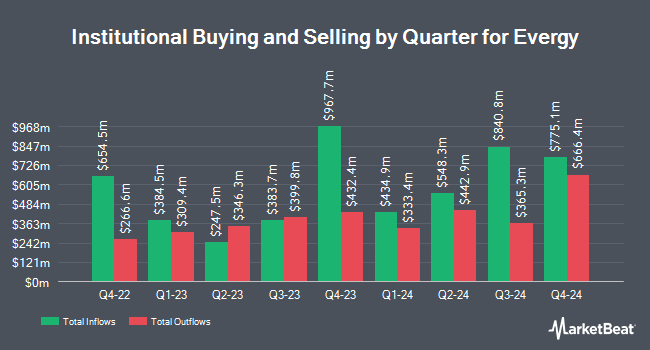

Northern Trust Corp grew its position in shares of Evergy Inc. (NASDAQ:EVRG - Free Report) by 16.7% during the 1st quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The institutional investor owned 2,737,480 shares of the company's stock after buying an additional 392,361 shares during the quarter. Northern Trust Corp owned 1.19% of Evergy worth $188,749,000 as of its most recent filing with the Securities & Exchange Commission.

Several other institutional investors have also recently made changes to their positions in the company. Horizon Investments LLC boosted its position in Evergy by 4.9% during the first quarter. Horizon Investments LLC now owns 3,353 shares of the company's stock valued at $231,000 after buying an additional 158 shares during the period. Stolper Co increased its holdings in Evergy by 0.5% in the 1st quarter. Stolper Co now owns 34,630 shares of the company's stock valued at $2,388,000 after acquiring an additional 169 shares during the last quarter. Retirement Planning Group LLC grew its stake in shares of Evergy by 0.9% in the 4th quarter. Retirement Planning Group LLC now owns 24,372 shares of the company's stock worth $1,500,000 after buying an additional 210 shares in the last quarter. MainStreet Investment Advisors LLC lifted its holdings in Evergy by 4.7% during the 4th quarter. MainStreet Investment Advisors LLC now owns 4,877 shares of the company's stock valued at $300,000 after buying an additional 221 shares in the last quarter. Finally, Parallel Advisors LLC raised its holdings in shares of Evergy by 2.5% in the 1st quarter. Parallel Advisors LLC now owns 9,338 shares of the company's stock valued at $644,000 after purchasing an additional 227 shares in the last quarter. Institutional investors own 87.24% of the company's stock.

Evergy Price Performance

Shares of EVRG stock traded up $0.13 during mid-day trading on Wednesday, reaching $71.89. The company's stock had a trading volume of 153,064 shares, compared to its average volume of 2,322,732. The company has a market cap of $16.55 billion, a P/E ratio of 19.76, a PEG ratio of 3.13 and a beta of 0.48. The company has a debt-to-equity ratio of 1.24, a quick ratio of 0.27 and a current ratio of 0.50. The firm's 50-day moving average is $70.16 and its two-hundred day moving average is $68.16. Evergy Inc. has a 1-year low of $58.25 and a 1-year high of $73.97.

Evergy (NASDAQ:EVRG - Get Free Report) last issued its quarterly earnings data on Thursday, August 7th. The company reported $0.82 EPS for the quarter, topping analysts' consensus estimates of $0.78 by $0.04. Evergy had a net margin of 14.29% and a return on equity of 8.62%. The firm had revenue of $1.43 billion for the quarter, compared to analyst estimates of $1.45 billion. During the same quarter in the prior year, the firm earned $0.90 EPS. The company's revenue was down .7% on a year-over-year basis. Evergy has set its FY 2025 guidance at 3.920-4.120 EPS. On average, research analysts predict that Evergy Inc. will post 3.83 earnings per share for the current year.

Evergy Dividend Announcement

The business also recently disclosed a quarterly dividend, which will be paid on Friday, September 19th. Shareholders of record on Friday, August 22nd will be given a dividend of $0.6675 per share. This represents a $2.67 dividend on an annualized basis and a yield of 3.7%. The ex-dividend date of this dividend is Friday, August 22nd. Evergy's payout ratio is 73.35%.

Analyst Upgrades and Downgrades

EVRG has been the topic of several recent analyst reports. Jefferies Financial Group set a $78.00 target price on shares of Evergy and gave the stock a "buy" rating in a research note on Tuesday, June 10th. BMO Capital Markets initiated coverage on shares of Evergy in a report on Tuesday, May 13th. They issued an "outperform" rating and a $75.00 target price for the company. Citigroup increased their price target on shares of Evergy from $77.00 to $79.00 and gave the stock a "buy" rating in a research note on Friday, May 16th. Barclays decreased their target price on Evergy from $73.00 to $71.00 and set an "overweight" rating for the company in a research note on Friday, May 30th. Finally, Mizuho boosted their target price on shares of Evergy from $74.00 to $77.00 and gave the company an "outperform" rating in a research note on Friday, August 8th. One investment analyst has rated the stock with a Strong Buy rating and eight have given a Buy rating to the stock. According to MarketBeat.com, Evergy presently has a consensus rating of "Buy" and a consensus target price of $74.44.

Check Out Our Latest Stock Analysis on EVRG

Evergy Company Profile

(

Free Report)

Evergy, Inc, together with its subsidiaries, engages in the generation, transmission, distribution, and sale of electricity in the United States. The company generates electricity through coal, landfill gas, uranium, and natural gas and oil sources, as well as solar, wind, other renewable sources. It serves residences, commercial firms, industrials, municipalities, and other electric utilities.

Further Reading

Before you consider Evergy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Evergy wasn't on the list.

While Evergy currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.