Northern Trust Corp trimmed its stake in Upwork Inc. (NASDAQ:UPWK - Free Report) by 2.5% during the 1st quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The fund owned 1,164,869 shares of the company's stock after selling 29,354 shares during the period. Northern Trust Corp owned approximately 0.89% of Upwork worth $15,202,000 as of its most recent SEC filing.

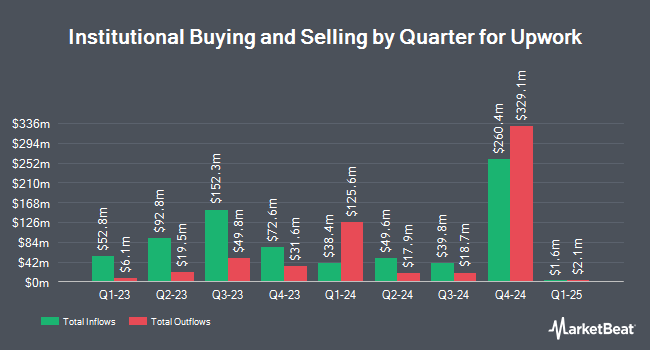

Several other institutional investors also recently modified their holdings of the stock. LSV Asset Management increased its position in shares of Upwork by 364.5% in the first quarter. LSV Asset Management now owns 5,351,406 shares of the company's stock worth $69,836,000 after purchasing an additional 4,199,244 shares during the last quarter. Dorsey Asset Management LLC increased its position in shares of Upwork by 15.0% in the fourth quarter. Dorsey Asset Management LLC now owns 3,045,142 shares of the company's stock worth $49,788,000 after purchasing an additional 397,997 shares during the last quarter. Invesco Ltd. increased its position in shares of Upwork by 50.5% in the first quarter. Invesco Ltd. now owns 2,630,379 shares of the company's stock worth $34,326,000 after purchasing an additional 882,059 shares during the last quarter. Two Sigma Investments LP increased its position in shares of Upwork by 49.2% in the fourth quarter. Two Sigma Investments LP now owns 2,436,680 shares of the company's stock worth $39,840,000 after purchasing an additional 803,929 shares during the last quarter. Finally, Nuveen Asset Management LLC increased its position in shares of Upwork by 15.8% in the fourth quarter. Nuveen Asset Management LLC now owns 2,283,040 shares of the company's stock worth $37,328,000 after purchasing an additional 310,678 shares during the last quarter. 77.71% of the stock is currently owned by institutional investors.

Analyst Ratings Changes

A number of research firms recently weighed in on UPWK. Citigroup restated an "outperform" rating on shares of Upwork in a research report on Friday, May 16th. Royal Bank Of Canada restated a "sector perform" rating and issued a $18.00 target price on shares of Upwork in a research report on Monday, June 2nd. Wall Street Zen downgraded Upwork from a "strong-buy" rating to a "buy" rating in a research report on Saturday, August 9th. Finally, JMP Securities boosted their target price on Upwork from $18.00 to $20.00 and gave the stock a "market outperform" rating in a research report on Friday, May 16th. Eight research analysts have rated the stock with a Buy rating and four have issued a Hold rating to the company. According to data from MarketBeat, the stock currently has an average rating of "Moderate Buy" and an average target price of $18.67.

Check Out Our Latest Report on Upwork

Upwork Price Performance

UPWK opened at $16.45 on Thursday. The stock's 50 day simple moving average is $13.64 and its 200 day simple moving average is $14.11. The company has a debt-to-equity ratio of 0.59, a current ratio of 3.36 and a quick ratio of 3.36. Upwork Inc. has a 1 year low of $8.90 and a 1 year high of $18.14. The firm has a market cap of $2.18 billion, a price-to-earnings ratio of 9.45 and a beta of 1.43.

Upwork (NASDAQ:UPWK - Get Free Report) last released its quarterly earnings data on Wednesday, August 6th. The company reported $0.35 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $0.26 by $0.09. Upwork had a net margin of 31.75% and a return on equity of 44.83%. The firm had revenue of $194.94 million for the quarter, compared to analysts' expectations of $187.56 million. During the same quarter in the previous year, the company earned $0.26 earnings per share. The company's revenue for the quarter was up .9% compared to the same quarter last year. As a group, analysts predict that Upwork Inc. will post 0.84 earnings per share for the current year.

Upwork declared that its board has approved a share repurchase plan on Wednesday, September 3rd that allows the company to buyback $100.00 million in shares. This buyback authorization allows the company to reacquire up to 4.9% of its shares through open market purchases. Shares buyback plans are generally a sign that the company's board of directors believes its stock is undervalued.

Insider Buying and Selling at Upwork

In other Upwork news, insider Dave Bottoms sold 11,562 shares of the company's stock in a transaction that occurred on Wednesday, June 18th. The stock was sold at an average price of $13.51, for a total transaction of $156,202.62. Following the completion of the transaction, the insider owned 9,345 shares of the company's stock, valued at $126,250.95. This represents a 55.30% decrease in their position. The transaction was disclosed in a document filed with the SEC, which is available at the SEC website. Also, Director Leela Srinivasan sold 3,314 shares of the company's stock in a transaction that occurred on Friday, June 6th. The shares were sold at an average price of $15.36, for a total value of $50,903.04. Following the transaction, the director directly owned 79,469 shares of the company's stock, valued at $1,220,643.84. The trade was a 4.00% decrease in their position. The disclosure for this sale can be found here. Insiders have sold a total of 162,922 shares of company stock worth $2,238,460 over the last three months. 7.60% of the stock is owned by corporate insiders.

Upwork Company Profile

(

Free Report)

Upwork Inc, together with its subsidiaries, operates a work marketplace that connects businesses with various independent professionals and agencies in the United States, India, the Philippines, and internationally. The company's work marketplace provides access to talent with various skills across a range of categories, including administrative support, sales and marketing, design and creative, and customer service, as well as web, mobile, and software development.

Featured Articles

Want to see what other hedge funds are holding UPWK? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Upwork Inc. (NASDAQ:UPWK - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Upwork, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Upwork wasn't on the list.

While Upwork currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Learn the basics of options trading and how to use them to boost returns and manage risk with this free report from MarketBeat. Click the link below to get your free copy.

Get This Free Report