Northern Trust Corp boosted its holdings in KBR, Inc. (NYSE:KBR - Free Report) by 0.6% during the 1st quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The firm owned 1,215,713 shares of the construction company's stock after buying an additional 7,411 shares during the period. Northern Trust Corp owned approximately 0.94% of KBR worth $60,555,000 as of its most recent SEC filing.

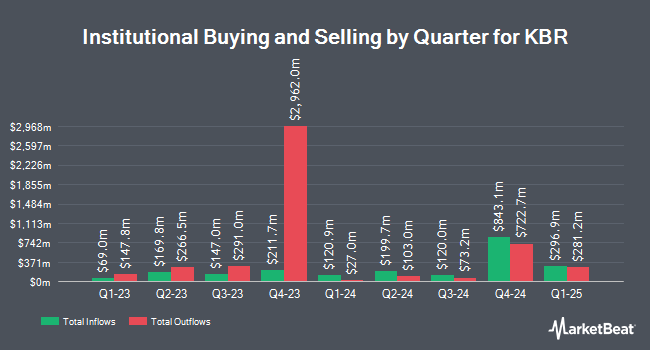

Other institutional investors and hedge funds have also modified their holdings of the company. GAMMA Investing LLC increased its position in shares of KBR by 295.5% during the first quarter. GAMMA Investing LLC now owns 795 shares of the construction company's stock valued at $40,000 after purchasing an additional 594 shares during the period. Principal Financial Group Inc. boosted its stake in KBR by 0.4% in the 1st quarter. Principal Financial Group Inc. now owns 307,121 shares of the construction company's stock valued at $15,298,000 after buying an additional 1,343 shares in the last quarter. Cerity Partners LLC boosted its stake in KBR by 697.0% in the 1st quarter. Cerity Partners LLC now owns 27,314 shares of the construction company's stock valued at $1,361,000 after buying an additional 23,887 shares in the last quarter. KBC Group NV boosted its stake in KBR by 4.8% in the 1st quarter. KBC Group NV now owns 5,703 shares of the construction company's stock valued at $284,000 after buying an additional 260 shares in the last quarter. Finally, Cetera Investment Advisers boosted its stake in KBR by 22.1% in the 1st quarter. Cetera Investment Advisers now owns 8,453 shares of the construction company's stock valued at $421,000 after buying an additional 1,531 shares in the last quarter. 97.02% of the stock is currently owned by institutional investors.

KBR Trading Down 1.5%

Shares of KBR stock traded down $0.79 during trading hours on Monday, hitting $50.50. The company's stock had a trading volume of 978,607 shares, compared to its average volume of 1,333,313. The company has a market capitalization of $6.51 billion, a PE ratio of 18.30, a price-to-earnings-growth ratio of 1.00 and a beta of 0.73. The company has a debt-to-equity ratio of 1.73, a current ratio of 1.13 and a quick ratio of 1.13. The stock has a 50 day moving average of $48.32 and a 200 day moving average of $50.41. KBR, Inc. has a 12 month low of $43.89 and a 12 month high of $72.60.

KBR (NYSE:KBR - Get Free Report) last issued its earnings results on Thursday, July 31st. The construction company reported $0.91 EPS for the quarter, beating analysts' consensus estimates of $0.88 by $0.03. KBR had a return on equity of 33.65% and a net margin of 4.52%.The business had revenue of $1.95 billion during the quarter, compared to analyst estimates of $2.10 billion. During the same period in the previous year, the company posted $0.83 EPS. The firm's revenue was up 5.7% compared to the same quarter last year. KBR has set its FY 2025 guidance at 3.780-3.88 EPS. Analysts predict that KBR, Inc. will post 3.26 earnings per share for the current year.

KBR Dividend Announcement

The company also recently announced a quarterly dividend, which will be paid on Wednesday, October 15th. Investors of record on Monday, September 15th will be given a $0.165 dividend. This represents a $0.66 dividend on an annualized basis and a yield of 1.3%. The ex-dividend date of this dividend is Monday, September 15th. KBR's payout ratio is presently 23.91%.

Analyst Ratings Changes

KBR has been the topic of several recent analyst reports. Stifel Nicolaus boosted their price target on KBR from $78.00 to $80.00 and gave the company a "buy" rating in a research note on Friday, August 1st. Wall Street Zen lowered KBR from a "buy" rating to a "hold" rating in a research note on Saturday, August 9th. Bank of America lowered KBR from a "buy" rating to a "neutral" rating and reduced their price objective for the stock from $70.00 to $55.00 in a research note on Wednesday, August 13th. DA Davidson reduced their price objective on KBR from $72.00 to $65.00 and set a "buy" rating on the stock in a research note on Friday, August 1st. Finally, The Goldman Sachs Group downgraded KBR from a "buy" rating to a "neutral" rating and set a $55.00 target price for the company. in a research report on Tuesday, May 27th. Four analysts have rated the stock with a Buy rating and five have given a Hold rating to the stock. According to data from MarketBeat.com, the stock currently has a consensus rating of "Hold" and a consensus target price of $62.78.

View Our Latest Analysis on KBR

Insider Buying and Selling

In related news, CEO Stuart Bradie sold 20,000 shares of the business's stock in a transaction dated Wednesday, June 18th. The stock was sold at an average price of $52.81, for a total value of $1,056,200.00. Following the completion of the sale, the chief executive officer directly owned 802,361 shares of the company's stock, valued at $42,372,684.41. The trade was a 2.43% decrease in their position. The sale was disclosed in a filing with the SEC, which is available at the SEC website. 1.11% of the stock is owned by insiders.

About KBR

(

Free Report)

KBR, Inc provides scientific, technology, and engineering solutions to governments and commercial customers worldwide. It operates through Government Solutions and Sustainable Technology Solutions segments. The Government Solutions segment offers life-cycle support solutions to defense, intelligence, space, aviation, and other programs and missions for military and other government agencies in the United States, the United Kingdom, and Australia.

Featured Articles

Before you consider KBR, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and KBR wasn't on the list.

While KBR currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.