the stock with a Buy rating, According to MarketBeat, Live Nation Entertainment has a consensus rating of "Buy" and a consensus price target of $168.94.

View Our Latest Report on LYV

Live Nation Entertainment Company Profile

(

Free Report)

Live Nation Entertainment, Inc operates as a live entertainment company worldwide. It operates through Concerts, Ticketing, and Sponsorship & Advertising segments. The Concerts segment promotes live music events in its owned or operated venues, and in rented third-party venues. This segment operates and manages music venues; produces music festivals; creates and streams associated content; and offers management and other services to artists.

See Also

Before you consider Live Nation Entertainment, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Live Nation Entertainment wasn't on the list.

While Live Nation Entertainment currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.